What Europe’s Covid-19 spike means for Sweden

The resurgence of Covid-19 in Europe undoubtedly poses a risk to Sweden's economy, although there are also some positive signs for the next phase of the recovery. We, therefore, think it's unlikely that the Riksbank will revert back to negative interest rates in the near future

Covid-19 is on the rise again across Europe. Countries across the continent are beginning to reimpose restrictions, raising the possibility of a renewed fourth-quarter slowdown.

All of this undoubtedly poses challenges for the Swedish economy. But having fared relatively lightly from the initial phase of the pandemic, there are some reasons to think the next phase of the economic recovery will be relatively solid too. In the end, it’ll depend on how far Covid-19 spreads in Sweden second-time around, how badly its core export markets are hit, and how the already fragile jobs market fares as social distancing remains a feature of every-day life.

We currently expect the Swedish economy to shrink by around 3.5% this year, which isn't as bad as first thought

We currently expect the Swedish economy to shrink by around 3.5% this year, which isn't as bad as first thought. This suggests that a return to negative interest rates by the Riksbank looks unlikely, and the central bank is unlikely to be a ‘dovish outlier’ among its peers, unlike times gone by.

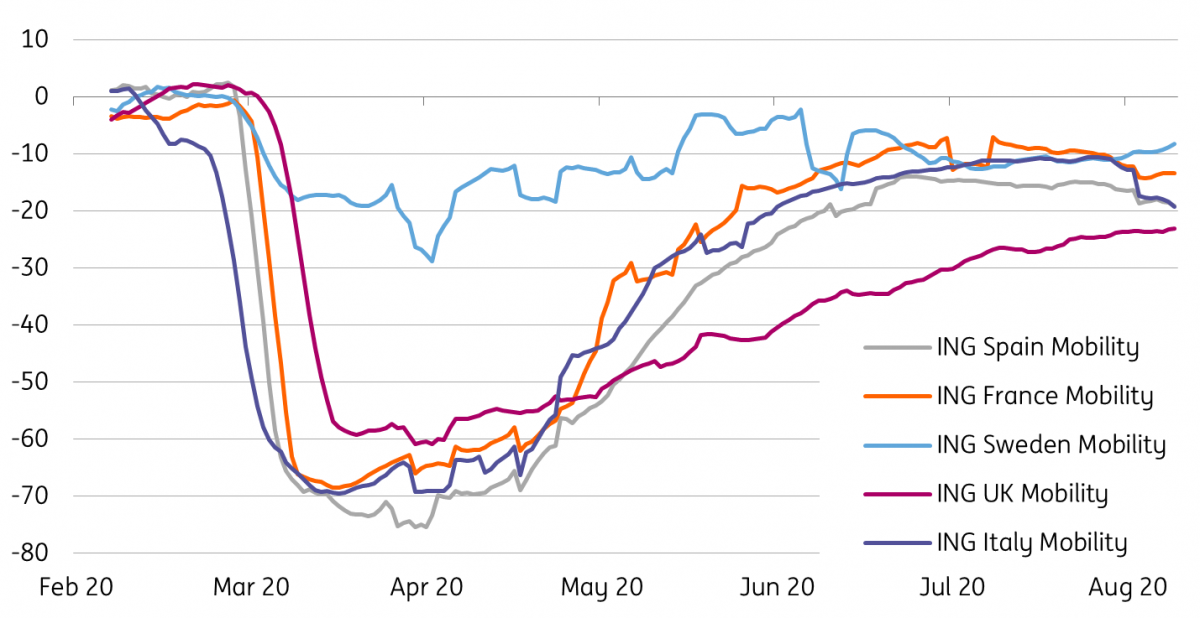

Mobility index

Swedbank payment statistics by industry

New infections

With infections rising in Europe, the key question is whether we see a renewed, serious spike in Sweden? There’s little doubt this is going to be the source of considerable interest over coming months, given the debate surrounding the herd immunity concept which still has scientists divided.

The Swedish health authorities predicted that 40% of the Stockholm population would have developed antibodies by May 2020, when in reality this figure is estimated to be below 20%

However, there is growing evidence that antibodies may not be long-lasting, or that they may not be developed in sufficient levels among mild-sufferers. The Swedish health authorities predicted that 40% of the Stockholm population would have developed antibodies by May 2020, when in reality this figure is estimated to be below 20%.

If cases rise again over the coming months, we’d expect consumer spending to come under some pressure again as it did in the second quarter. However, the evidence from current Covid-19 hotspots - e.g. France and Spain - suggests that this time behaviour may differ somewhat. Mobility data provides few signs so far that people are reducing their movements in response to higher case numbers.

It's early days, but we'd suggest that if we were to see another spike in Sweden, then social spending (which dipped noticeably during the pandemic despite the absence of a full lockdown) would be less adversely affected.

