Copper back above $7k as the curve flirts with backwardation

The start of labour negotiations at the world’s largest copper mine, Escondida, have restored volatility to the copper market. We are keeping a close eye on the tightening spreads which could restore fund flows but also seem dependent on stock holdings

Labour negotiations back to the fore

At the beginning of 2018, we cautioned bulls were likely pricing in a high amount of mine disruptions too early which only risked disappointment. With the retreat of prices, open interest and money manager positions through Q1, this seemed to play out as we expected.

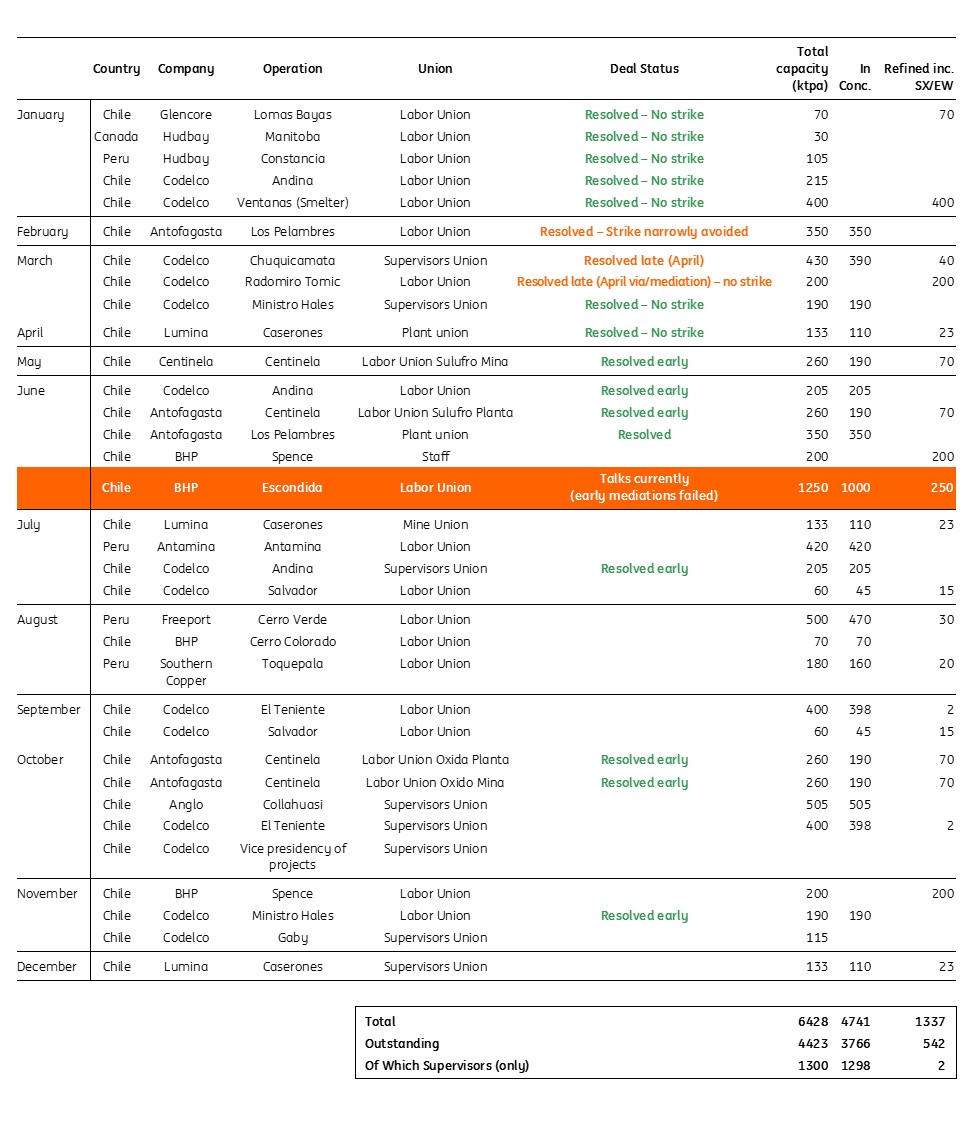

2018 is indeed an extreme year for the number of labour negotiations in Chile and Peru, but until now all talks have gone without any hit to supply. Only two mines including Los Pelambres and Chiquicamata/Radimoro Tomic saw negotiations go down to the wire.

