Consumption tax distortion to Malaysia’s inflation is over

The low inflation trend in Malaysia is here to stay, leading a further downgrade of our inflation forecast this year to 0.7% and for the next year to 1.2%. With persistent external headwinds to growth, one more Bank Negara policy rate cut this year won’t hurt. Don't be surprised if we get one at the next BNM meeting on 5 November

| 1.1% |

Malaysia inflationSeptember |

| Lower than expected | |

Downside inflation miss

Malaysia’s consumer price index (CPI) rose less than expected, by 1.1% year-on-year in September, against the consensus forecast of a 1.3% rise. The inflation rate is down from 1.5% in August as most CPI components posted slower increases. Food, housing, and transport get the most attention given their combined 69% weight in the CPI basket -- all posting lower inflation in the last month.

However, the September inflation slowdown is more of a reflection of what happened a year ago – the consumption tax distortion – than what’s happening now. The headline CPI index was, in fact, unchanged in September from its level in August.

Consumption tax distortion

CPI data from June to September this year was distorted by the consumption tax overhaul carried out by the Mahathir administration a year ago. Its first move was the scrapping of the Goods and Services Tax (GST) from June 2018. This dented inflation below 1% in that month from an average of 1.7% in the first five months of 2018. Then came the replacement of GST with a more benign Sales and Service Tax (SST) from September 2018, though the inflationary impact of this policy was much muted.

The low base effect resulting from the GST removal pushed inflation back above 1% to 1.5% in June this year. And the high base effect from the SST introduction worked in the opposite direction to reverse some of that spike in September.

Consumption tax impact on consumer prices

It’s also about weak demand

With the consumption tax distortion behind us, supply and demand forces will be the clear inflation drivers in the period ahead. A supply disruption to food prices from flash floods in Kuala Lumpur and other parts of the country poses an upside risk while low fuel and transport prices continue to exert downward pressure on headline CPI.

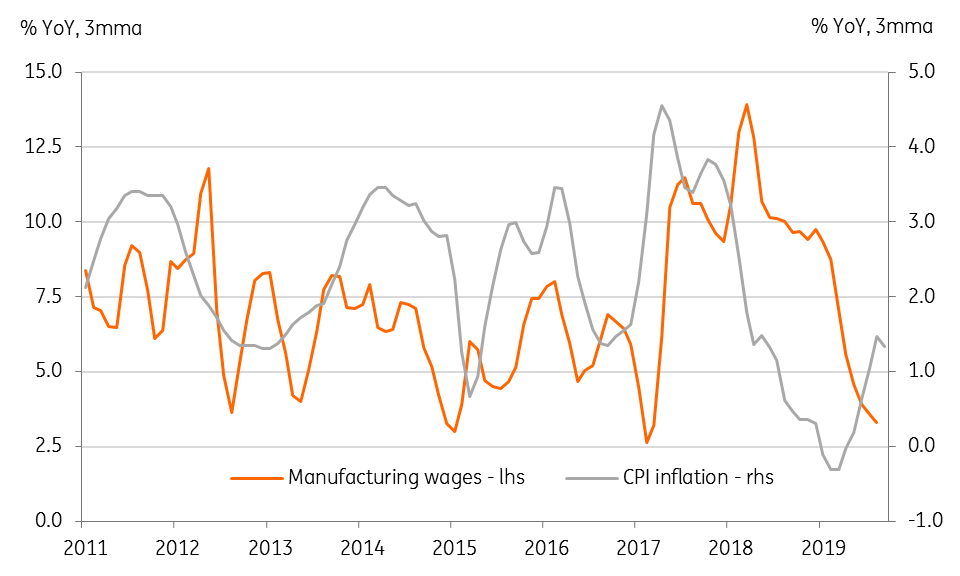

The current low inflation also reflects weak domestic spending. Wage growth has been on a steady downward pressure this year. At 3.3% YoY in August wage growth in the manufacturing sector has decelerated sharply from 10% at the end of 2018. No doubt this will be associated with weak consumer spending.

Slowing wage growth weighs on spending

More reasons for monetary policy easing

We see inflation hovering around 1% through the rest of the year, nudging down our full-year forecast slightly to 0.7% from 0.8%. We don’t see any inflation risk in 2020 either and we're cutting our forecast for next year to 1.2% from 1.4%.

Growth also faces downside risks ahead. Even if the Malaysian economy outperforms its Asian neighbours in terms of growth in the first half of 2019, sustaining that performance ahead will be a challenge as the global headwinds to the export-dependent economy become stronger. There have been some weak signals recently underpinning this.

We believe one more pre-emptive Bank Negara Malaysia (BNM) policy rate cut in the current quarter won't hurt. Today’s inflation figure strengthens this view further. We see a 25 basis point cut in the BNM overnight policy rate to 2.75% at the next and the last of this year on 5 November.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

23 October 2019

Good MornING Asia - 24 October 2019 This bundle contains 4 Articles