Exports

Sweden is a particularly open economy, and its relative-reliance on exports and its trade links with Europe and the US leaves it vulnerable to Covid-19 disruption elsewhere.

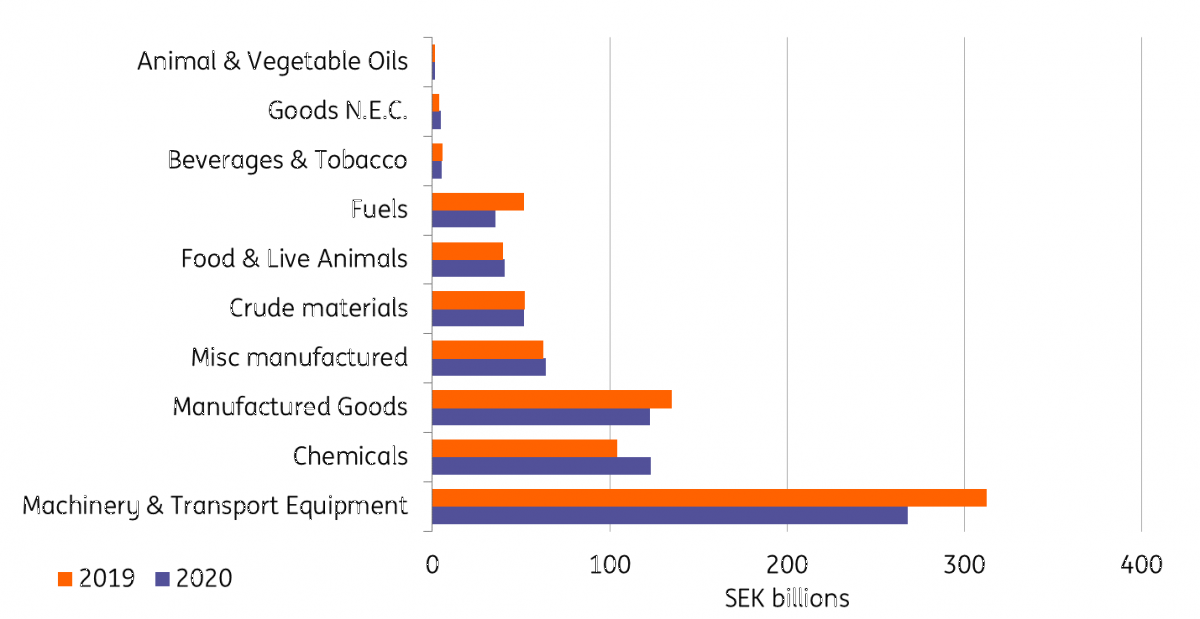

Exports, already hit by a combination of the global trade war and to a lesser extent the threat of a 'no-deal' Brexit, were hit hard during the wider European lockdowns. Sales of Swedish goods to the rest of the world fell 20% in the second quarter (albeit this data is ordinarily fairly volatile). Machinery and transport equipment, a key export category, saw trade plummet as global industrial demand fell and key supply chain links (e.g. with Germany) stalled.

The silver lining, at least for the time being, is that Sweden’s major trading partners are currently experiencing lower cases of Covid-19 in relative terms. That suggests a more stable demand environment for Swedish exports over the winter, and unlike the earlier phase of the pandemic, significant supply chain disruption has become less of a risk. Factory closures across Europe – a feature of many of the stricter lockdowns – are unlikely to be repeated, even if other ‘social’ sectors in Europe are shuttered once more.

Exports by Country 2019 vs 2020 (Jan-Jun)

Exports by Industry 2019 vs 2020 (Jan-Jun)

Jobs market

Swedish unemployment was already creeping higher before the crisis struck, and has risen further than most other European countries through the pandemic. Admittedly, the statistics have been mired in uncertainty over the past year, following statistical errors around the same time in 2019. But even so, the level of redundancies have spiked, particularly in the hardest-hit sectors of manufacturing, hotels/restaurants and transportation.

The more encouraging news is that things appear to have stabilised over the summer, and of course, like other European countries, the Swedish government is continuing to provide help in the form of short-term work schemes. Job vacancies have been showing a moderate rise since the low in June, and this can be expected to recover further we should the virus remains under control. Swedish business surveys and PMI data are already showing an improvement in expectations.

For instance, European Commission services confidence data shows that demand expectations have recovered - the balance of firms expecting an improvement over the next three months -50% in April, to now only around 0%.

Job vacancies by industry

Housing market

Finally, the housing market has been a key weakness of Sweden for a while with high household debt levels and a price decline in recent years.

Having said that, the short-term price shock from the crisis remained relatively small. This is perhaps partly because the absence of a full lockdown meant Swedes were still able to move house, but as we've seen elsewhere, trends such as increased home-working have seen buyers alter their buying criteria as a result of the pandemic.

The SEB housing price indicator has been on a positive trend in recent months, and we expect this to continue if cases remain under control.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

SwedenDownload

Download article