Czech Republic: Headline inflation accelerated further in January

January inflation accelerated due to a sharp increase in regulated prices. Core inflation slowed down but still remained high, reflecting the persistence of previous demand pressures

| 17.5% |

January inflation (YoY%) |

| Higher than expected | |

Increasing regulated prices push inflation higher

Czech headline inflation accelerated in January from 15.8% to 17.5% year-on-year in January (more or less in line with our estimate of 17.6%, above the market consensus at 17.1%). The main contribution to the acceleration of inflation came from administered prices, which increased by 30% month-on-month in January and added 4.6pp to the MoM increase of CPI. As expected, the biggest shock came from a considerable price increase in 'housing, water, electricity, gas and other fuels' (electricity prices for households jumped by 139.8% MoM). Core inflation added 0.8pp.

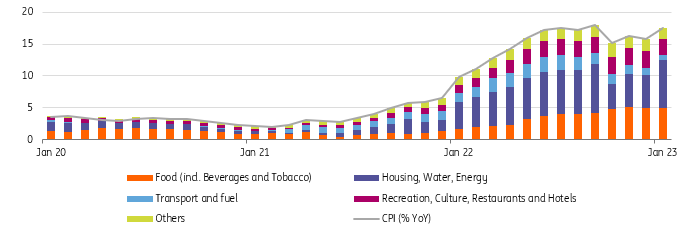

Contributions to year-on-year inflation (pp)

Core inflation slowed down but still strong

The acceleration of headline inflation mainly due to the hefty increase in regulated prices is surely impressive. For the Czech Central Bank, however, what is more important is the development of core inflation. Although core inflation slowed down in February by 1pp to 12.3% YoY, this still-strong growth shows the persistence of previous demand pressures on inflation in the Czech economy, despite the moderation of real consumer spending in the second half of 2022. The CNB board can be satisfied that owner-occupied housing is slowing, as a consequence of the previous hefty tightening of monetary policy.

Regulated prices, core inflation, fuel prices (%YoY)

Inflation likely to moderate to single digits in 2H23

At 17.5% YoY, we suppose this could be the likely peak of headline inflation this year. However, there is still a risk that some re-pricing was done later in January. Therefore, it may not be fully reflected in the January CPI report but could contribute to a still-hefty headline inflation figure in February, above 17% YoY. The risk for stubbornly high inflation in coming months stems from the uncertainty regarding the near-term development of fuel prices. The first February surveys signal that fuel prices could be edging up again.

We expect headline inflation will likely start to moderate in the second quarter, towards 9.2% YoY by the end-2023. The CNB forecast is more optimistic, at 7.6% YoY by end-2023, then falling swiftly close to the inflation target during the first quarter of next year.

CPI forecast (%YoY)

CNB board unlikely to hurry with rate cuts this year

In our view, the CNB board will be unlikely to hurry with rate cuts this year. The winter CNB forecast suggests a reduction in interest rates as of the second quarter. However, it seems more likely that the bank board would prefer to keep interest rates at current levels of 7% for a longer period until inflation falls below nominal rates. Therefore, only 'cosmetic' reductions of interest rates or a wait-and-see approach seem more likely. We see the first possible debate about rate cutting in August when a symbolic 25bp could be delivered.

"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).