Covid weighs heavy on US consumers, but light – and rate hikes – are at the end of the tunnel

Sentiment is under pressure from Covid and inflation, but with case numbers falling rapidly we expect households to swiftly re-engage with the economy after the recent “soft patch”. Inflation is unlikely to fade as swiftly with Federal Reserve policy normalisation clearly on its way

Sentiment hit by Covid and inflation

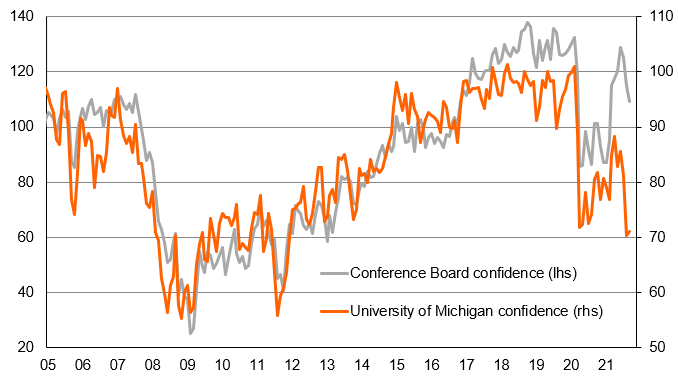

The Conference Board measure of US consumer confidence has fallen again in September. It is now at 109.3 versus 115.2 in August with the present situation and expectations components falling similar amounts. It is not as weak as the university of Michigan measure (see chart below) but reinforces the message that the economy has hit a speed bump in the third quarter with the resurgence of Covid having made households more cautious.

Consumer confidence measures

It also likely reflects an acknowledgement of higher inflation eating into household incomes. Big ticket buying intentions numbers have clearly dragged down the overall indices with automobile, home and major appliance all set to experience less demand.

The good news is that Covid case numbers are trending downwards and the number of deaths appears to be peaking out. Assuming the latest wave has peaked this should gradually ease some of the health concerns and we will see sentiment recover and people re-engaging with the economy (travelling and eating out for example).

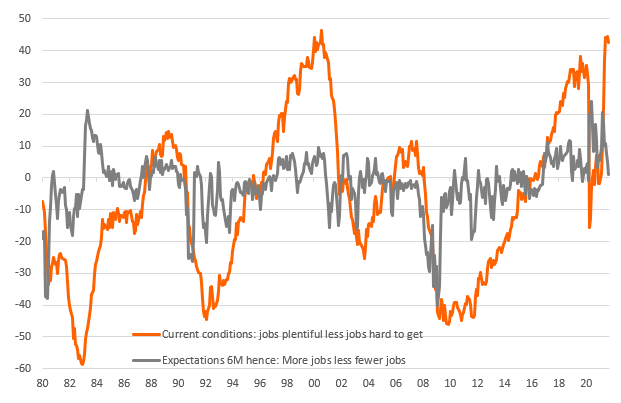

Labour market sentiment remains strong

Moreover, the underlying sense of a strong economy is still there in the numbers with households expecting the strong jobs market to continue as underscored by the ongoing elevated reading for the proportion of respondents thinking jobs are plentiful.

Our central case is that after a softening in GDP growth in 3Q to around 4.5% annualized we will see a re-acceleration back above 6% in 4Q 2021, led by stronger consumer spending numbers.

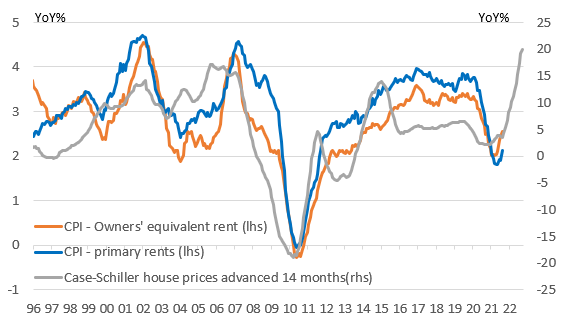

Surging house prices add to inflation threat

Separately we have had the S&P Case Shiller top 20 city house price data, which showed prices rising 1.5% month-on-month/20.0% year-on-year. Phoenix is the real hot spot (32.4% YoY) followed by San Diego (27.8%) and Seattle (25.5%). The laggards are Chicago (13.3%), Minneapolis (14.5%) and Washington DC (15.8%).

Ordinarily rising asset prices are good news for consumer confidence as it reflects a strong economy, but when prices are rising as rapidly as they have been it can lead to a sense of an economy that is a little out of control. Significantly the scale of these price increases also has important implications for consumer price inflation.

Housing components account for 31% of the weight of the basket of goods and services that make up headline CPI and 40% of the core (ex food and energy). The primary rents and owners' equivalent rents components that form housing within CPI lag behind actual house price changes by anywhere between 12 and 18 months – 14 months is currently the best fit (see chart below).

House prices to boost inflation

Given housing's hefty weighting in CPI the inflation pressures here will offset the declines in some of the "hot" CPI components such as used car prices, hotel prices and airline fares with inflation kept elevated – we expect headline to stay above 5% through 1Q 2022 with core inflation unlikely to get meaningfully below 3.5% until next summer. This is based on the assumption that supply chain strains ease up quickly through the winter and a flood of potential workers return to the jobs market, which is looking a little doubtful.

Fed set to pull the trigger

In this regard the comments from Fed Chair Jerome Powell at today’s Senate Banking Committee hearing are interesting. He has acknowledged that supply bottlenecks “have been larger and longer lasting than anticipated” and while they are expected to eventually abate “inflation is elevated and will likely remain so in coming months”. Consequently the Fed stand ready to act – “if sustained higher inflation were to become a serious concern, we would certainly respond and use our tools to ensure that inflation runs at levels that are consistent with our goal.”

None of this is ground breaking with it merely building on the hawkish shift from the Fed at last week’s FOMC meeting. A decent September jobs number (the consensus is currently 515k) should be enough for the Fed to feel confident enough to proceed with a QE taper announcement in November. With this set to end by next summer we think a strong economy with elevated inflation will result in interest rates being raised by 25bp in both September and December.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article