Crude oil: Free fallin’

An escalation in the trade war, supply returning from Libya and Nigeria and the potential for the US to tap its emergency Strategic Petroleum Reserve, have all weighed heavily on the market. While we remain comfortable with our current forecast for weaker prices, we do believe the market remains vulnerable

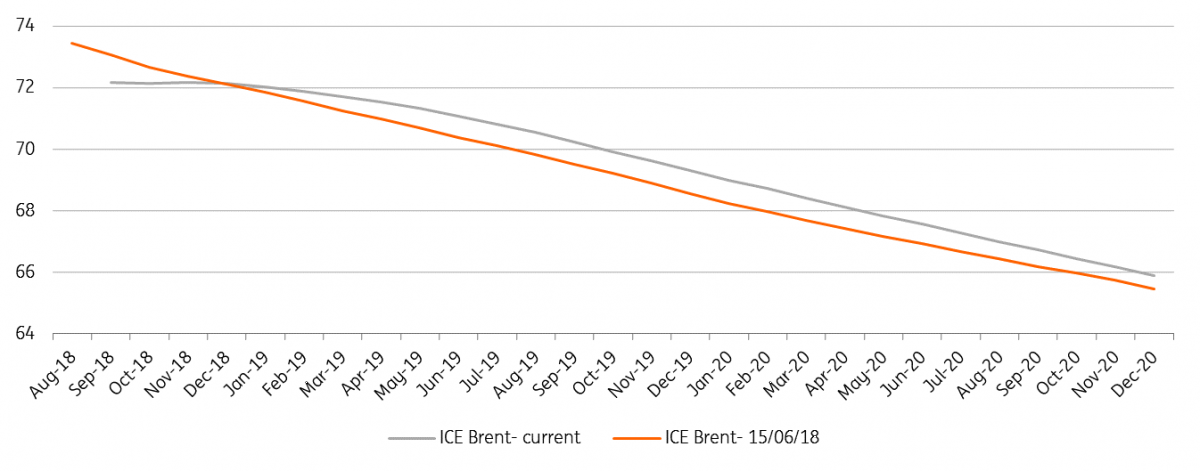

Time to say goodbye to the backwardation?

One of the most interesting changes in the oil market has been the ICE Brent forward curve, the front end has flattened considerably, which has seen the backwardation in the prompt spread flip to contango. Trade war concerns do seem to have pulled out a lot of macro money from the oil market, along with the broader risk-off approach across the commodities complex. The flatter curve does now appear to be more aligned with a somewhat weaker physical market. A flatter curve also means that the market becomes less appealing to those speculators who have enjoyed the roll yield, and so the potential for further long liquidation at the front end, keeping the curve under pressure.

The same however cannot be said for WTI. While the prompt WTI spread has come in considerably since the start of July, from over $2.50/bbl to just under $1/bbl currently, the curve is still in deep backwardation, with the spot US physical market looking tighter. Inventories in Cushing have fallen to 25.7MMbbls, down from 57.6MMbbls at the same stage last year, and the lowest inventory levels at the WTI delivery hub since 2014. The 360Mbbls/d Syncrude outage in Alberta, Canada will certainly not help, with the facility only expected to be fully operational by September. As of yet, flows from Canada do not seem to have been affected, in fact, Canada exported a record 3.73MMbbls/d the week following the outage. However moving forward, this loss in supply should start to feed through to lower flows into the US. Syncrude recently stated that they will cut supply to buyers by 35% over August.

ICE Brent curve flattens at the front end (US$/bbl)

US SPR release?

President Trump has put a large amount of pressure on OPEC to increase output, in the hope that this would see domestic gasoline prices edge lower. However, it would appear he has grown frustrated that they are not responding to his 2MMbbls/d increase request. So it seems that he may take matters into his own hands now, with media reports that the US is looking at a release from the Strategic Petroleum Reserve, with anything ranging between 5-30MMbls. In terms of ability to do so, the US sits on a significant amount of SPR, with it totalling 660MMbbls. As the US has become a bigger crude oil producer, net imports of petroleum have fallen significantly, and so the amount of SPR that the US must hold has also fallen. At the moment the US holds around 295 days of import coverage. Under IEA regulations, the US needs to hold just 90 days of import cover, and this includes both private and public inventories. So there is plenty of room for a release, however it may be more effective if the government were to put in place some export restrictions on refined products.

