Credit markets and the coronavirus threat

We take a look at what it could mean for EUR and USD in Investment Grade and High Yield

Some sectors more exposed to coronavirus

The Euro and USD credit markets are seeing the repercussions of the spread of coronavirus. We have already seen widening in credit spreads, but these events have highlighted the weakness due to leverage in higher beta credit, high yield and leveraged loans. All sectors have seen widening spreads and steepening curves, but there are some sectors that are more exposed to Covid-19. Consumer goods, Autos, Chemicals, Food & Beverages, Oil & Gas and Travel have been the biggest underperformers.

Performance (bp)

Corporate spread developments

Financial spread developments

Credit curves steepened considerably at the start of last week, but as the week progressed the short end began to underperform, particularly in BBB, causing slight flattening of the curve. This is due to potential rate cuts being priced in, despite the ECB having limited room to cut further. This will result in widening on the short end because credit will struggle to go further into negative yields.

Using the ICE BofA Euro Corp Non-Financial BBB indices as a proxy, spreads widened 21bp last week. This is a substantial widening. Interestingly, according to the relative value heat maps, the 1-3yr maturity bucket of Energy, TMT and Covered bonds still look statistically expensive.

Major events

A push for higher quality should fears continue

High Yield credit has largely underperformed, with over a 100bp widening in the ICE BofA Euro High Yield index. Although single B spreads underperformed the most in Euro high yield with a widening of 174bp. Some B rated names may be on the verge of being downgraded to CCC. Last week saw mutual fund outflows in Euro high yield of 0.29% of assets under management, but interestingly, Euro investment grade funds remained inflowing at 0.11% of assets under management.

If the Covid-19 fears continue, we are likely to see similar trends of a push for higher quality, resulting in more underperformance of higher beta names and long end of curves.

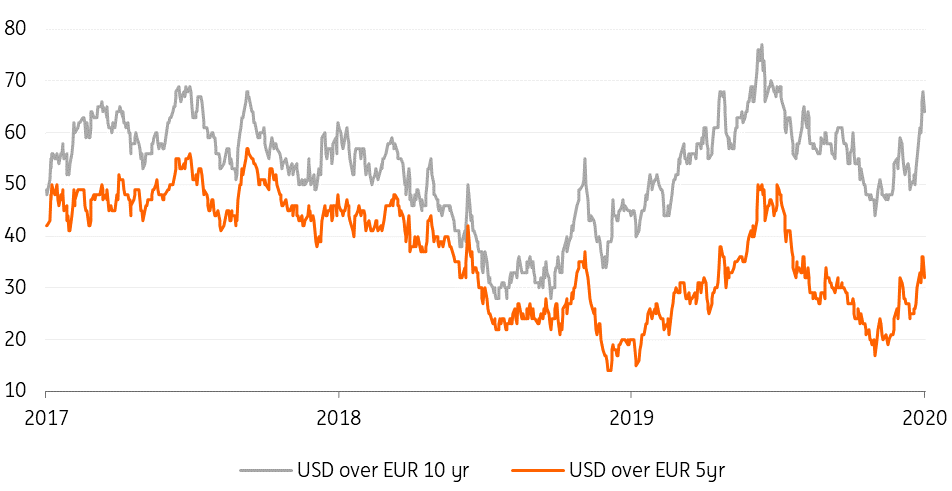

USD spreads have also widened considerably, underperforming against the Euro spreads. Figure 4 illustrates the growing differential between USD spreads and Euro spreads. This is particularly so on the long end of the curve. Much like in Euro, USD investment grade mutual funds remained inflowing at 0.12% of assets under management, whereas USD high yield has flipped to outflows of 1.99% of assets under management.

USD credit spreads over EUR spreads

A potential warning for credit markets at large

One swallow does not make a summer but outflows in USD high yield mutual funds over the past week at almost 2% of assets under management should be seen as a warning for credit markets at large.

Outflows in USD high yield mutual funds should be seen as a warning

We have often been at pains to stress that one of the biggest risks for credit spreads is the leveraged part of the credit spectrum in the US where investor protection has fallen whilst leverage and debt levels have risen substantially. Expectations on default rates are still very benign and the downturn in economic activity could trigger an uptick, expectations of which will lead to investors in the higher yield space and the leveraged loan space to reduce holdings at an aggressive pace, liquidity in these parts is limited and as such could lead to capitulation trades. And a serious repricing.

The leveraged loan price index has fallen from 98bp to below 96bp; the last time we were at these levels was at the end of 2018. This large pressure build up in the leveraged loan space, may result in an increase in the default rate.

Leveraged loan price index (bp)

Concerns about a significant credit market correction

Credit markets might have seen a serious widening in credit spreads but from a yield perspective, in investment grade USD and EUR at least, the effect has been far more benign. Nonetheless, the events have highlighted the weakness due to leverage in higher beta credit, high yield and leveraged loans. Our rates strategists and economists, earlier today, emphasised their expectation that coordinated action from central banks is likely and the ECB will participate. These measures could include a 10 or 20 basis point rate cut, combined with tweaking of tiering and TLTROS. From a credit market perspective that leaves tweaking of the corporate sector purchasing programme on the cards at a later stage, in this instance we would be looking at a possible increase of (the share of) CSPP to €10bn a month and, even more speculatively, the addition of purchasing preferred bank debt comes back into the mix.

The longer the credit market fall-out continues, the more the aforementioned risk scenario comes into play and a significant credit market correction becomes a possibility. Given ECB QE, the Euro-denominated market is better protected as is the lower leveraged investment grade arena.

Worst performers in February (%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 March 2020

In case you missed it: Global flight to safety This bundle contains 9 Articles