Crude oil: Flat price vs time spreads

Oil has come under renewed pressure, reflecting broader macro concerns, and the potential impact this could have on oil demand growth. However, time spreads continue to point towards a tightening market. A weaker flat price might force OPEC+ to act, which would mean an even tighter market moving into 3Q

Justifying the price weakness

Looking at the flat price, one could easily think that the oil market is battling with a surplus of oil. Having traded to a recent high of US$75.60/bbl towards the end of April, ICE Brent has fallen by more than 10% since. While breaking below key technical levels this week would have exacerbated the move lower, the catalyst for the move appears to be broader macro concerns, and the potential impact this could have on oil demand growth moving forward. Just last week, the IEA revised lower its demand growth forecast by 90Mbbls/d to 1.3MMbbls/d, although admittedly, this revision reflected poorer than expected demand over 1Q, rather than the demand outlook for the rest of the year. Unusually large crude oil builds in the US have not helped sentiment.

What is not being priced in is the recent tension we have seen in the Middle East, which includes the sabotage of a number of tankers off the coast of Fujairah, along with a drone attack on the East-West pipeline in Saudi Arabia. This does suggest some level of complacency by market participants.

However, at least for now it does appear that the flat price is going to be largely dictated by broader macro concerns. Looking at positioning data, speculators still held a sizeable net long of almost 400k lots in ICE Brent as of last Tuesday (14 May), although given the recent sell-off, this is likely to be somewhat lower currently. But it still leaves quite a bit of potential for further spec liquidation, as investors turn towards safe haven assets in this risk off environment.

ICE Brent managed money position (000 lots)

How will OPEC+ respond?

We do believe that further significant price weakness would be sending the wrong signal to the market, and more importantly OPEC+. A very real risk for the market is that if we do see further price weakness, OPEC+ could be forced to continue with its production cut deal into the second half of the year. This is something that we do not believe the market needs. We are already forecasting a relatively large deficit over 3Q, and extending cuts would only mean a deeper deficit. If this turns out to be the case, it means the potential for only higher prices as we move through 3Q.

It is widely known that out of all members of the OPEC+ deal, Russia is the most reluctant to extend production cuts. However, if we get to the OPEC+ meeting in July and prices are trading sub $60/bbl, this might be enough to persuade even the Russians to continue with the deal.

Spreads suggest a tight market

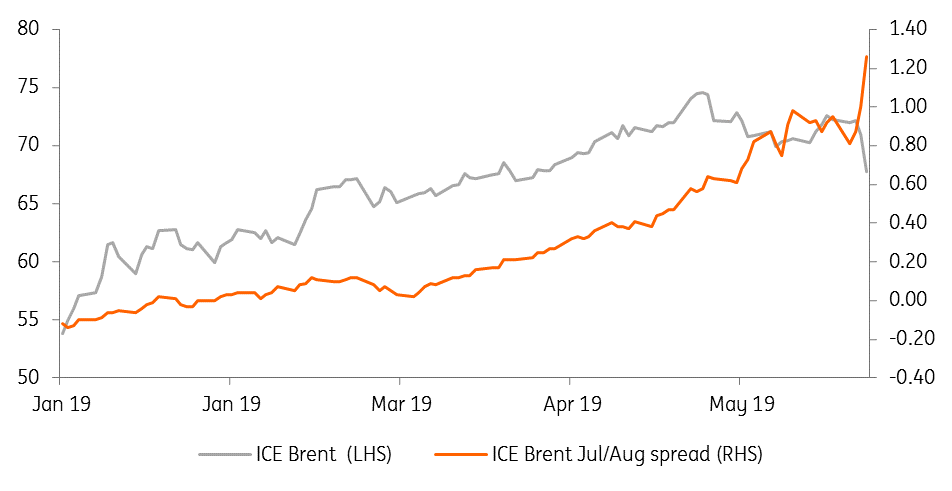

If we look at the time spreads, they are a much better reflection of the state of the physical oil market. The prompt ICE Brent spread has traded to as high as US$1.29/bbl recently, clearly a signal that the prompt market is tight and is set to tighten further if we see OPEC+ cuts extended, along with a further decline in Venezuelan oil output, and a further decline in Iranian oil exports following the expiry of waivers.

Physical values confirm this tightness in the market, with the official selling prices (OSP) for a number of Middle East producers edging higher. The OSP for Arab Light into Asia has increased from US$0.60/bbl in January 2019 to US$2.10/bbl for June.

ICE Brent flat price vs. Jul/Aug spread (US$/bbl)

What is tightening the market?

There have been a number of developments which have helped to tighten the oil market, but the key culprit has been the effectiveness of OPEC+ production cuts. In particular, the over compliance that we have seen from Saudi Arabia has certainly helped, with the Kingdom continuing to cut output by 500Mbbls/d more than agreed- something that the Saudi Energy Minister has said they will do through until at least the end of June.

Other drivers for physical tightness includes the contaminated Russian oil incident along the 1MMbbls/d Druzhba pipeline, which is forcing some refineries in the CEE to turn to strategic reserves and the spot market. This has come at a time when there have been a number of planned outages in the North Sea.

US market better supplied

It is clear that the US market is not dealing with the same degree as tightness, the WTI/Brent spread remains largely under pressure, trading at a discount of more than US$9/bbl, while the front end of the WTI curve is in contango. Inventory builds are behind this weakness, with both Cushing and total US crude oil inventories edging higher in recent months. In fact, Cushing crude oil inventories are in excess of 49MMbbls, levels last seen in late 2017. Meanwhile, total US crude inventories continue to trend above the five-year average. Unusually low refinery utilisation rates are the key driver behind these crude oil builds, with refineries appearing to have a prolonged maintenance season this year, along with a number of unplanned outages as well.

Even record low flows of Saudi oil to the US have not been enough to offset these lower refinery utilisation rates. However, we would expect to see run rates increase as we move into the summer, which should bring an end to these unusual crude builds that we are seeing at the moment.

US crude oil inventories vs. refinery utilisation rates

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article