Cross currency opportunities: EUR spreads to outperform USD counterparts

We expect USD spreads to underperform against EUR in 2021. Alongside this, we expect the cross-currency basis swap and 3m vs 6m roll to remain tight. In combination, this will offer a cost saving advantage for US corporates to issue in EUR and swap back to USD. We forecast corporate Reverse Yankee supply to reach €80bn

Corporate credit and Reverse Yankee supply implications

Following on from our report 'Cross Currency Swap Decomposition A rationale for swapping from USD into EUR', which you may be able to access here (under Developed Rates Strategy), we take a look at what this means for corporate credit and Reverse Yankee supply. As stated in the previous report, we find that swapping from USD to EUR is becoming more attractive in light of the widening of the spread in recent months. It will likely move wider, but even at current levels, there is opportunity to get cheaper funding.

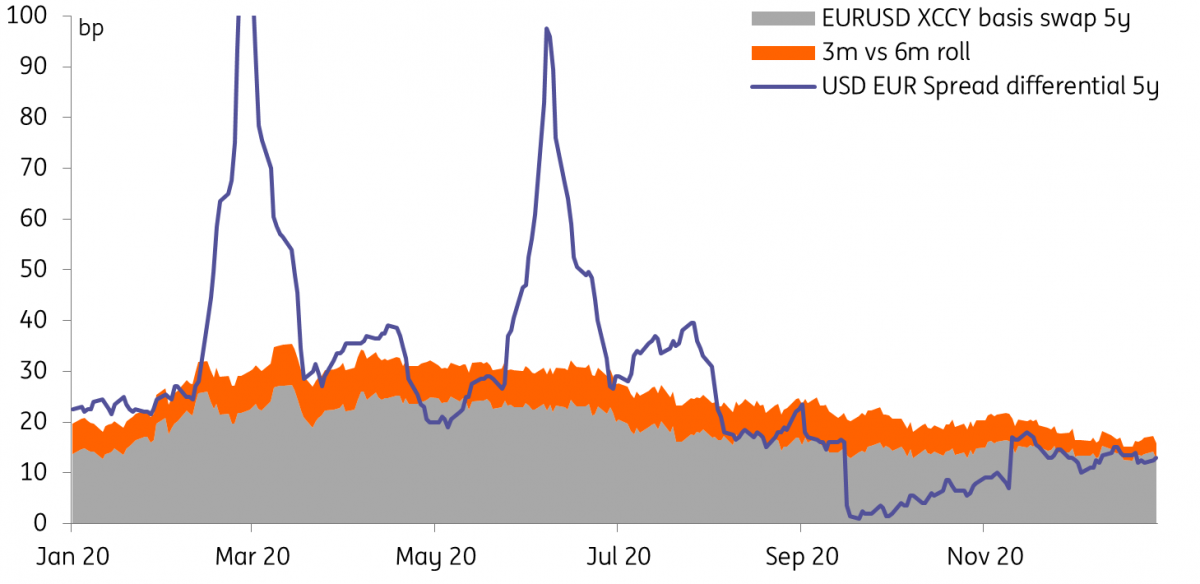

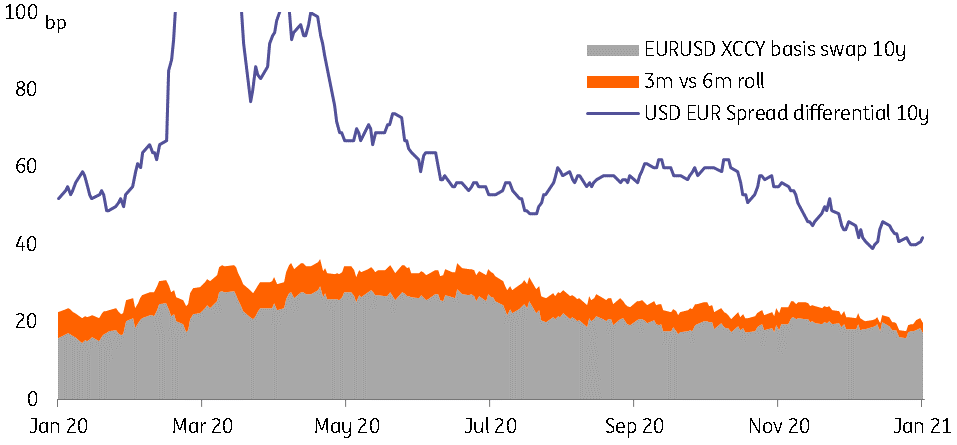

As seen in the two charts below, the cross-currency basis swap and the 3m vs 6m roll have tightened significantly. Furthermore, in the 10yr area, the USD EUR spread differential is notably wide. The 5yr spread differential on the other hand is significantly tight. At current levels, the long end of the curve offers an attractive cost-saving opportunity for US corporates to issue in EUR.

Cross currency basis swap 5yr & EUR USD spread differential 5yr

Cross currency basis swap 10yr & EUR USD spread differential 10yr

Examples indicate a similar picture

The table below illustrates the cost or saving for both European and US issuers to swap. As you can see, the 10yr+ area is very advantageous for US issuers to issue a EUR bond. Whereas the opposite can be said, but not to the full extent, for European corporates issuing in USD. As mentioned we expect the entire USD curve to underperform versus EUR and as a result, we will likely see the 5yr area also open up a cost-saving advantage for US corporates. However, this then eliminates any of the marginal cost saving seen for European corporates issuing in USD.