Now labour is back in focus as talks have now begun at the world’s largest mine Escondida. A record 44-day strike here cost c.200kt of supply in 2017, and the rebound (+ concentrator expansion) is expected to add c.300kt this year making it the largest contribution to supply growth.

As we stressed in our 2018 copper outlook, counting on a higher supply disruption rate than usual for 2018 was a tough sell because fewer greenfield mines are ramping up and prone to delays. Given the smooth start to the labour negotiations in the first five months, it would take a very prolonged strike at Escondida to now surpass the 5% disruption allowance in our models and swing the market into a price driving, curve flipping, refined deficit. At the historical disruption rate, copper concentrate looks set for a shortfall of around 100kt, but the refined market looks effectively balanced.

Our base case doesn’t see prices break much higher than $7k

However, never say never. Both sides appear to be far apart since early mediations broke down and the union is demanding the largest one-time bonus ever for Chilean mining. More worryingly, the union has said they have the cash to potentially sustain a strike for up to a year. Those possibilities have sent the speculators bidding up copper prices, but we would still urge caution. Last year’s lengthy strike was extreme and if not the workers, then certainly BHP, would have little appetite to withstand such a lengthy outage.

In short, supply disruptions are expected and will happen this year, but only a very extreme Escondida strike can swing the balance. But Escondida will not be the last strike either. The year has started smoothly, but plenty of labour negotiations remain (c.4.4Mt of annualised production). Some look less risky because they concern supervisors, but many of these mines have also had strike action in just the last few years.

Copper mine labor negotiations until now go without a hitch (ktpa)

Physical is firm but unchanged

Since February, we've been forecasting copper's return to $7,000 for Q3.

As we saw it, copper prices were bullied lower through March/April by both a temporary blip in Chinese demand (extended new year/NPC slowdown) and concerns over trade wars. But the fund length has now been essentially washed out limiting any further downside. With Q2 and Q3 being seasonal deficits for copper, the tightening backdrop seems suitable setting for copper to regain some of the aggressive liquidation.

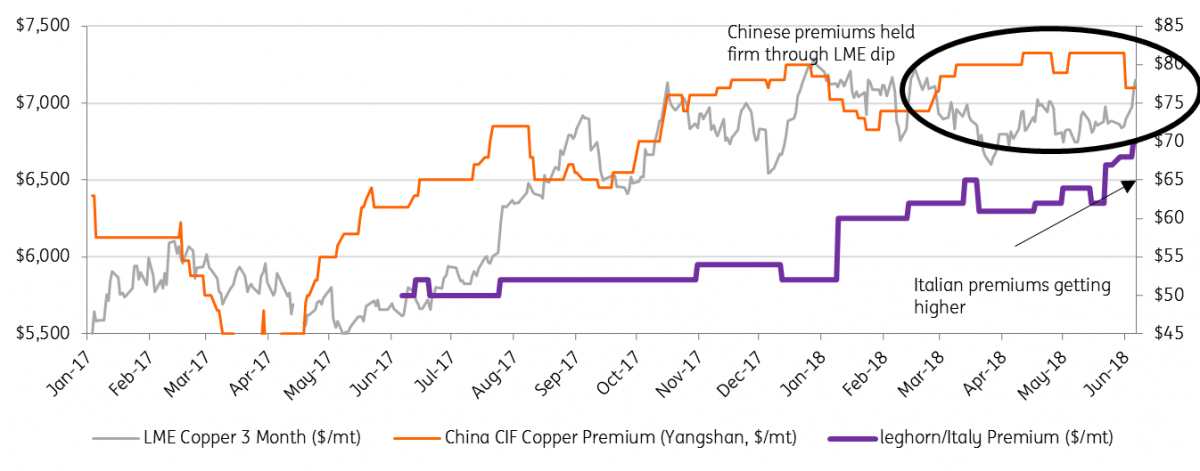

Meanwhile, the physical premiums have actually been holding up firm. The Chinese premium has mostly been around $80 (a slight nudge down recently), and the European premiums have been picking up considerably in Italy after tightness draws the LME European stocks down 40kt since March. While total visible stocks are moving in the right direction (down 100kt since March), the LME stocks in Asia have been so volatile that they are almost ignored by the market. The draw in Europe (and Comex in late May) however, is a first and could prove more meaningful.

