Coronavirus prompts a crude rethink

Oil has had a volatile few weeks, with coronavirus demand fears weighing on prices, only for the market to bounce back with opportunistic buying from Chinese refiners. OPEC+ has failed to take action yet, and the recent price recovery means they are unlikely to rush this. We have revised lower our price forecasts as a result of lower consumption

Price forecasts revised lower

The outbreak of the coronavirus has had a significant impact on commodity markets, and oil has certainly felt the pressure, with the demand outlook looking weaker as a result. Given expectations for an even larger surplus over the first half of 2020 we have revised our ICE Brent forecast down from an average of US$62/bbl over 2020 to US$59/bbl. An extended or more widespread demand impact could lead to further revisions lower, whilst similarly, failure from OPEC+ to act would likely mean further downside.

ING oil price forecast

What is the impact so far?

Travel restrictions and an extended industry shut down as a result of the coronavirus has had an impact on oil consumption within China, and further afield. This has had clear implications for the global oil market. The country is much more important to the world market these days than it was back in 2003 during the SARS outbreak. In 2003, Chinese oil consumption averaged 5.61MMbbls/d, making up 7% of global consumption. In 2019, domestic consumption averaged 13.61MMbbls/d, increasing China’s share of global consumption to more than 13.5%. This only leaves the US ahead of China when it comes to liquids consumption.

The Chinese aviation sector is also far more important these days, with considerable growth in air travel in the country. Jet fuel demand has grown three-fold since 2003, with China consuming a little over 900Mbbls/d of jet fuel. Although admittedly this still only makes up less than 7% of total Chinese consumption.

It is not just air travel that has been affected, lockdowns have also meant that gasoline and diesel demand within China have come under pressure. As a result we have seen product inventories in China growing, and this has led to refiners having to cut run rates. The latest data from Sublime China Information shows that run rates at independent refineries in Shandong fell from a little over 65% prior to the Lunar New Year holidays to 47.82% currently. Independent refiners make up around a fifth of total crude oil imports into the country. Meanwhile, a number of state refiners have also reduced run rates due to weaker demand.

Despite lower consumption, and refiners cutting run rates, there have been media reports of opportunistic buying from some independent refiners in China at these lower prices. This has helped oil prices rebound and the ICE Brent spread structure to strengthen, flipping from contango to backwardation once again.

Regional oil consumption (Mbbls/d)

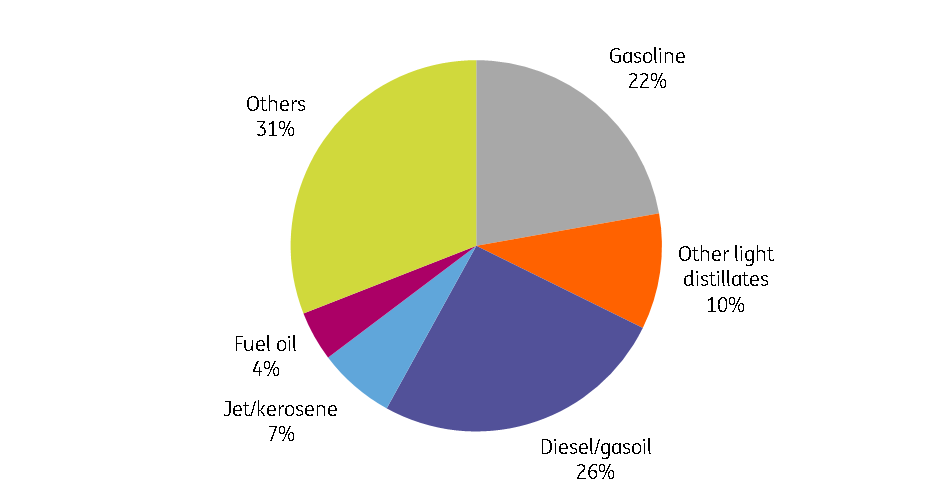

Chinese demand by product (%)

Chinese oil imports

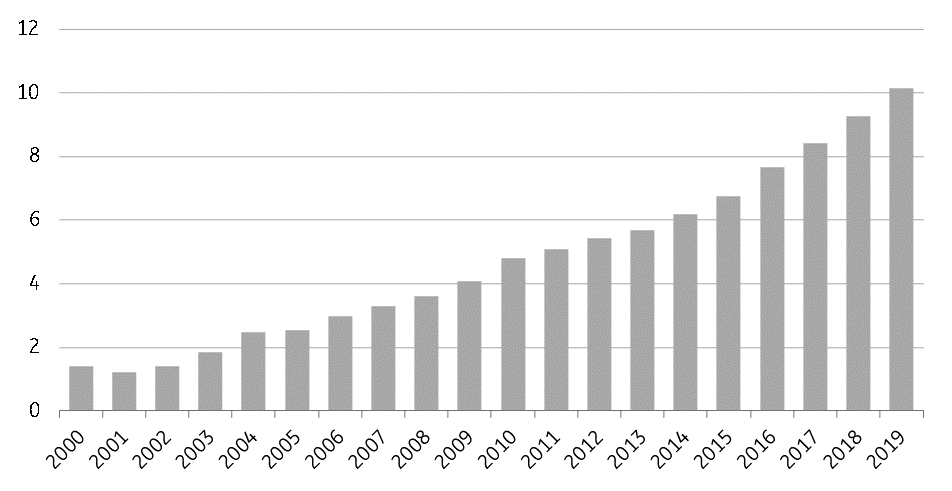

China is the world’s largest crude oil importer, having imported 10.16MMbbls/d of crude oil in 2019. This compares to import volumes of 1.83MMbbls/d in 2003. In fact, despite SARS, Chinese oil imports increased by 31% year-on-year in 2003.

