Market turmoil leaves credit in limbo

Recent market turbulence might get you asking 'just what sort of crisis is this?'. We think it's one that will be reflected in both short and long-term spreads. And this changes the investment decision. Initially, we'll see more volatile spread movements; later, higher funding costs. But many areas of value will be created

If the recent crisis of confidence was created by bigger concerns about inflation and sharp moves in rates, the focus now is more on Alpha, the issuers in credit markets. In our 2023 forecasts, we felt this would be a year where issuer selection would be key and the indirect effect of the events of 2022 would resurface. Hence this is more a credit crisis, less so a macro or rates crisis, as we noted last week in Market turmoil: Making sure you don’t make a drama out of a crisis… yet).

We expect spreads will remain under pressure in specific areas and the market will remain volatile. We are still constructive for the whole of the coming year as we see strong technicals to drive spreads tighter than current levels. But this won't come without turbulence, as we acknowledge there are numerous risks, uncertainties and negative drivers.

Bank debt market in limbo: what is the value of this product?

It's clear that regulators, not just in the case of Credit Suisse but also in the States and elsewhere, have not followed their own blueprints that were put in place after the credit crisis of some 15 years ago. This raises numerous questions as to the value of investments across the bank liability structure right across the globe. At the end of the day, a credit investment is all about the possible jump to default. Given the unpredictable ways both regulators and governments approach distressed banks, it all means that it's becoming increasingly difficult to calculate and therefore invest in any segment of the liability structure.

It's doubtful that banks will be able to issue new AT1 anytime soon

The decision of the Swiss authorities to wipe out the Credit Suisse AT1 debtholders and not respect the normal creditor 'waterfall' resulted in the AT1 market being severely hit. Despite other European bank regulators proclaiming that the Swiss way should not be seen as the blueprint for future bank trouble in Europe as a whole, the AT1 market remains in limbo and the question around what the actual value of this product - and subsequently the rest of the liability structure - lingers.

It's doubtful that banks will be able to issue new AT1 anytime soon, increasing the likelihood of outstanding AT1 notes being extended. We consider that the recent events in the banking sector have resulted in substantially increased uncertainty, which is likely to continue to be reflected in substantial short-term volatility in credit markets. We expect bank spreads to be negatively impacted both in general terms and longer term, whether in bank capital or in bank senior debt, as bank investors factor in more uncertainty regarding resolution practices.

Concerns on regional banks

Another drag on bank risk comes from the US regional banks. After three of them failed in the past couple of weeks, US regional banks have remained under strain. Silicon Valley Bank and Signature Bank were labelled earlier as 'systemic on-the-go' to allow for support for their complete deposit bases. Uncertainty prevailed, not least because of mixed messages from US Treasury Secretary Janet Yellen, which added confusion over whether or not support is offered to depositors.

Uncertainty prevailed because of mixed messages

US officials are also said to be studying ways to extend the FDIC deposit coverage on a temporary basis, according to media sources. If it's extended, these types of measures should help alleviate bank risk and provide more stability for (uninsured) deposits. Large deposit shifts increase the risk of liquidity-driven bank collapses. The more limited size of regional banks means that it is less straightforward to assume they would then be extended this support. It would create pressure for uninsured depositors to move from smaller non-systemic banks to larger systemic ones.

Small banks (less than $250bn of assets) account for 43% of all commercial bank lending in the States, up from 30% in 2008, so they have become more important for the US economy. If they pull back, it is doubtful that large banks can completely fill the void. And don't forget that small banks account for more than two-thirds of all outstanding commercial real estate lending and more than a third of all outstanding residential real estate lending. Should price falls for these assets accelerate, the balance sheet position of the small and regional banks could look even more strained and intensify any turmoil.

Tighter lending standards will widen spreads long term

So, all these challenges are already restrictive for banks' general funding levels in general. Add on the side-effect of potential rising capital costs and there is every reason to believe that there will be a feedback loop from there to rising financing costs for non-financial corporates.

The inclination or even possibility of banks to lend will be subdued

After all, the inclination or even possibility of banks to lend will be subdued. Lending standards have been tightening in both Europe and the US. This will have a negative credit effect on credit spreads. The feedback loop to credit spreads is evident and thus should be a negative driver for spreads. New issue premiums on newly issued bonds will increase and ultimately, spreads will need to be priced wider long-term. This will particularly be the case for the high-yield market. This isn’t necessarily driving spreads right now but does add an additional negative factor in a secondary effect.

