The Czech government steps in against high inflation

October inflation showed the first price decline in almost two years thanks to government measures against high energy prices. The surprise of the market and the central bank stems from the unclear approach of the statistical office. Inflation should remain at only slightly higher levels until the end of the year, but January remains a question

| 15.1% |

October inflation (YoY) |

| Lower than expected | |

Savings energy tariff pushed inflation down

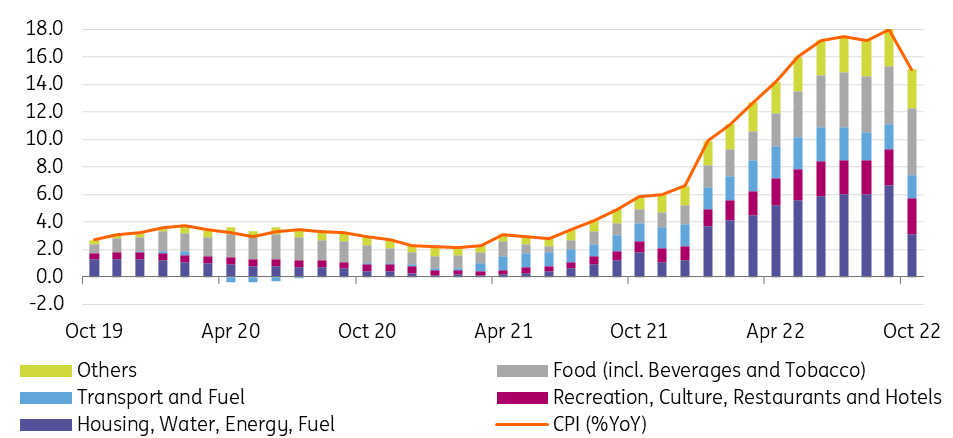

Consumer prices decreased by 1.4% month-on-month in October, the first MoM decrease since December 2020. This development primarily reflected the government savings tariff and waiver of fees for supported energy sources for electricity prices and on the other hand higher food prices. The year-on-year growth of consumer prices amounted to 15.1% in October, which was down 2.9 percentage points on September. The result is 2.3pp below the Czech National Bank's new forecast and 2.8pp below market expectations. On the other hand, core inflation shows the opposite picture with an acceleration from 0.3% to 1.2% MoM, translating to 14.6% YoY, which is basically the same level as in the last five months, surprising the CNB forecast on the upside by 0.3pp.

The main topic here is government energy measures that are effective from October to December and from January the type of measures will change again from the savings tariff to price caps. Therefore, we can expect weaker CPI prints in November and December as well, but in January the uncertain approach of the statistical office comes into play again, just like in the case of today's number. According to the CNB's calculation, the impact of the government measures reduced inflation by 3.5pp, otherwise inflation would have been 18.6% YoY.

Contributions to year-on-year inflation (pp)

Clear outlook for the end of the year, but January brings back uncertainty

For the coming months, we can expect inflation to be only slightly higher in YoY numbers, but January remains the big question. On the one hand, based on energy supplier announcements and other anecdotal reports, it seems that a massive new year's repricing upwards can be expected. On the other hand, the government's price cap comes into play, which unevenly affects households depending on their contract. Moreover, here again it is unclear how the statistical office will approach this. At the moment we are leaning towards the view that we should see just slightly higher household energy prices from January compared with the October number under effect of the savings tariff, so January inflation will be driven mainly by new year repricing but still lead to a lower number due to base effects.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more