Swapping into home currency (bp)

EUR spreads will outperform USD as ECB support remains across the curve

In 2021 we expect to see USD spreads underperform against EUR across the curve. Therefore, we will likely see the 5yr USD EUR spread differential also widen. USD curves have been particularly steep as a result of the short end limitation of the Fed support. The recent underperformance of USD is highlighted by the fact that the USD EUR spread differential is widening in the 5yr area of the curve, the exact area where both the US Federal Reserve and the European Central Bank were active. Naturally, the differential is much wider in the 10yr area where the FED was not directly purchasing. The cost-saving advantage in the 10yr is significantly higher and although these are indexed averages we can assume a funding advantage for almost all US corporates. Consequently, the majority of Reverse Yankee supply will be longer-dated bonds.

Many US corporates are likely waiting to issue multiple Reverse Yankee bonds in order to build their EUR curve

On saying that, we do still expect USD to underperform against EUR across the curve as the ECB remains active at roughly €5.5-6bn per month in EUR purchases. The Fed, on the other hand, has ended its purchasing programme for both corporates ETFs. Therefore, we may see a widening in the 5yr area of the spread differential, offering more Reverse Yankee likeliness. Many US corporates are likely waiting to be able to issue multiple Reverse Yankee bonds in order to build their EUR curve.

Apart from the ECB, other reasons we expect USD underperformance are;

