Crunch time for OPEC

OPEC members descend on Vienna next week for the official semi-annual meeting on 22 June. Will members of the OPEC+ deal decide to ease production cuts? While some members appear to be against the idea, we believe that we will see a gradual lifting of cuts

Why are some calling for an increase in output?

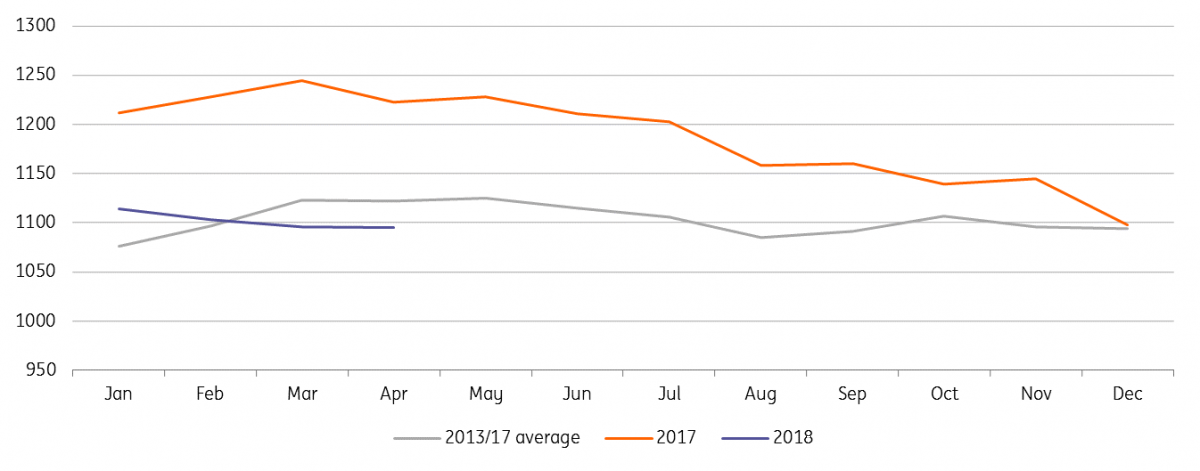

As we wrote in our previous note, OPEC oil cuts: To continue or not to continue, that is the question, we were of the view that OPEC would look to implement an exit strategy at its June meeting. This was due to the fact that the group has achieved its goal of bringing OECD crude oil inventories back to the five-year average. We also felt that implementing an exit strategy at a time when there is downside risk to Venezuelan and Iranian supply would be appropriate. Let’s also not forget the growing pressure from a number of key importers about higher oil prices.

OECD crude oil inventories (MMbbls)

What increase could we see?

At the moment, the potential range of increases is rather large, with many expecting somewhere between a 300M-1MMbbls/d production increase. There have been media reports that the US government asked OPEC to increase output by 1MMbbls/d, while more recently Bloomberg reported that Russia is planning to suggest that members scrap the cuts altogether, and take production back to October 2016 levels. This would suggest a 1.8MMbbls/d increase in supply. We believe that we will see a gradual increase of between 800M-1MMbbls/d over the course of the year.

Will the Russians and Saudis get what they want?

It is pretty clear that the one member of the OPEC+ deal that believes it is time to ease production cuts is Russia. Heading into the last official OPEC meeting, they were reluctant to extend the deal, and this time around that reluctance has certainly grown. As part of the initial deal, Russia agreed to cut production by 300Mbbls/d to 10.95MMbbls/d. However, since February, the country has produced more than this and, in fact, according to Interfax, Russia’s oil output in the first week of June increased to 11.1MMbbls/d.

We would not rule out a scenario where Russia decides to exit the deal altogether. They believe that the intervention carried out has achieved its target. If Russia were to break away from the broader OPEC deal, we believe they could increase supply by around 300Mbbls/d from their current quota level.

Saudi Arabia is the other main proponent of increasing output. It seems that concerns over possible demand destruction and calls from importing countries have distracted the Saudis from pursuing higher oil prices in the run-up to the Saudi Aramco IPO.

