Crude oil: How backwardated can it go?

OPEC+ production cuts are working. The oil market is tightening and this is reflected in the deepening backwardation of the forward curve. While we remain constructive, we see limited further upside in the near-term for the flat price

Deeper into backwardation

The global oil market is clearly moving back towards balance thanks to OPEC+ production cuts. OPEC production has fallen 1.98MMbbls/d from October levels, far exceeding the agreed OPEC cut of a little over 800Mbbls/d. Whilst a large part of this has come down to agreed OPEC cuts, production declines in exempt countries have also played a key role. Venezuelan oil output is estimated to have fallen from 1.19MMbbls/d in October to 890Mbbls/d in March while output from Iran has fallen from 3.33MMbbls/d to 2.71MMbbls/d due to sanctions. Declines from these two exempt countries account for almost 47% of the reduction seen from OPEC.

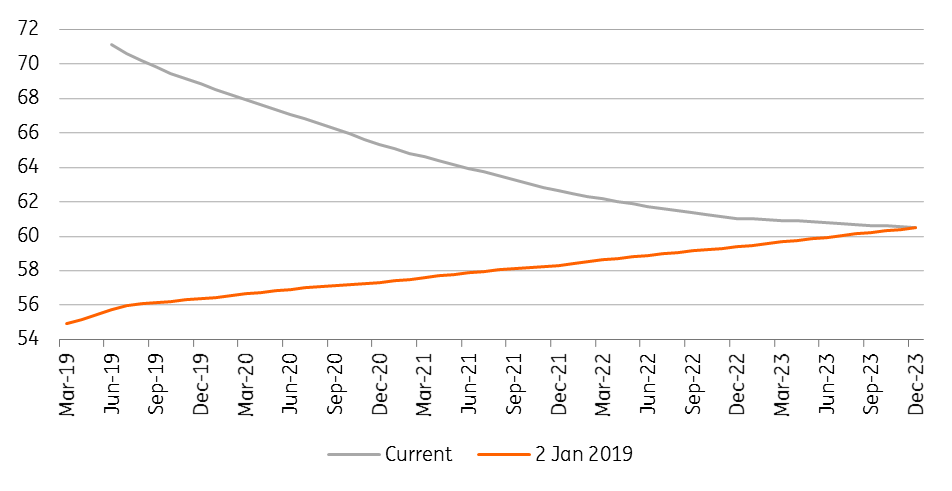

The forward curve for ICE Brent confirms that the market is moving towards balance. In fact, nearby spreads suggest that the prompt market is tight. The Jun/Jul spread has traded to a premium of US$0.50/bbl, having been at a discount of US$0.20/bbl at the start of the year.

Unsurprisingly, WTI has not seen the same strength in the spread structure, given the relatively more bearish fundamentals in the US market. US crude oil inventories remain stubbornly high despite the fact that imports from Venezuela have dried up, whilst Saudi Arabia continues to limit flows to the US in the hope that it leads to some draws in US inventories, given that this is what the market focuses on. That being said, we have seen the more constructive picture in Brent start to feed through to WTI, with the prompt WTI spread flipping from contango to backwardation recently.

ICE Brent forward curve

Increased speculative activity

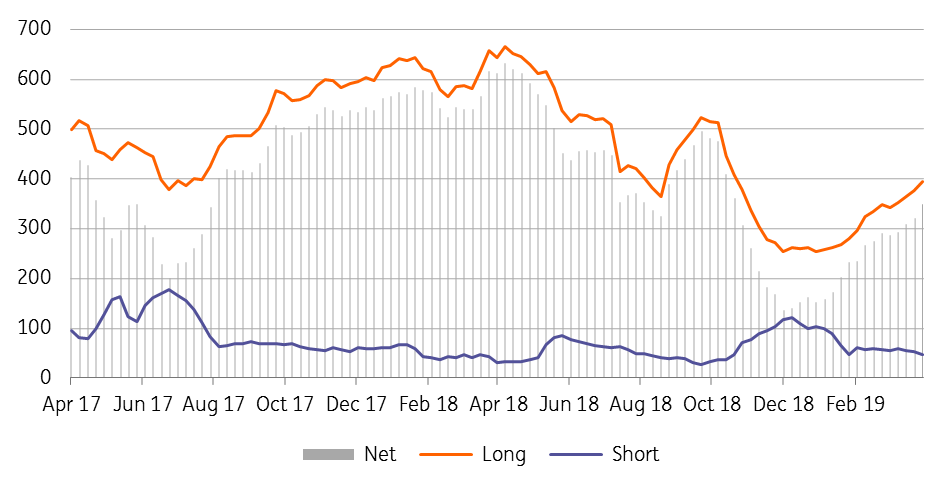

What is adding to the extreme backwardation in the market is increased speculative activity. The managed money net position in ICE Brent has increased by 212,194 lots since early December to total 348,660 lots. A tightening market, along with growing supply risks from Venezuela, Iran and now Libya are appetising enough to attract spec length into the market. Furthermore, as roll yields become more attractive this will also attract spec longs. In the current environment of supply cuts, we believe that the spread structure is likely to remain fairly well supported in the near term.

ICE Brent managed money position (000 lots)

What about producer pricing?

Producers should be happy with the flat price strength that we have seen in the market, and this is somewhat reflected in the short positioning for both commercials and swap dealers, which has increased by a total of 161k lots since the start of the year. However producers certainly aren’t jumping into the market with both feet, given that they will be pricing further along the curve, and these forward values are not as attractive as the prompt market, given the steep backwardation.

So where next for the flat price?

Similar to the spread structure, in the current environment of supply cuts we believe that the flat price should remain well supported in the near term. Although saying this, the upside is looking fairly limited, and so from a risk/reward point of view, we would not recommend initiating fresh longs at current levels. Any further upside from current levels will likely bring unwanted political pressure, in the form of President Trump calling on Saudi Arabia to increase output.

From a demand perspective, we believe the Saudis would be reluctant to push prices much higher. We remain in a fairly strong USD environment, and if this is to persist, along with stronger oil prices, the risk of demand destruction will likely become a key theme for the market again.

Chinese import demand has certainly helped the market over the last few months, with the country importing well in excess of 10MMbbls/d between November and February. A stronger price environment may see the Chinese shy away from the market to a certain extent. Another factor to consider for Chinese import demand is the use of import quotas for independent refiners. It is widely thought that refiners have front loaded imports in the hope that the government would issue a larger amount of quotas when it comes to the second tranche. If this does not materialise, imports could disappoint moving forward.

Chinese monthly crude oil imports

Key downside risks

Other than the “Trump risk” there are a couple of other key downside risks for the market.

The first being that OPEC+ fails to extend the deal at its June meeting. While our balance sheet shows that there is no need for OPEC+ to extend the deal, we believe that sentiment will be hit if the group fails to come to a deal, as it would see an end to two and a half years of cooperation between OPEC and Russia. For Russia, it makes little sense to extend the deal. From a fiscal breakeven point of view, current prices are attractive, and if they were to continue with cuts they would be helping out those OPEC nations with a higher fiscal breakeven oil price, as well as US producers. We believe that Russia not continuing with the deal is a very real risk for the market.

Another risk is that we see OPEC production edging higher as we move towards the summer, in order to meet domestic cooling demand over the hotter months. A key bullish factor since the start of the year has been Saudi Arabia’s over compliance with the output cut deal. If this were to start slipping moving forward, it would call into question overall OPEC+ compliance with the deal.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download article