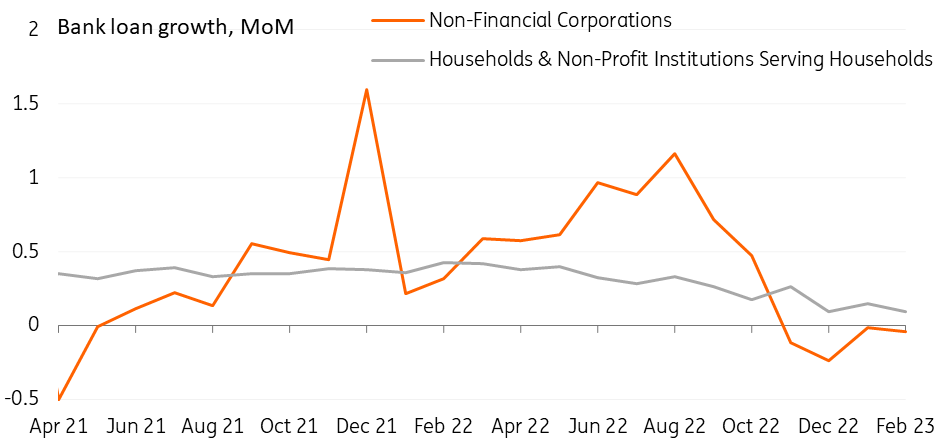

We talk a lot about what's going on with bank lending; take a look at this article: Eurozone bank lending dampened by ECB’s monetary tightening. And bank lending to corporates has fallen again, as you can see in the chart below. At the same time, growth in household borrowing remains on a downward trend. We expect weakness in lending to continue as the effects of the ECB’s rate hikes work their way through the system. The risk of contraction on the back of monetary tightening in the eurozone remains significant.

Eurozone bank lending shows another contraction

Spread developments and direction

Significant volatility over the past two weeks has seen spreads jolting wider on the back of increased uncertainty in the global banking system and violent swings in rates markets. A small retracement last week offered some stability following initially supportive comments from Janet Yellen. But this was short-lived as risk-off returned on Friday after subsequent comments from the US Treasury Secretary appeared to be less supportive.

The risks remain high and market direction's uncertain

And it all left us wondering how or even if the government would step in if there were deposit runs on smaller banks. We feel that risks remain high and market direction uncertain, as there may be more hunting for weakness. Already the market's eyeing up its next potential victim.

