Czech Republic: inflation rises again despite government measures

Inflation accelerated again in November and would have been at a new record high without government measures. Prices will rise further but the key question is the January number. This is heading towards 19% in our estimates. Even so, this will not be a reason for the central bank to hike rates. However, the risk is a later rate cut than our forecast

| 16.2% |

November inflation (YoY) |

| Higher than expected | |

Inflation is back

Consumer prices rose by 1.2% month-on-month in November, a re-acceleration from the 1.4% decline in October. Of course, in the previous month, the main reason for the fall in prices was the introduction of government measures against high energy prices. Thus, inflation has rather returned to the normal of recent months.

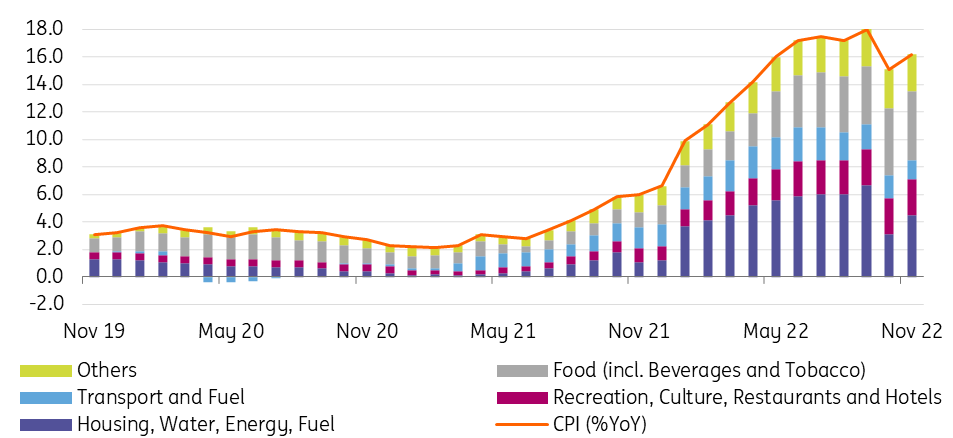

Month-on-month growth was mainly driven by higher prices of housing, food and clothing. By contrast, the only item that fell in November, as we expected, was fuel. In year-on-year terms, consumer prices rose by 16.2% in November, which was 1.1pp higher than in October. The higher year-on-year figure is partly due to the comparative base from last year when VAT on energy prices was waived. In terms of year-on-year contributions to the CPI, only energy prices (from 3.1pp to 4.5pp) and transport prices (from 1.7pp to 1.4pp) showed a significant change from the previous month.

Contributions to year-on-year inflation (pp)

Without measures, inflation would be at a new record high

Year-on-year inflation would have reached a record high of 19.8% without the effect of the energy-saving tariff. Thus, with the inclusion of government measures, inflation is below the central bank's forecast, while without the inclusion of measures it is well above the forecast.

On the other hand, core inflation slowed from 1.2% to 0.6% MoM and from 14.6% to 13.6% year-on-year, according to our estimates. The Czech National Bank (CNB) will release commentary later today including core inflation. If our estimate is confirmed, the overall picture for the fourth quarter would show headline inflation significantly higher than the CNB forecast if we exclude government measures, while core inflation is roughly in line.

January revaluation will push inflation even higher

Our fresh estimate for December points to a further rise in inflation to 16.9% YoY, but the more interesting question is January inflation. We expect January's change in government measures from the savings tariff to the price cap to have about the same impact on CPI. Thus, the main upside risk is the new year's repricing. A number of large companies have already announced significant price increases for January, on the other hand, the already high comparative base from this year should come into play. However, ultimately this means inflation will move close to the 19% YoY level, more than we previously expected.

Given that the CNB's summer forecast expected inflation to be above 20% by this time, and even that was not a reason to raise rates, we believe that this outlook will not be a reason for the central bank to raise rates either. We do, however, see a risk of a slower inclination to discuss rate cuts next year compared to our forecast, which currently expects the first rate cut in the second quarter of 2023.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Czech RepublicDownload

Download article