US SPR import coverage- 4 week rolling average (days)

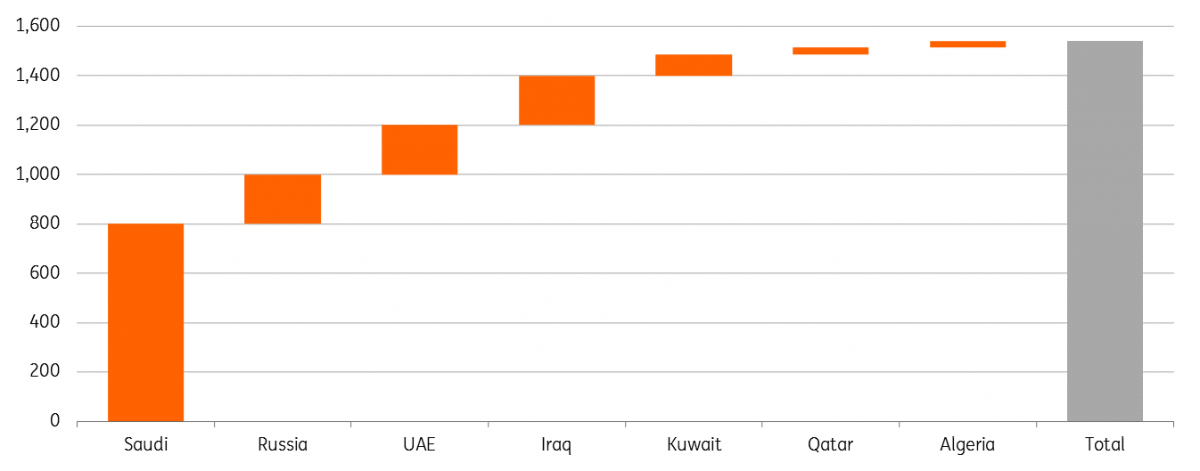

OPEC+ ramp up output

Casting our minds back to the OPEC meeting at the end of June, there was plenty of confusion around how much OPEC+ would increase output. The group’s comment to “strive” for 100% was not enough for the market. But fast forward a couple of weeks, and it has become very clear from those who have spare capacity, that production is only going higher.

Any OPEC+ production increases were going to have to be largely driven by Saudi Arabia, given that they are the member with the largest amount of spare capacity. In May, Saudi Arabia produced a little over 10MMbbls/d. In June, the Kingdom produced 10.49MMbbls/d, a clear sign that they knew exactly how the meeting was going to play out. Expectations for July are that the Kingdom could produce as much as 11MMbbls/d, which would be a clear record.

Turning to Russia, and over June the country increased output to 11.06MMbbls/d, up from 10.97MMbbls/d in May. It is no secret that Russia has been keen to relax the production cut deal for some time now, and Russia’s energy minister has said that output from the country could increase by 200Mbbls/d moving forward.

If we add up potential increases from other members of the deal, we could see a further 500Mbbls/d of additional supply coming onto the market. These increases come from the UAE, Iraq, Kuwait, Qatar and Algeria.

In total, this does suggest a potential increase of around 1.5MMbbls/d in supply in the coming months, compared to the 1MMbbls/d mentioned at the OPEC+ meeting in June.

Potential OPEC+ output increases from May levels (Mbbls/d)

Libya makes a return... for now

Libya was one of the drivers that initially saw oil prices rally towards $80/bbl at the end of June. Fighting in the fractured country led to supply disruptions, whilst forces handing over oil ports in the east of the country to the unrecognised National Oil Corporation led the official NOC to declare force majeure on loadings from a number of export terminals.