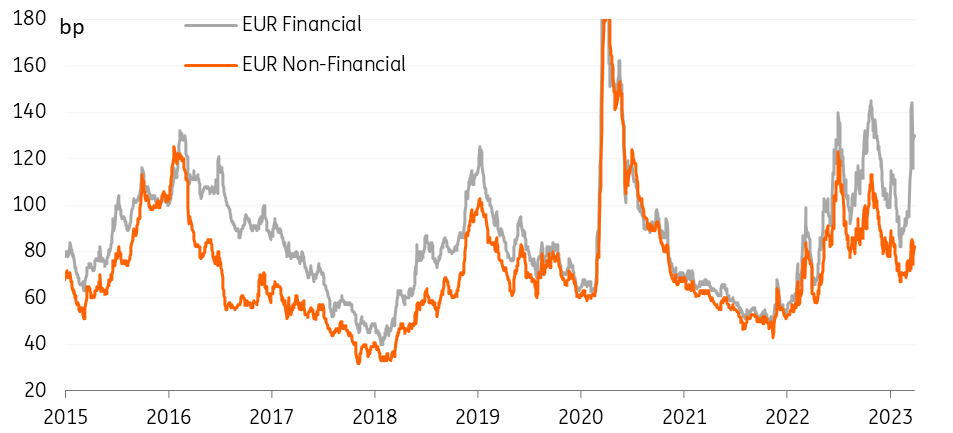

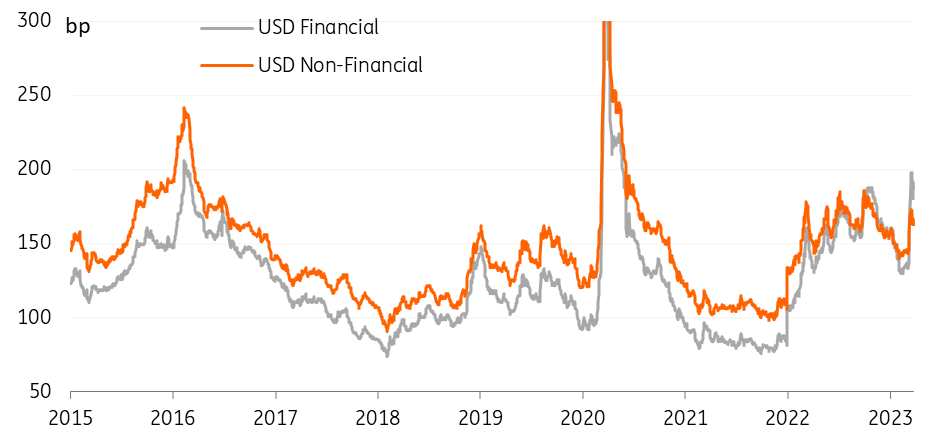

Using BofA ICE indices as a proxy, we note the initial widening of each index from around 9th-10th March and subsequent tightening thereafter:

- EUR Financial spreads widened 48bp and came down to sit just 34bp wider,

- EUR Corporate spreads widened 13bp and came down to sit just 10bp wider,

- USD Financial spreads widened 30bp and came down to sit just 20bp wider,

- USD Corporate spreads widened 65bp and came down to sit just 54bp wider.

Euro credit spread developments

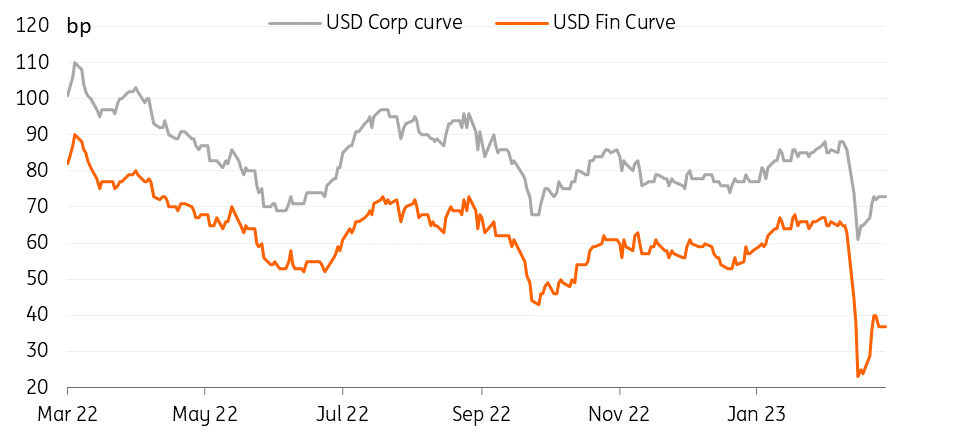

USD credit spread developments

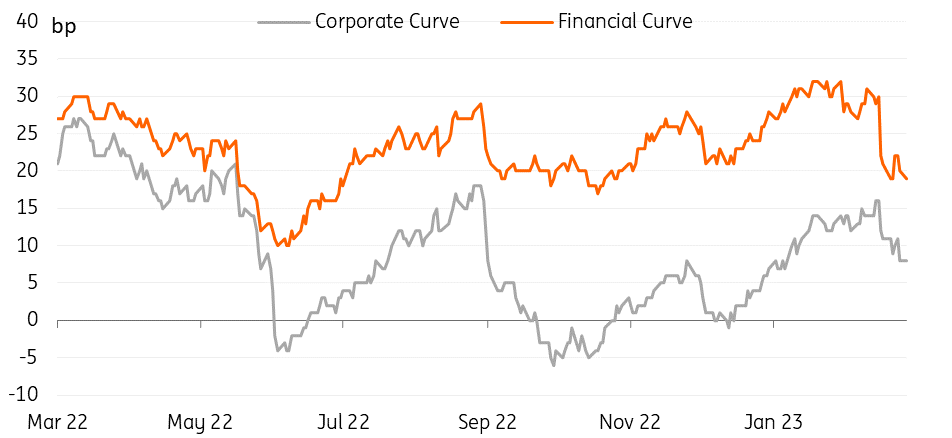

Curve flattening substantially, pushing yields in the short end higher

The short end of the curve has been under more pressure over the past two weeks, pushing credit curves in both EUR and USD much flatter, particularly the financials credit curve. With both rates curves and spread curves looking very flat (pricing in a jump to default). There appears to be higher yields being offered, notably at the shorter end of the curve.

