Cross currency swaps: USD premium to remain intact

Even as the US dollar comes off its highs post the Fed funds rate peak, the dollar cross-currency basis should maintain a decent premium versus the euro and the yen. But the dollar premium should still edge lower in 2023, and all-in spreads (incl. the basis) should be falling in the second half. Sterling paves a different path, on tight spreads to dollar rates

All-in spread into USD to come off highs by the second half

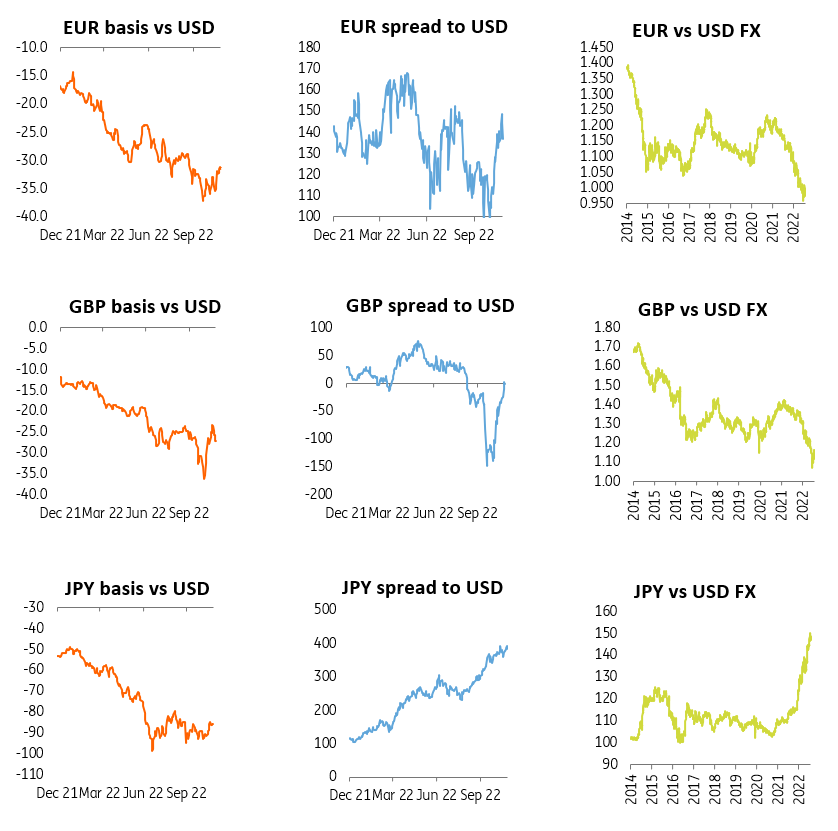

A USD premium on the cross-currency basis remains thematic versus the likes of the euro, Japanese yen and British pound. This is equivalent to a basis discount on the latter three currencies, with the most extreme version attached to the Japanese yen. For 2023, we doubt there will be a huge amount of change here. Effectively that means rate differentials that manifest in a pickup into dollar rates continue to be amplified by the basis to give a larger all-in spread.

We see from the US side a tightening in liquidity

When we look at drivers, we identify from the US side a tightening in liquidity dominating for most of 2023. This will be tempered by our call for rate cuts in the second half of the year, but balance sheet roll-off can technically continue in tandem, at least for a period. This may appear contradictory, but the balance sheet roll-off towards a better liquidity equilibrium can be viewed as a separate exercise to interest rate cuts to cushion the economy.

The eurozone and Japan lag this process

Both the eurozone and Japan lag this process, although the UK is primed to be more in line. That, in part, helps explain why the UK basis and all-in spread remain relatively tight to the US. In contrast, the euro and yen spreads remain relatively wide for the first half of 2023, but are likely to tighten in the second half. This tightening could come from a combination of the narrowing in absolute spreads and a de-compression of respective basis discounts.

All-in spreads to tighten

For example, the all-in spread between the SOFR 5yr and the TONAR 5yr is in the area of 4.5% in the first half of 2023, but this narrows to 3% in the second half, including some 20bp in basis decompression. For the euro, the equivalents are 175bp in the first half versus 100bp in the second half, with a more moderate basis compression of some 5-10bp. For the UK, there is a more balanced spreads scenario in play, but one that maintains a basis discount in sterling versus the US dollar on the cross-currency swap.

Dashboard of cross-currency components for EUR, GBP and JPY (vs USD)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 November 2022

Rates Outlook 2023: Belt up, we’re going down This bundle contains 9 Articles