Corn: US crop downgrade

The USDA’s June WASDE was clearly bullish for the corn market, with US corn output cut by more than expected, following delayed plantings. Given expectations for drawdowns in stock this year and next, we remain constructive on CBOT corn

Planting delays

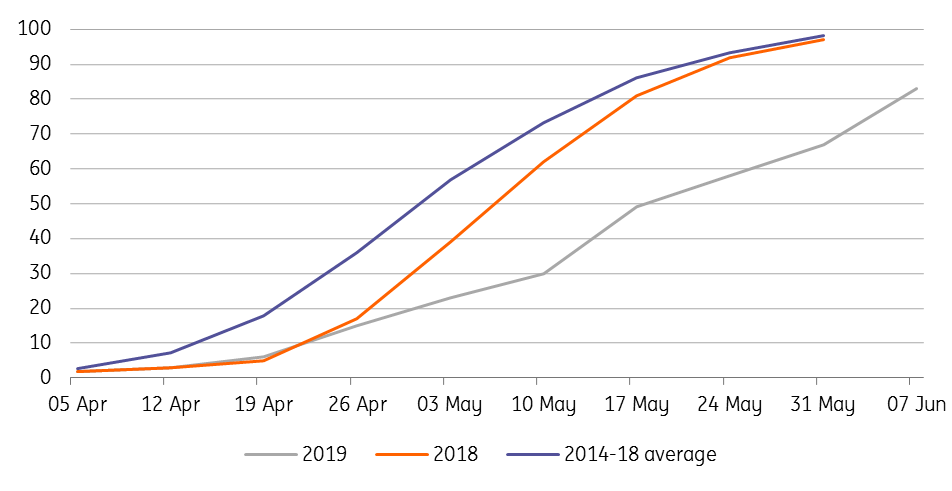

Heading into 2019 US plantings, many in the market had a bearish outlook for corn, with the US planted area set to increase as farmers switch from soybean to corn as a result of the ongoing trade war and the Chinese-imposed tariffs on US soybeans. However, looking at the price chart, it is clear that this has not gone to plan, with corn prices having rallied as much as 27% since early May. Heavy rainfall in the US Midwest has meant that farmers have struggled to plant corn in a timely manner, with plantings lagging significantly behind historic norms. These late plantings do raise concerns over yields for the 2019/20 crop, and in this week’s WASDE report the USDA took the opportunity to slash its yield forecast from 176 bu/acre to 166 bu/acre, leaving it well below the 5 year average of 173 bu/acre. This has seen their production estimate for the season fall from 15.03b bushels to 13.68b bushels- a more significant reduction than most were expecting in the lead up to the release, and if realised would also mean that the US will see its smallest corn harvest since 2015/16.

US percent of normal precipitation

US corn planting progress (%)

Tightening balance

A smaller US harvest does mean that domestic ending stocks are set to decline quite substantially over the 2019/20 marketing year. The USDA is forecasting that we go into 19/20 with 2,195m bushels of stock, however expect that stocks will end the season at 1,675m bushels, the lowest since the 2013/14 season. Looking at the stocks-to-use ratio it is forecast to end the 19/20 season at just 13.8%, down from an estimated 18% in the current season, and the lowest STU since the 13/14 season.