The spread differential between the 7-10yr index and the 3-5yr index fell:

- 12bp in EUR Financials,

- 8bp in EUR Corporates,

- 15bp in USD Financials,

- 28bp in USD Corporates.

EUR credit curves flatter on the back of short end underperformance

USD credit curves substantially flatter on the back of short end underperformance

Primary markets beginning to re-open for corporates

Naturally, in all the rate and spread volatility, primary markets were closed. However, there are likely many issuers ready to come to the market now that some stability is being offered. This is certainly the case for EUR corporates, but not as true for financials due to more uncertainty, much more severe volatility and larger spread widening.

Volkswagen re-opened the market pricing for two green bonds last Thursday, which went rather well. There was decent tightening down from IPT and it was met with strong demand with a healthy oversubscription of over 3x in both deals. New issue premium was 15bp and 20bp on the 3s and 6s, respectively. Similarly, Wolters Kluwer was priced yesterday, which saw a 35bp tightening down from IPT, with a book 5x oversubscribed, and still a 15bp new issue premium.

We expect most new issues coming to the market and they will be met with solid demand, as investors are still sitting on cash that needs to be put to work.

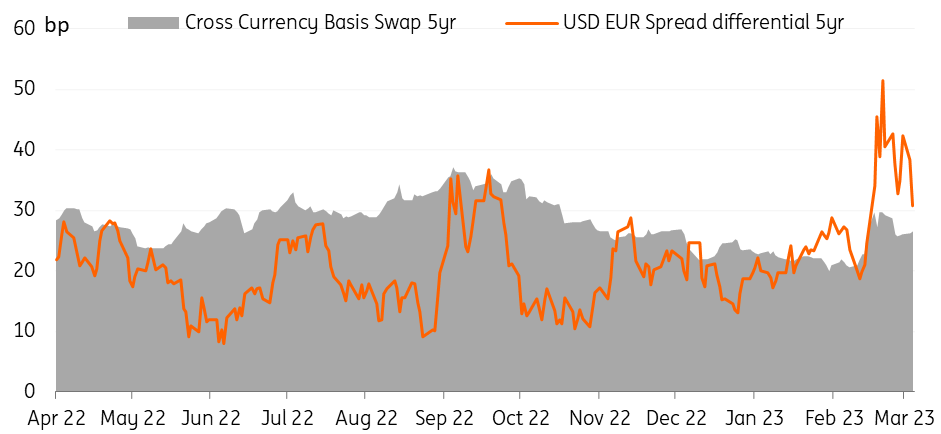

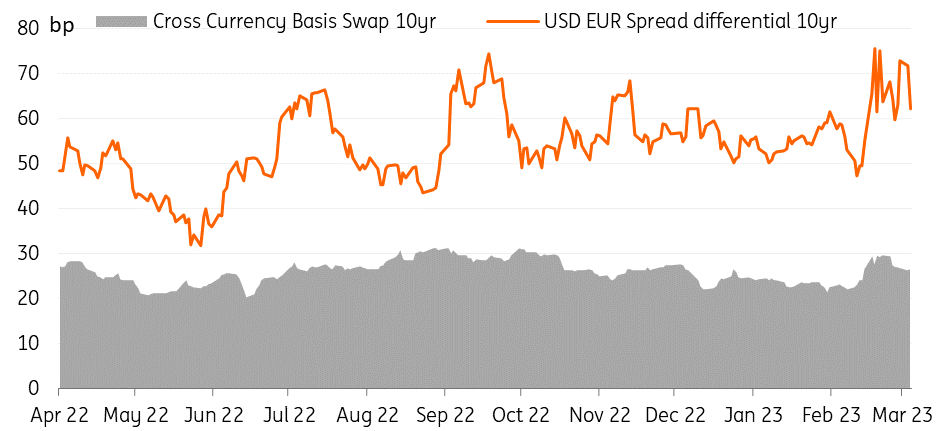

