Copper: V-shaped rally but curveballs ahead

After a V-shaped rally in the second quarter, copper faces challenges in the second half of the year. There are many potential curveballs as uncertainty mounts about the aftermath of the pandemic

A stunning V-shaped rally so far

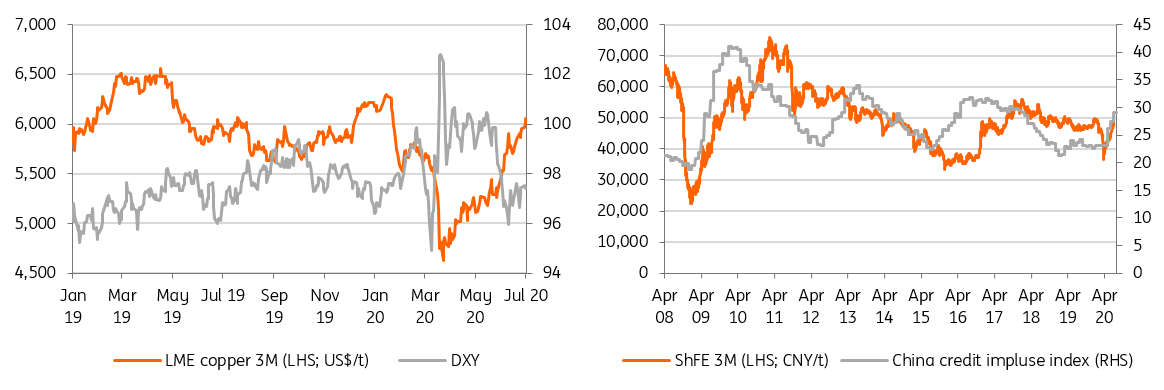

Copper has seen a stellar V-shaped rally, paring almost all of the losses since the outbreak of the pandemic. LME prices have extended above US$6,000/t, further boosted by supply worries from Chile.

So far, the V-shaped move has been driven by a number of factors: a) unprecedented monetary easing and government fiscal stimulus; b) the tailwind from a weaker dollar, with the downward trend expected to continue; c) supply disruptions across the supply chain from mine to smelting as well as scrap supply and d) more importantly, apparent demand from the world’s largest consumer China has made a strong recovery. This has been backed by pent-up demand following the easing of lockdowns and has dovetailed with the traditionally strong demand season.

The buoyance has also been underpinned by some micro indicators, including destocking in China and more recently in the LME. Spot treatment charges are still depressed at a low of around US$50/t. On the macro side, industrial profits and PMIs are pointing to economic resilience, though exports are still a pain point.

Fig 1. Copper prices vs DXY and China credit impulse

Cautious optimism towards short term market

For now, all the themes are there for the bulls to join the summer ‘party’. The worst economic damage is probably behind us. The market seems to believe that there won’t be a nationwide lockdown, even though there has been a resurgence of virus cases in some areas. Thus, the recovery is not expected to be derailed. With fiscal packages gradually kicking in over the coming months and a looser liquidity environment, it’s hard to be bearish.

However, further upside will be living on borrowed prosperity, and copper will need to find a solid chair while the music is still playing. Thus, we are cautiously optimistic for the short-term market reaction.

Still plenty of challenges in 2H20

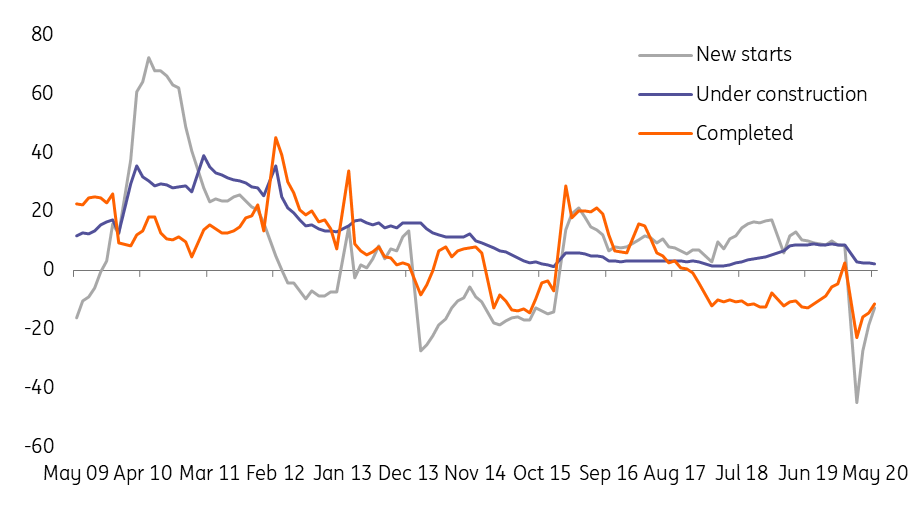

a) Demand faces a reality check. So far, the major pillars have been a mixed bag for copper demand in China. We maintain our view about demand (see Copper growth: Still reliant on traditional sectors). Recent property completion continues to recover, in line with our view. However, it remains to be seen to what extent stimulus goes into other metal-intensive sectors and how effective that is. At least so far, the grid company hasn’t offered much help.