These disruptions saw Libyan oil supply fall from 962Mbbls/d in May to 527Mbbls/d in early July. However since then, the recognised NOC has regained control of these ports, and exports should start to resume as normal, which also means that output should start to edge higher once again. The latest numbers show that output has edged back up to around 650-700Mbbls/d.

Given the volatility in Libya though, it is difficult to forecast with accuracy about where output is going. However, it is probably safe to assume that output from the country will remain fairly volatile moving forward.

US sanction impact on Iran remains the big unknown

A key bullish factor for the market has been the US insisting that allies cut purchases of Iranian crude oil to zero by 4 November, with no waivers on offer. However, the US does appear to have relaxed this stance somewhat, and waivers are now expected to be granted on a case by case basis. Who will receive waivers is still a big unknown and there are reports that the US has rejected requests from Europe for waivers against the sanctions. It seems that the key for Iran will be trying to convince Asian buyers to purchase more Iranian crude oil. Iran has already lowered its official selling price into Asia for August by $0.20/bbl to $2/bbl for its Iranian Light.

Key to this will be China, and given the worsening relationship between the US and China with the escalating trade spat, China is unlikely to listen to calls from the US to cut purchases. If anything, with the potential for discounted Iranian crude, we could, in fact, see China stepping in as a bigger buyer. In doing so, this would partially offset the impact from US sanctions on Iran. We continue to assume that we will see Iranian supply fall by 500Mbbls/d but are conscious of the fact that we may have to increase this number moving forward.

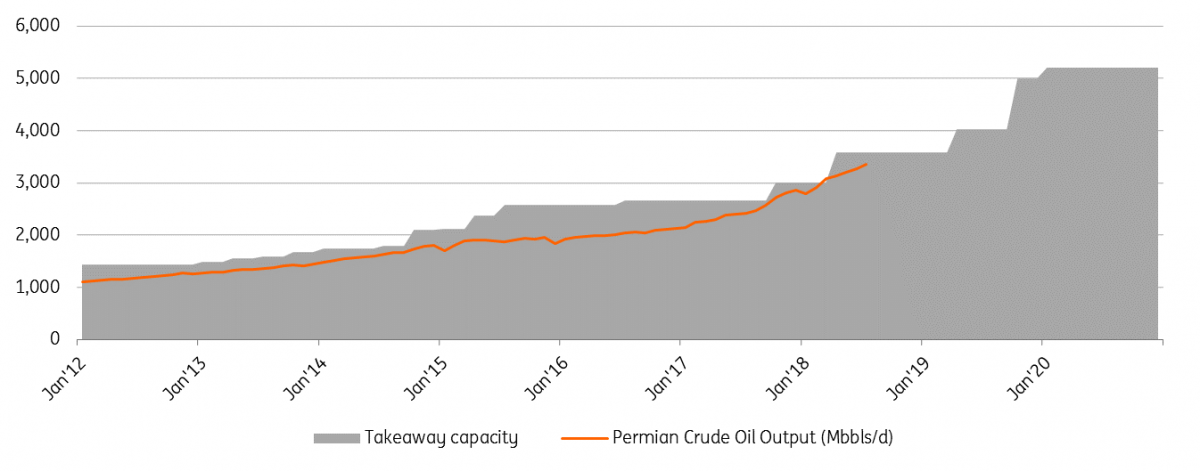

US pipeline constraints and supply growth

Limited pipeline capacity in the US continues to hit spreads, with crude in Midland, Texas continuing to trade at large discounts to Cushing and the Gulf. The concern has been that pipeline constraints would start to have an impact on production growth in the Permian region, and it does appear that we are seeing early signs of this. If we look at the US oil rig count it has been largely flat since the beginning of June, whilst EIA weekly production data has been flat since early June as well.

Pipeline capacity is going to remain an issue through until at least the 2H19, which is when new capacity is expected come online. If pipeline constraints do continue to hold drillers back, we believe that there could be some downside to the EIA’s current production forecast of 11.9MMbbls/d for 2019.

Permian oil output vs. takeaway capacity (Mbbls/d)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

OilDownload

Download article

17 July 2018

In Case You Missed It: Nothing thrilling This bundle contains 6 Articles