Potential reverse yankee supply as cost saving advantage opens up

The equation may be changing for reverse yankee supply, with more attractive swapping conditions for US issuers resulting from USD credit underperformance versus EUR credit. The USD EUR spread differential has jumped wider in the past two weeks, by 23bp in the 5yr and 27bp in the 10yr. However, the cross-currency basis swap has widened in the past couple of weeks, and after a small retracement, the cross-currency basis swap is now sitting 6bp wider in both the 5yr and 10yr. It will be interesting to see where things lie after the dust settles and if there are some attractive funding opportunities for reverse yankee issuers.

Cross currency basis swap and USD EUR spread differential 5yr

Cross currency basis swap and USD EUR spread differential 10yr

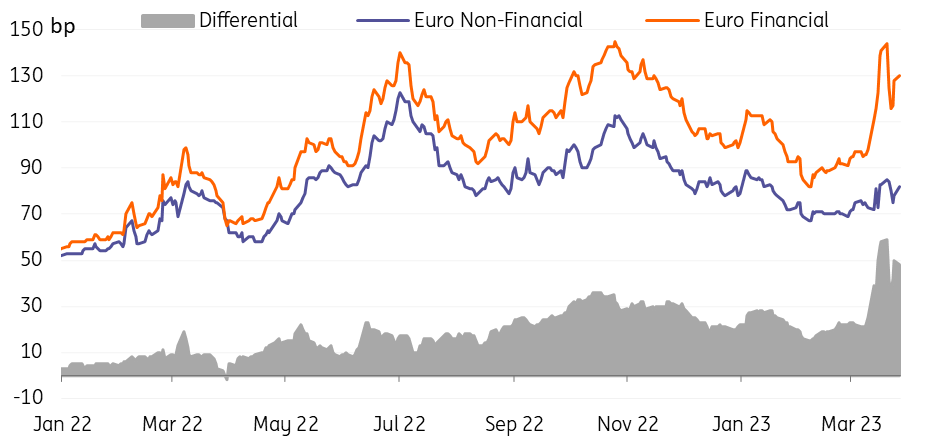

Corporate vs Financials: significant underperformance of financials

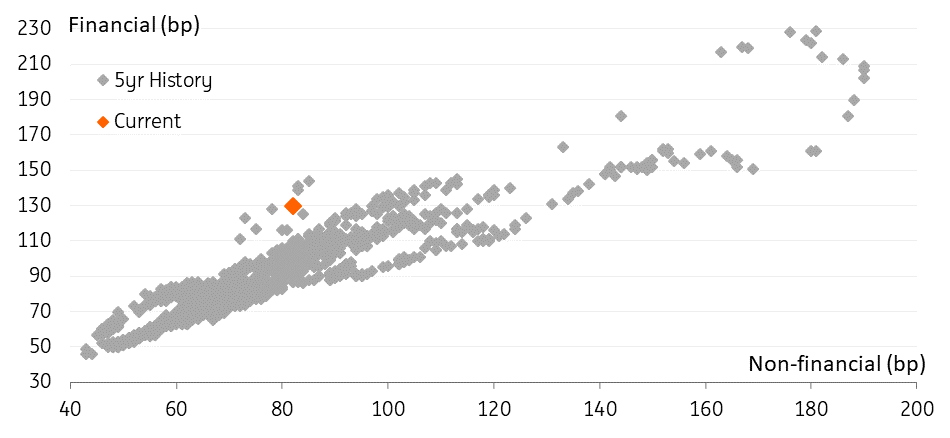

We've seen large financials' underperformance over the past couple of weeks, with substantial widening here. That said, financial spreads have been underperforming corporates slowly over the past year, with the differential slowly growing. Is this the new pricing norm? Or is the market overpricing the risk of a jump to default? We feel on the senior finanicals side, this may be nearly fully priced in, and while we feel less comfortable with finanicals now, there is value priced in against coprorates.