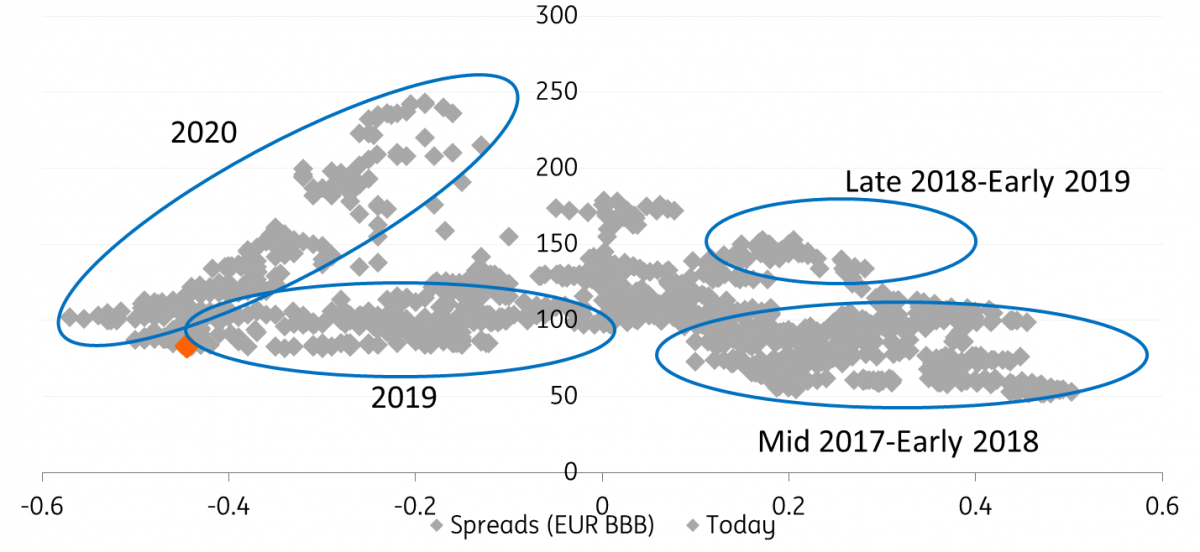

The chart below illustrates the regression of yields to spreads, which shows constituents are currently deep in negative yield territory. Interestingly, 2019 also saw negative yields, but regardless of the direction that negative yields moved, spreads were locked in at or close to 100bp (in the case of a Euro BBB index). Essentially, negative underlying yields constrained further spread tightening, thus last year it seemed that in a negative rate yield environment there was no big movement in spreads.

In 2020, however, due to the substantial Covid 19 spread widening, this was no longer the case in terms of potential widening. Although, it is likely that the lack of tightening potential may hold true, meaning that the squeeze from here will not occur whilst in negative yields. However, as we expect rates to rise this year the tightening potential for the short end of EUR spreads increases, and subsequently increasing the spread differential between EUR and USD on the short end.

Regression of euro yields to spreads over the past five years

The euro's strong and positive technical picture

The technical situation in USD is not as positive as it is in EUR. The strong positive technical picture for EUR in 2021 will be a tightening driver for spreads. With a net corporate supply of just €270bn (€350bn supply expectation) as well as the increase in demand via continued ECB support and positive although limited mutual fund inflows. This results in just €50bn in positive EUR net supply for 2021. Indeed USD supply will substantially less than last year, with our expectation of around US$800bn, combined with increased redemptions of US$480bn, which is, of course, a positive technical swing. However, this is not as considerable as EUR.

The current low yields environment in Europe is credit tourism

The current low yields environment in Europe is credit tourism. Corporates will be attracted to the EUR credit markets and cheaper funding. Meantime, the search for yield will be very prevalent.