Fig 2. China housing constructions

b) Supply return; we have seen close to half a million tonnes of losses so far this year, but some mines have started to make a comeback, such as Antamina. Chile's copper sector will eventually return to normal after the peak of the virus.

c) As it is a US election year, trade tensions could well spike. Therefore, despite short-term optimism, copper will need to navigate plenty of risks through the second half, and we see prices, on average, gravitating towards the upper bound of US$5,000.

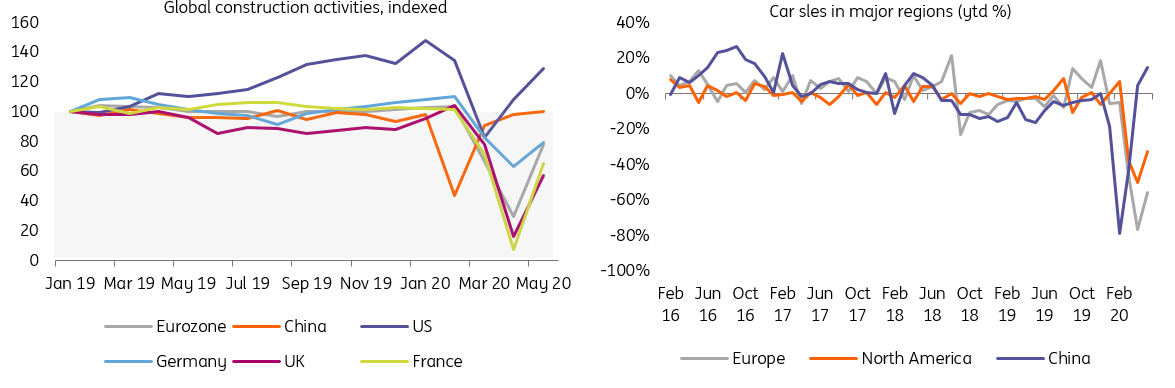

Fig 3. China leads the recovery in major demand sectors

Scrap re-debuts under a new identity but supply uncertainty remains

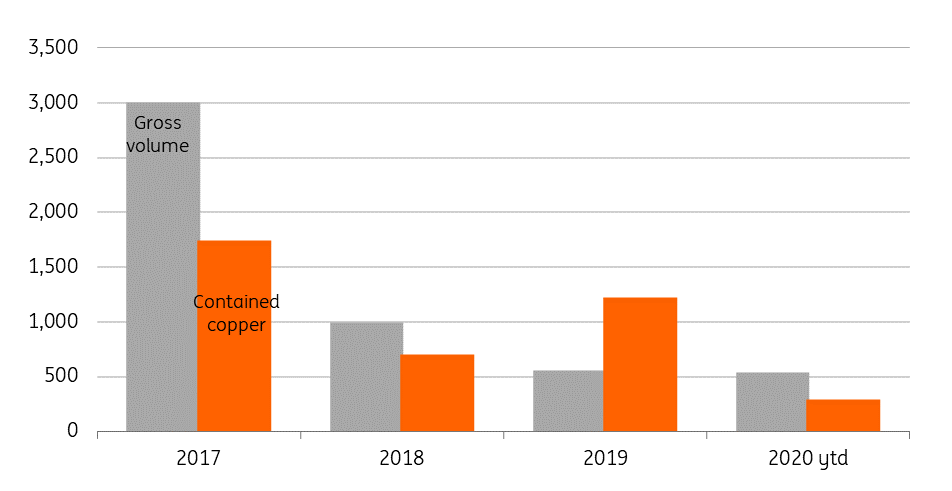

A strict scrap import policy, together with this year’s virus impact on the supply chain, have reduced scrap supply. Thus, there has been some displacement from cathode to fill the gap. Starting from today, 1 July, some scrap exports to China are re-debuting under a new identity –‘resources’ instead of ‘garbage’. We had expected this to recover from the second half. However, a recent report from Reuters and our own sources say it may take some time to disentangle the mess there. It remains to be seen to what extent scrap supply recovers in the second half.

Fig 3. China scrap import quota approval vs. estimated contained copper from actual imports (kt)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article