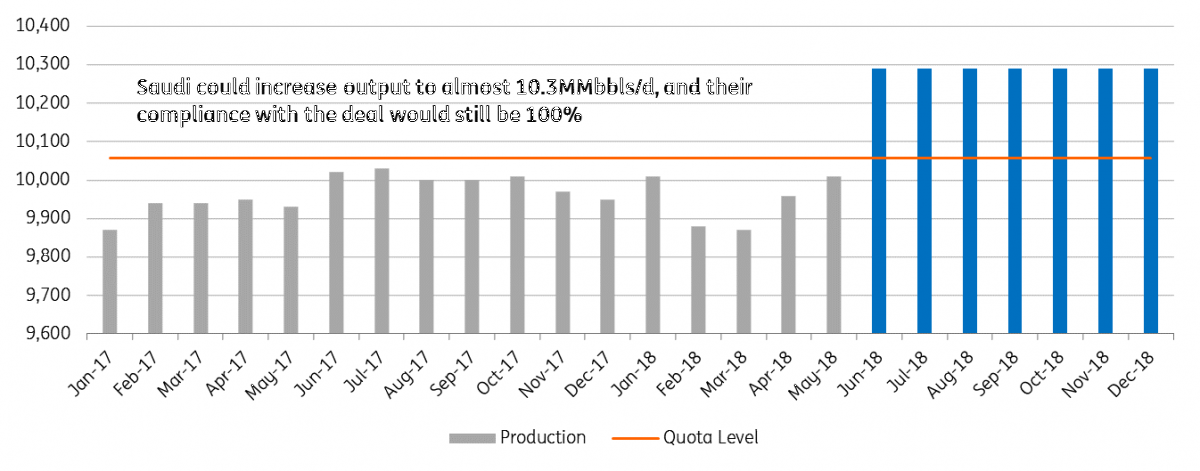

The Saudis up until now have done a great job with compliance; they have cut more than they should, with compliance averaging 120% since the start of the deal. This strong compliance does give the Kingdom a rather large buffer. They can increase production by almost 300Mbbls/d by the end of this year, and they will still be 100% compliant with the deal. The Saudis have appeared to make their intentions clear, with May production exceeding 10MMbbls/d for the first time since August 2017, although this could be nothing more than the usual seasonal increase we see in production, with a pick up in domestic demand over the summer.

Russian monthly oil production (MMbbls/d)

Saudi Arabia could still pump much more and remain compliant with the deal (Mbbls/d)

Who are those against increasing output?

A short answer to this question would be anyone who does not have the capability to increase output. The bulk of other OPEC members do not have much in the way of spare capacity, and so would be worse off if the likes of Russia and Saudi Arabia increase output.

It is in Venezuela’s interest to continue with the current framework of the production cut deal. The oil industry continues to suffer as a result of a lack of investment, and production has been in steady decline since early 2016. Looking at the latest Baker Hughes rig data for the country, the number of active rigs stands at just 28, down from more than 70 in early 2016, and the lowest number since 2003. As a result, there appears to be no reversal in this trend, with production expected to continue declining towards 1.2MMbbls/d by the end of this year. In order to help offset these declines, stronger oil prices are needed.

As for Iran, it would also be keen for the deal to stay as is, as the country could be forced to reduce supply if buyers take a step back from Iranian crude as a result of US sanctions.

Finally, plenty of noise has come from the Iraqis in recent days, calling for the deal to remain intact. However, Iraq is at the bottom of the leaderboard when it comes to compliance amongst OPEC nations. The country’s compliance has averaged just 57% over the course of the deal and, in fact, compliance hit just 39% in May.

Iraq fails to meet compliance with the deal

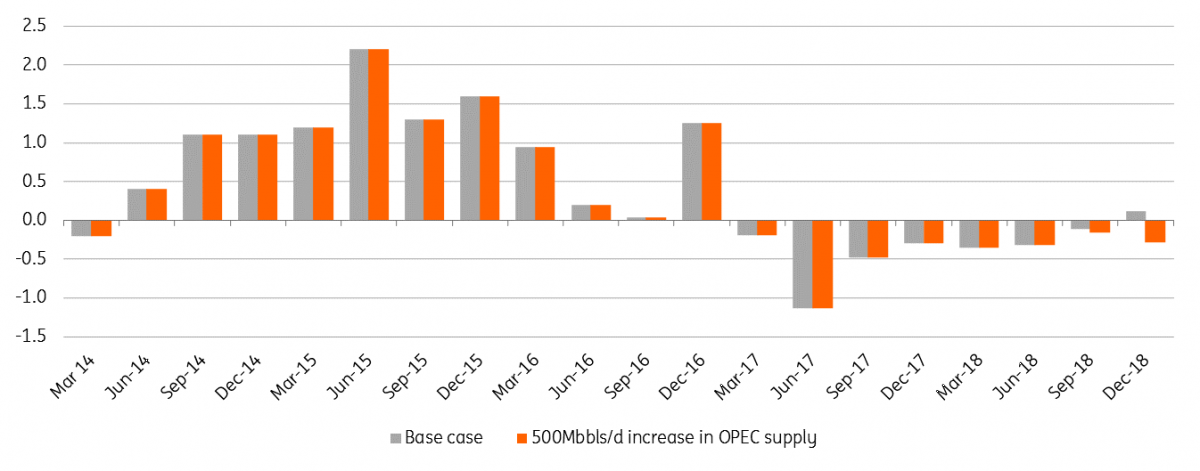

The global balance

Under our base case scenario, we are assuming that we will see 500Mbbls/d of Iranian oil supply lost by the end of this year, along with Venezuelan production falling towards 1.2MMbbls/d. In order to offset these losses, we are assuming that we see the remaining members of the OPEC+ deal increase output gradually by a little over 900Mbbls/d by the end of this year. Unsurprisingly, the bulk of this increase is driven by Saudi Arabia and Russia. Under this scenario, we do see a smaller deficit over 3Q18, and in fact a small surplus in 4Q18.

However if we were to assume only 500Mbbls/d of additional supply, and assume similar losses for Iran and Venezuela, the global market will remain in deficit through the end of 2018. The more extreme scenario, which would lead us to revisit our current price forecasts, is if we were to see Iranian supply fall by more than 500Mbbls/d by year-end, or if OPEC decides to leave the current deal intact.

Quarterly global oil balance (MMbbls/d)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

13 June 2018

In Case You Missed It: Confidence and cracks This bundle contains 7 Articles