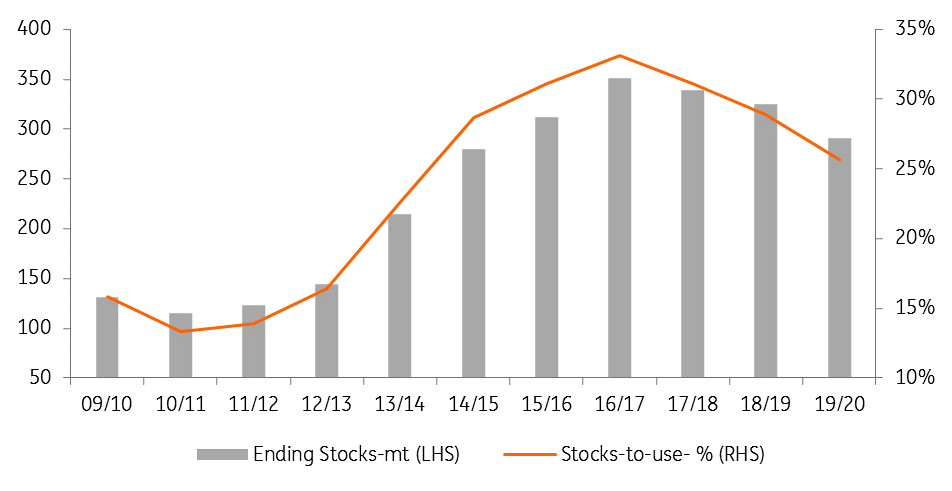

Global inventories are also set to continue their decline, with stocks set to fall for the third consecutive season, with ending stocks set to drop by 34.9mt YoY to 290.5mt- leaving inventories at their lowest level since 2014/15. The expected decline in 2019/20 will more than exceed the declines seen in the previous two marketing years combined. This will see the global stocks-to-use ratio fall from an estimated 29% in 18/19 to 26% in 19/20. However, if we strip out China, given that an estimated 66% of global corn stocks sit in the country, the ex-China balance sheet is set be even tighter, with a stocks-to-use ratio of just below 12%. We expect that this tightening in the global balance will be broadly constructive for corn prices.

Global corn ending stocks

The short covering rush

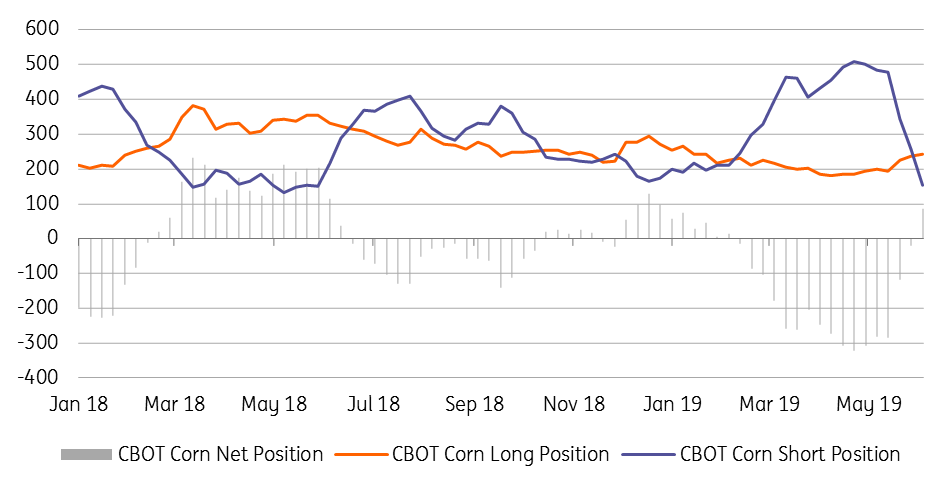

Given that consensus earlier in the year was largely bearish, it is no surprise that speculators were holding a record net short position of around 322k lots in CBOT corn in late April. However as it became clearer that there were significant delays in plantings, speculators ran in to cover these shorts, and in fact, speculators have flipped to holding a net long of a little over 87k lots as of the 4 June. Given the scale of the move we have already seen, it does seem as though there is limited room for further short covering to push the market significantly higher in the short term. If we look at the gross short position in CBOT, it has fallen from around 506k lots in late April to around 154k lots as of the 4th June. So in order to see significantly more upside to prices in the near term, we would have to see speculators comfortable in going long - so far they appear to have been reluctant to do so, with the gross long having only increased from around 182k lots in early April to almost 241k lots as of the 4th June.

CBOT corn managed money position (000 lots)

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more