There have been reports of Chinese buyers trying to defer cargoes, or resell cargoes in the market. We will not get trade data out of China for a while, with the country set to release January data along with February, and so we will have to wait until March for official import numbers from the National Bureau of Statistics. Clearly, expectations would be for flows to decline, although the number of cargoes deferred or sold out may take some time to feed through into the figures.

China annual oil imports (MMbbls/d)

Demand revisions

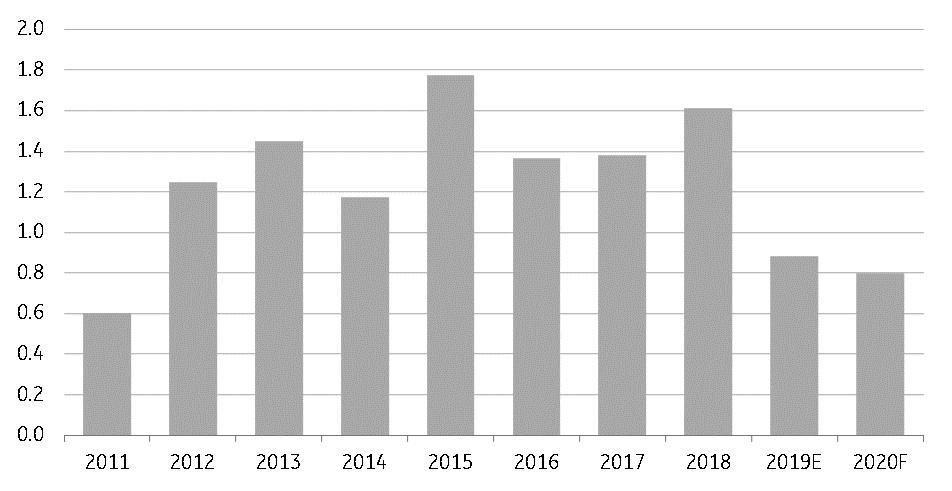

Taking into consideration the run cuts we have seen in China, and assuming this is an event that continues to drag on through until the end of the first quarter and into early second quarter, we estimate this could see demand growth cut by around 400Mbbls/d over 2020. This would suggest that global demand growth could fall to somewhere in the region of 800Mbbls/d this year. Clearly, if travel restrictions remain in place for longer, or we are to see more widespread travel disruptions as a result of this virus, there would be further downside to this number.

We have also seen revisions coming through from a number of agencies. OPEC revised lower its global demand growth forecast for 2020 by 230Mbbls/d, the EIA reduced its growth forecast by 320Mbbls/d, while the IEA was most bearish, cutting consumption growth for this year by 365Mbbls/d, leaving consumption growth this year at 825Mbbls/d- which would be the lowest growth seen since 2011.

Global oil consumption growth (MMbbls/d)

OPEC+ action needed?

It initially appeared that OPEC+ was set to take swift action to offset any downside as a result of demand losses. Saudi Arabia was pushing to bring forward the meeting currently scheduled for March to February, and the OPEC+ Joint Technical Committee recommended additional cuts of 600Mbbls/d through until the end of June, while extending the current deal through to year-end. However, Russia once again appears to be the sticking point, reluctant to make deeper cuts or extend the deal timeline significantly.

The urgency to act has also disappeared to a certain extent, with prices appearing to have stabilised for now, and in fact strengthening. OPEC+ has also been helped out by the fact that Libyan supply has ground to a halt, taking in the region of 1MMbbls/d off the market at the moment. The risk though is that Libyan supply could return to normal fairly quickly if export blockades are lifted, and if this were to happen, OPEC+ would have no choice but to act or risk seeing much lower prices.

Prior to the coronavirus outbreak we were of the view that OPEC+ would need to extend its output cut deal through until mid-year. Back then, we thought that cuts of 1.2MMbbls/d would be adequate, which would mean reverting to the quotas set for 2019 over the second quarter of 2020. However, given the demand impact from the coronavirus, we believe that current cuts of 1.7MMbbls/d need to be extended, along with continued over compliance from Saudi Arabia. These stronger-than-needed cuts in the second quarter would help offset stock builds over the first quarter.

However, obviously if we see the demand impact from the virus spill over into the latter part of the second quarter, this would likely require even further action from OPEC+.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article