Financial spreads underperforming versus corporates

Non-Financial versus Financial regression

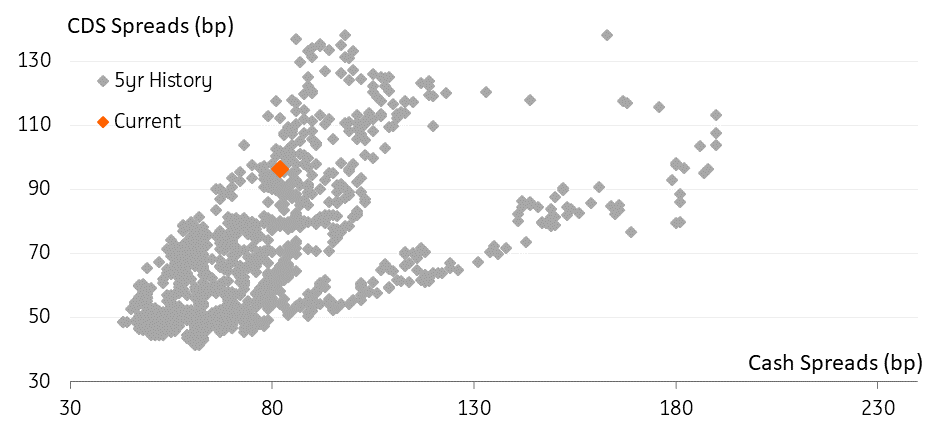

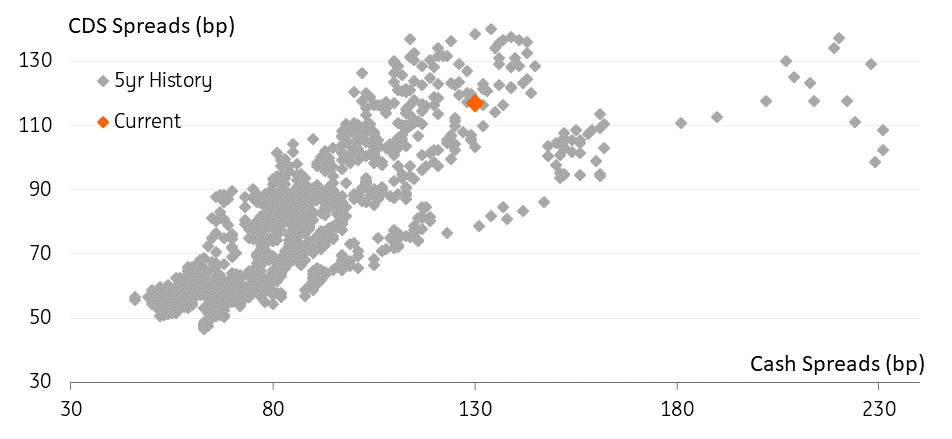

Cash vs CDS: corporate cash outperforms

Corporate cash spreads have outperformed against CDS over the past couple of weeks. The differential between the iTraxx main and the BofA ICE Non-financial index has grown. As you can see in the regression chart below, cash spreads are sitting much tighter than the iTraxx main, based on 5 years of history. This is, of course, very typical in a bearish market as buying protection and hedging come to the forefront.

On the other hand, financials' cash spreads are underperforming CDS. Cash spreads are sitting about 10-15bp wider than the iTraxx senior financials index. The 5yr regression, below, also illustrates the underperformance of cash. This is less typical, suggesting there is more real money activity which is driving spreads wider.

