Czech Republic: Higher energy prices postponed

Inflation in July showed a further slowdown in the month-on-month rate, despite the announced record hike in household energy prices. We believe inflation will continue to rise, but the pace may be more gradual and peak later, making things easier for the dovish Czech National Bank. We see less risk of an additional rate hike after today's number

| 17.5% |

July inflation (YoY) |

| Lower than expected | |

Second month in a row indicating slowing inflation

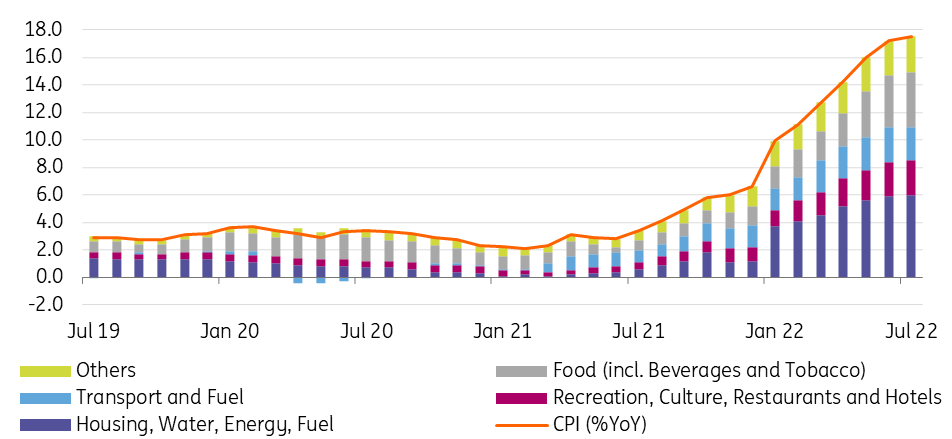

Consumer prices increased by 1.3% MoM in July, driven mainly by seasonal growth in holiday prices. In annual terms, the growth of consumer prices amounted to 17.5%, 0.3 percentage points up on June. The slowdown in the month-on-month rate from 1.6% in June marks the second slowdown in inflation in a row without seasonal adjustment. Food prices continued to rise, but at their lowest rate (1.3%) so far this year. Fuel prices were virtually flat. The main question, however, is where the effect of the announced energy prices is, as this had been expected to be the main driver of inflation in July.

Contributions to year-on-year inflation (pp)

Household energy prices rose by only 1.6% MoM, the lowest rate this year, while the announced changes in list prices, on the other hand, indicated their biggest hike this year. The statistics office does not comment on the situation and the only explanation we see is a significantly higher ratio of fix/float contracts, which would imply a more gradual impact of the energy price increase in the following months and especially in January, when a large proportion of fixed contracts expire.

Today's result is 0.4 percentage points below the market estimate and 1.3 percentage points below the CNB forecast. According to our calculations, core inflation remained unchanged at 14.6% YoY. As always, the official numbers will be released later today, alongside CNB commentary.

The one-off effect, or a different story of a later peak in inflation

Along with the central bank, we were in the camp expecting a jump in prices in July, which did not happen. Key to understanding the situation will be August inflation, which similarly should be hit by the announced hikes in household energy prices. This will thus be an opportunity to confirm the statistical office's approach, or, conversely, it will turn out that the July effect was specifically due to a different mix of fix/float contracts.

For the headline numbers, our forecast now stands at 18.8% YoY for August, with the impact of July's higher energy prices pushed into this number. This shouldn't much change the narrative of inflation peaking in September, as even the central bank assumes.

On the other hand, if we see the same effect of energy prices in August as we did in July, their impact on inflation will take much longer to filter through, and should only peak in January next year, along with the end of much of the fixed contracts. This would already imply a significantly different inflation story in the Czech Republic, with a later peak.

Any result below CNB forecast would be good news for the new board

Inflation below the central bank's forecast will be welcome news for the doves in the board. We will get one more inflation number before the September meeting that may confirm or refute the current trend. We believe inflation will continue to rise, but for the weeks ahead today's number will be ammunition to confirm the dovish tone of the CNB. We do not have further rate hikes in our forecast, and the more gradual pass-through of energy prices into CPI makes this decision easier for the new board. We see the risk of an additional rate hike after today's inflation number as lower.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article