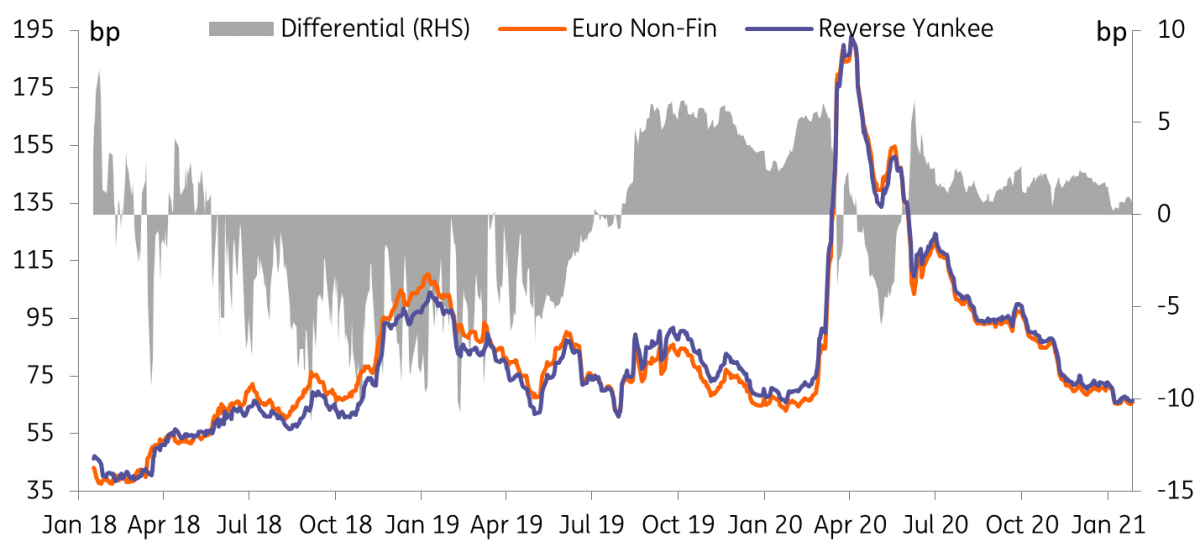

Interestingly, in the EUR credit market, US corporate EUR bonds only offer marginal spread premium versus European corporate EUR bonds as seen in the chart below. In saying that, it still holds true that Reverse Yankee issues tend to hold more premium in the primary market. Predominately, due to the US corporate bonds not being ECB eligible, we expect ECB eligible bonds to outperform in 2021, particularly in the second half of the year when we expect to see a slight widening in spreads.

Euro corporate non-financial versus Reverse Yankee corporate non-financial spreads

Reverse Yankee supply to return to 10% of US Corporates supply

2021 will continue to see the US issuer active in the European credit market driven by the fallen cross-currency basis swap, the need to diversify the funding mix after a USD focussed year, the current net funding advantage and the expected outperformance of EUR debt relative to USD. Supply as a whole is expected to return to normality after the substantial supply in 2020 but is likely to still be a sizeable amount of €350bn. Furthermore, we expect Reverse Yankee supply to play a role in this sizeable supply forecast. Our forecast for 2021 corporate reverse Yankee supply is €80bn. Hence last year reverse Yankee issuance at €65bn stood at 17% of total EUR IG issuance and only 7% of total US corporate (all currency) issuance.