iTraxx main versus Non-Financial index – 5yr regression

iTraxx senior Financial versus Financial index – 5yr regression

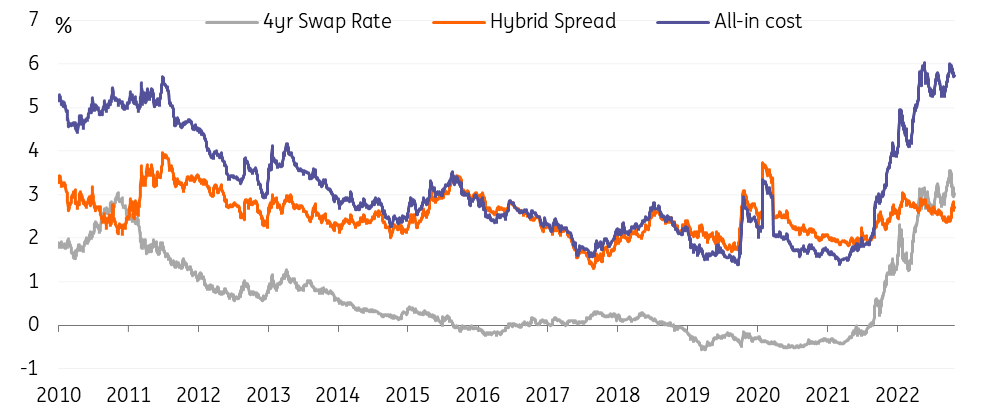

Corporate hybrids still looking at very high cost of capital

Corporate hybrids did see some underperformance in recent weeks, widening initially by 44bp in sympathy with subordinated bank debt. After a retracement, spreads are only sitting 34bp wider now. This much higher cost of capital does pose a lack of comfort for hybrid issuers and extension risks here are still prevalent. Nonetheless, one may see significant value in the hybrid spreads at these levels from frequent issuers. Hybrids are looking wide relative to equity prices and relative to BB spreads.

Naturally, bank capital debt is now in a similar position that hybrids were in six months ago. Corporate hybrid issuers went through the same exercise of if and how to refinance these subordinated bonds. Eventually, supply has started to come back from frequent hybrid issuers, despite the higher cost of capital. The same is likely for larger systemically important banks.

The cost of hybrid capital remains very high

Notable fund outflows last week in credit markets

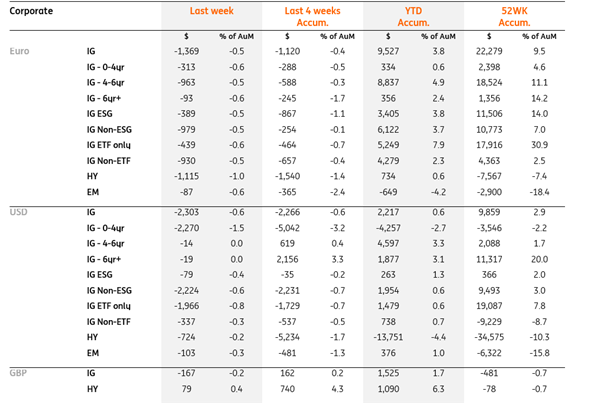

EUR IG funds outflows amounted to 0.5% of AuM (US$1.4bn) last week. Flows were mainly positive in the few weeks before, albeit very small. Last week’s outflows were mostly consistent through all segments. In any case, flows remain positive for the year, with inflows of 3.8% of AuM (US$9.5bn) on a YTD basis, due to the large inflows seen earlier this year.

EUR HY funds also saw notable outflows last week, totalling 1% of AuM (US$1.1bn). Flows were slightly more negative the three weeks previous, but nothing dramatic at 0.4% of AuM. YTD flows remain positive, but just barely at 0.6% of AuM.

USD IG funds outflows amounted to 0.6% of AuM (US$2.3bn). The vast majority of these outflows were in the 0-4yr maturity bucket and a large portion were also from Non-ESG funds and ETF-only funds. Contrary to last year, which saw consistent USD IG inflows in the midst of EUR outflows, USD IG inflows are now much smaller than EUR IG inflows on a YTD basis, sitting at just 0.6% of AuM (US$2.2bn).

USD HY funds have been outflowing much more this year, with YTD outflowing totalling 4.4% of AuM (US$13.8bn), after 1.7% outflows were pencilled in the last four weeks.

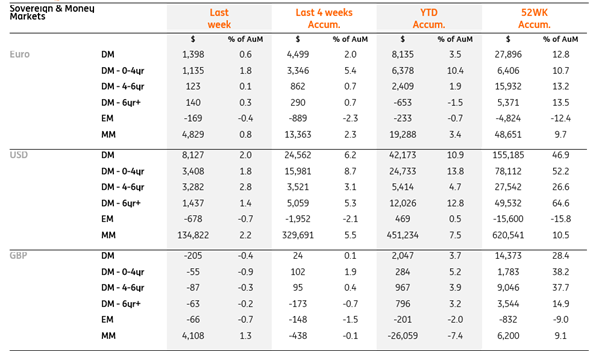

DM Sovereign and Money Market funds have remained positive over the past number of weeks, despite the market turmoil.

Corporate fund flows

Sovereign fund flows

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article