Crude oil: More downside to come

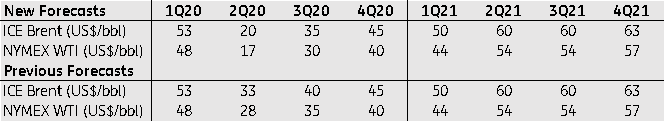

The oil market remains under pressure, given the demand shock from Covid-19 and the expected surge in OPEC+ supply from April. Demand continues to deteriorate as more countries impose shutdowns and stricter travel restrictions. We have therefore revised lower our ICE Brent forecast for 2Q20, from US$33/bbl to US$20/bbl

ING oil price forecasts

Demand contraction

The outlook for the oil market changed following the failed OPEC+ meeting in early March. The failure to reach a deal has seen a price war ignite between Saudi Arabia and Russia. This could have not come at a worse time, with more widespread travel restrictions and country shutdowns weighing heavily on demand. What many thought as a China and Asian issue has clearly proven otherwise, with Covid-19 infections soaring globally.

With this, the idea that we would see a slowdown in global consumption growth is no longer the case. Instead we are set to see a sizeable contraction in demand YoY. We are of the view that demand will fall in the region of 2MMbbls/d YoY. However this number is constantly evolving as we see more countries implementing restrictions in order to try to contain the virus.

The ongoing price war

Saudi Arabia made its intentions clear following the breakdown of the OPEC+ deal. They immediately made significant cuts to their official selling prices for crude oil over April. They also plan on increasing supply in the month to 12.3MMbbls/d, 300Mbbls/d above their sustainable production capacity and 2.6MMbbls/d above their production levels in February. Meanwhile Russia has less room to increase supply, but they are expected to increase output by 200-300Mbbls/d in the near term.

It does seem that the only thing that will bring OPEC+ back to discuss stabilising the market will be lower prices. Therefore we are likely to see more pain in the near term. Reports suggest that President Putin is in no rush to revive the deal with OPEC, saying that Russia will not give in to what he sees as blackmail from Saudi Arabia. From a fiscal breakeven point of view, Russia should be better placed to weather the current low price environment. Russia has a fiscal breakeven oil price of a little over US$40/bbl, while the Saudis need a price in the region of US$80/bbl to balance their budget.

In the absence of an emergency meeting, the market will likely have to wait until the scheduled OPEC meeting in June for some sort of action. Although by that stage it would be too late, with a significant surplus already built over much of 2Q20. The risk to our bearish view is that OPEC+ does take steps to revive the output cut deal over coming weeks. That said, any deal would still likely not be enough to bring the market back to balance, given the demand hit we are seeing. Instead, the most it will do is to reduce the sheer size of the surplus over the second quarter.

Supply response to lower prices

Clearly the current low price environment means that we will see some slowing in supply from some producers and this will likely feed through to the market as we move into 2H20. Recently, Canadian producer Suncor said that it will shut one of its two trains at its 194Mbbls/d Fort Hills oil sands mine, while delaying the startup of its Mackay River project. Canadian oil producers are really feeling the pressure, with West Canada Select trading sub US$9/bbl currently.

Meanwhile, expectations are that we will see downside to US oil production moving forward. The EIA now expects US crude oil supply to grow by 770Mbbls/d this year, compared to a previous forecast of closer to 1MMbbls/d. For 2021, US output is now expected to fall by around 350Mbbls/d. There have also been calls from regulators in Texas for the state to look at capping output for producers - we think this would be difficult to achieve, given the nature of the US industry.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article