Czech inflation back in single digits

Inflation fell into single-digit territory for the first time since early 2022 and is the lowest in the CEE region. However, this will not be enough for the Czech National Bank to change its tone. Disinflation will slow next month. We do not expect the first cut until November

| 9.7% |

YoY inflation |

| As expected | |

Lowest inflation in the CEE region

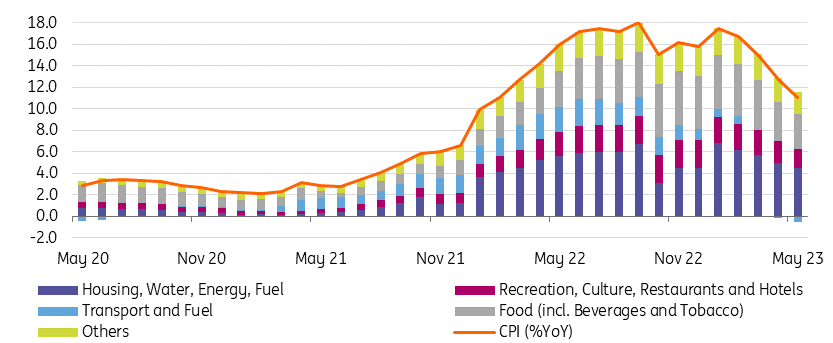

June consumer prices rose 0.34% month-on-month, which translated into a drop from 11.1% to 9.7% year-on-year. Inflation in the Czech Republic is the lowest since December 2021 and the country is now the first in the CEE region to have returned to single-digit territory. Prices were pushed up in June mainly by seasonal factors in recreation prices. Otherwise, we saw a steady rise across the consumer basket.

Core inflation fell from 8.6% to 7.8% YoY with downside risk, according to our calculations. The CNB will release official numbers later today, as always. June inflation is four-tenths below the central bank's forecast, but this means a one-tenth reduction in the previous forecast deviation. Core inflation in the second quarter, by our calculations, surprised the central bank to the downside by two-tenths on average.

Contributions to year-on-year inflation (bp)

The CNB wants to see more before cutting rates

Looking ahead, our fresh nowcast indicator points to July inflation falling to 8.6% YoY. The pace of disinflation should thus start to slow in line with our earlier expectations. Therefore, we think today's result will not be a game-changer and the current drop in inflation will not be enough for the CNB. Today's inflation number is the last before the central bank's August meeting, including a new forecast. We expect the CNB to wait to cut rates until the November meeting with the risk of postponement until the first quarter of next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article