However, our base case doesn’t see prices break much higher than $7k. To really back this rally we would need to see physical conditions tighten: a prolonged Escondida strike needs to happen or Chinese premiums to edge up. Or, the curve needs to go to a sustained backwardation (next section).

The slightly softer Chinese premium has been disappointing given the now permanent closure of Vedanta’s Sterlite smelter (400ktpa with India exporting 340ktpa to China) and the month-long blockade on US scrap trade to China. It seems this could be a now or never moment for the premium to edge closer to those $90’s levels that historically coincide with a bull rally, but instead, it's moving the wrong way. The Chinese refined market actually seems well supplied: SHFE stocks are drawing very slowly after the new year (they are up 43% YoY), the SHFE market is in contango, and the import arb remains in loss-making territory.

Physical premiums had held firm through LME weakness ($/mt)

Spreads and dominant stock holders in focus

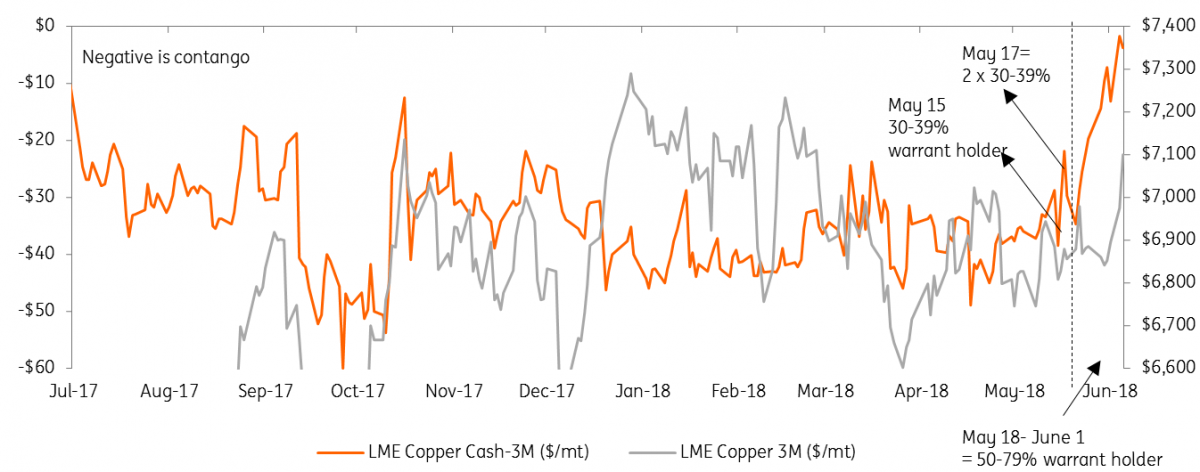

The copper cash-3M was stuck in a wide contango for most of 2017-18 and the lengthy costs for funds to roll longs likely contributed to the liquidation and sliding prices between January to March. Since May 15th, however, the spreads have tightened significantly flirting ever closer to a backwardation. Nothing drives metal markets like a backwardation and if so we could expect a volatile up-shoot but is unlikely to hold its ground unless the physical market genuinely tightens.

In particular, we are concerned if LME stocks become more freely distrusted/free floating then spreads might return to a wider contango. LME data shows much of the tightness in the spreads has coincided with a building dominant LME stockholder(s) position.

On May 15th, the LME warrant holdings report showed the largest stockholder held 30-39% of warranted LME copper stock. On the 16th, the one day spread (tom-next) hit the highest backwardation since 2012 ($35b) as another party also held 30-39% (60-78% in total).

With one holder presumably selling their position into the backwardation the other party went on to hold 50-79% of the warrants. The availability rather than the total amount of stock is what most directs the spreads and while a large stockholder is obligated to lend the very nearby tom/next spreads (via the LME lending rules) the influence further along the curve can surely be felt. As of the most recent June, 4th warrant holdings report the dominant stockholder had retreated to the 40-49% banding.

Copper flirts with backwardation amid dominant LME stock holder

Bottom Line

As far as the copper curve seems to be running ahead of current tightness in physical markets, both spreads and outright prices seem pegged to the outcome of Escondida negotiations.

For a strike to surpass our disruption allowance and bring the refined market to a curve flipping deficit, it needs to be extreme. We reiterate our $7,000/mt Q318 forecast and $6,900 for Q4 unless the situation changes.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CopperDownload

Download article

6 June 2018

In case you missed it: Big week ahead This bundle contains 8 Articles