We expect US corporate supply to fall from 2020's dizzying heights

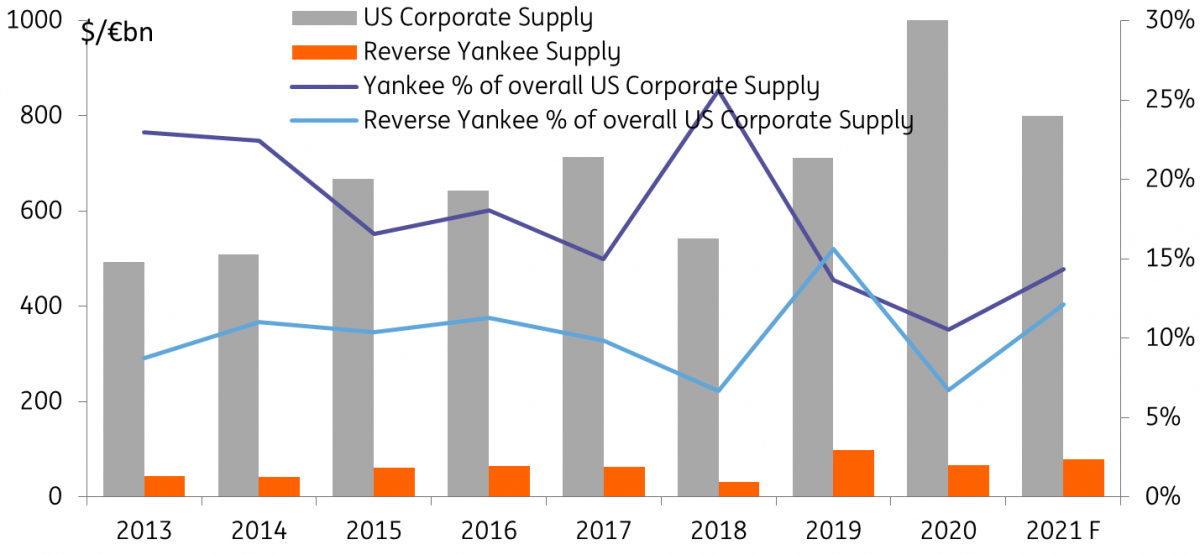

We expect US corporate supply to fall from 2020's dizzying heights (given the coronavirus-related emergency liquidity needs) and we think US corporates will increase the share of euro funding and hit their trending average of 10% or more in the EUR currency. This is illustrated in the chart below, where we see the 2020 percentage of Reverse Yankee supply relative to domestic US corporate supply amounts to no more than 7%. For 2021, we expect US supply to return to the norm slightly, but still be a sizeable amount of $800bn, marginally beating the previous records set in 2017 & 2019. Meantime the percentage of Reverse Yankee supply edges higher again to 10-12% of total USD supply like in 2017 and 2019. The means the total Reverse Yankee number is just over €80bn.

Corporate Yankee and Reverse Yankee Supply vs U.S. Corporate Supply

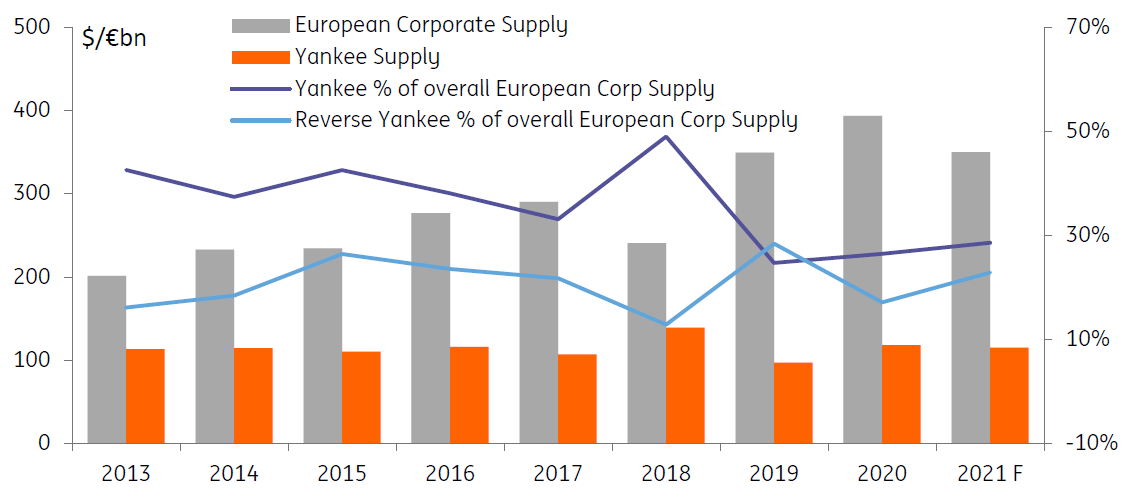

We also consider what percentage of EUR issuance is typically supplied by US corporates and see that the average here over the last few years (from 2014) stands at 25%. As seen in the chart below, we pencil in a forecast of €80bn, which will be roughly 23% of the €350bn we forecast for corporate supply. This is similar but slightly lower than 2019 when the arithmetic was also such that it offered a considerable cost-saving advantage.

Corporate Yankee and Reverse Yankee Supply vs European Corporate Supply

In conclusion, we expect the cross-currency basis swap to tighten further and remain tight for 2021. Alongside our expectation for USD spreads to underperform EUR, based on the lack of central bank support, EUR low yields environment being credit tourism, short end EUR outperformance and the stronger EUR technical picture. As a result, there will be a very attractive cost-saving opportunity for US corporates to issue EUR bonds and therefore we set our Reverse Yankee supply forecast at €80bn.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

27 January 2021

Hopes fade for a synchronised global recovery This bundle contains 10 Articles