Credit squeezing into central banks – what next?

Further spread tightening today as the significant inflow-induced squeeze in credit continues. We see room for widening and volatility, especially tapering, but overall remain constructive on credit overall for 2023. Further returns in the sector will be a function of yield and carry. We look at what's new for the Corporate Sector Purchase Programme

Further squeeze in spreads – but room for widening

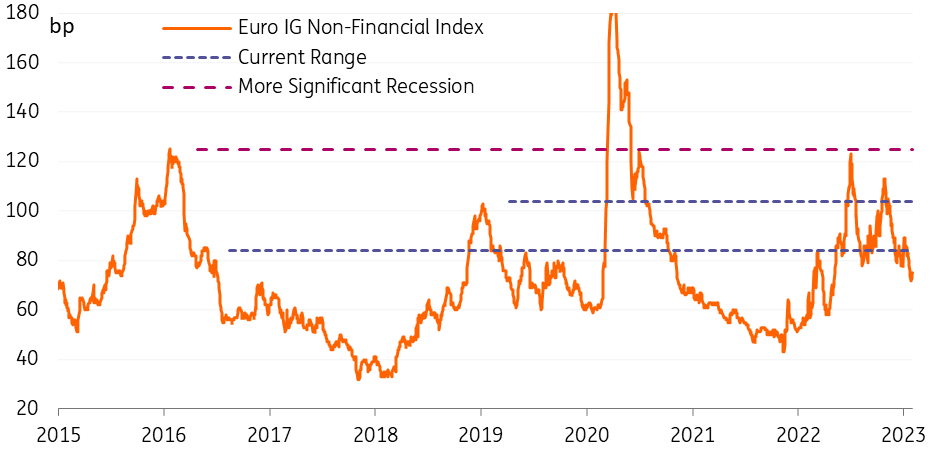

The strong rally in credit markets continues after a couple of slow days ahead of the central banks meetings. After a rather hawkish ECB, credit spreads tightened around 5bp on average. The value we saw in credit three months ago has evaporated and spreads are looking rather tight, (now trading 10bp below the bottom of the previous recession trading range). Thus we feel there is plenty of room for widening and still expect volatility on the horizon. In saying that, we still remain constructive about credit and still expect spreads to end the year even marginally tighter than current levels. Further returns in the sector will be a function of yield and carry, rather than spread tightening.

EUR IG non-financial spread range

Tapering of reinvestments will add turbulence and increase volatility

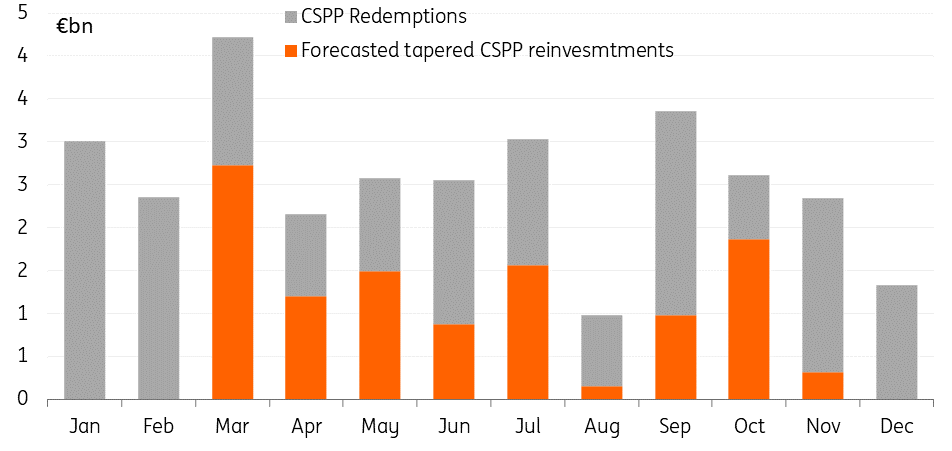

Amongst the list of risk factors and negative drivers for credit is quantitative tightening. Some additional details were released on the tapering of the asset purchase programmes starting in March.

What is new for CSPP?

- The reduction of the holdings by €15bn per month via lower reinvestments is confirmed.

- They will not continue with primary market purchases via CSPP in order to focus on the secondary market.

- However, issuers with a better climate performance and green bonds will continue to be purchased in the primary market, as the ECB vows to tilt in a stronger manner towards better climate performing issuers.

The statement “The remaining reinvestment amounts will be allocated proportionally to the share of redemptions across each constituent programme of the APP”, means that we can compute the CSPP reinvestments for the coming months. The following table assumes the pace of €15bn reduction remains consistent, however it is also possible the reduction pace increases or they stop reinvesting completely come July.

The lower level of support could add to the turbulence and increase volatility, potentially reprice spreads wider, ultimately adding more value to credit. Should there be even faster tapering then it will change the positive technical further and lead to spread widening in the case of faster tapering come July or an abrupt stop. Active selling of holdings will clearly have much more negative implications on spreads.

Expected CSPP reinvestments

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more