Construction in North America: US hands the baton to Canada and Mexico

The US construction sector has outperformed Canada and Mexico over the past 18 months, but the headwinds facing the US are now intensifying. In contrast, the outlook for Canada and Mexico is modestly strengthening as income and employment gains underpin residential construction and strengthening business activity boosts investment plans

Pandemic responses contributed to diverging recoveries

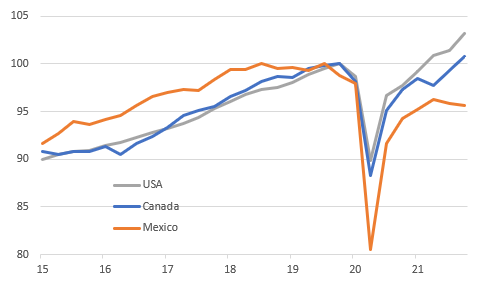

The pandemic wreaked havoc on the global economy as consumer and business confidence plummeted and Covid containment measures were introduced. The US economy contracted by 10% and the Canadian economy by 12% in the first half of 2020, but for Mexico the decline in output was even sharper. The economy was already struggling and by the end of the second quarter of 2020, output was 19.5% lower than it had been just two years before.

In terms of the US and Canada, economic output is now back above pre-pandemic levels thanks to successful vaccination programmes that have allowed a broad re-opening of the economy, and massive fiscal and monetary stimulus has further fuelled a recovery in demand.

In contrast, the stimulus efforts in Mexico have been modest. Interest rates were cut, but only to 4%, rather than close to zero as in the US and Canada, while fiscal support has been severely lacking in comparison. The IMF estimated that gross spending commitments for Covid relief amounted to just 0.7% of GDP versus a recommendation of 2.5-3.5% of GDP and the cumulative near 20% of GDP spent by the US government in 2020/21.

This reluctance to provide debt-financed support has contributed to the lower deficit and debt numbers versus peers, but has come at an economic cost. Mexico’s economic rebound has been far more muted with the economy falling back into recession in the second half of last year.

Level of real GDP (pre-pandemic peak = 100)

Construction followed suit

Given this broad economic divergence, it isn’t surprising that we saw the respective construction sectors perform disparately. In the US, construction output fell 8.5% in real terms in the first quarter of 2021 as Covid containment measures prevented construction activity from mid-March. However, we then saw a recovery in the second quarter with output surging. Since then output has dropped back in volume terms, primarily due to ongoing weakness in the non-residential sector.

In Canada, the sector was even more durable with non-residential construction seeing less of a downturn versus the US, while residential construction has continued apace. Mexico is far weaker with construction activity having initially plunged 30% before recovering and then dipping once more in the second half of 2021.

Construction real value added (4Q 2019=100)

As a result, construction as a proportion of overall economic activity has remained fairly steady at 4.1% in the US and 7.4% in Canada, but it has dropped from 8.4% of total Mexican economic activity in 2008 to a mere 6% today.

Residential outlook: US slowdown likely, Canada to hold firm, but Mexico to modestly strengthen

In the US, the Federal Reserve has already raised interest rates, but with officials signalling a need to “catch up” to regain control of inflation and inflation expectations, we expect the pace of interest rate increases to be stepped up. A rapid-fire pace of aggressive 50bp rate increases looks likely with the Fed funds rate set to hit 3% by the beginning of 2023. The Federal Reserve is also seeking to shrink its balance sheet in quick fashion.

The US housing market looks vulnerable in this environment. House prices nationally have risen more than 30% since the start of the pandemic, outpacing the increases in wages and thereby making it more challenging to save for a deposit to buy a property.

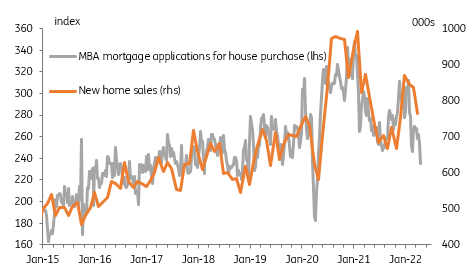

Affordability issues have then been compounded by the sharp rise in mortgage rates. The average contracted rate for a 30-year fixed-rate mortgage jumped from 3.3% at the beginning of January to 5.4% in mid-April, putting up the cost of monthly mortgage payments by more than $500 on the average $450,000 loan.

Add in the fact that consumer confidence has weakened in response to concerns over higher inflation, and it is understandable that we are seeing a downturn in mortgage applications for home purchases. This is already translating into lower housing transaction numbers.

Falling US mortgage applications for home purchase points to a slowdown in home sales

US housing downturn a growing risk

With building permits and housing starts having accelerated we could conceivably swing from excess demand to excess supply over the next year, which would depress prices and feed even more negatively into housing transactions and homebuilder sentiment.

It also implies a downside risk for residential construction in 2023. Homebuilders' profits are already being squeezed by rising labour, energy and raw material costs and if sold new home prices come under downward pressure we could see residential construction weaken.

Nonetheless, low inventory levels overall and strong household income fundamentals mean we are unlikely to see forced sellers that could lead to a precipitous housing crash. In our US construction report from January, we saw housing starts slowing to around 1500k by the end of this year and to 1400k in 2023 from the February annualized rate of 1769k. These forecasts still hold. They are below the 1623k and 1550k consensus predictions for the respective years.

Canada housing is strong and is set to remain so

In Canada, housing affordability is even more stretched than in the US. The average Canadian home is priced at C$817,000 – nine times the average household income. In the US, the median home price is a “mere” 5.5 times greater than household income. The property markets in the cities of Toronto and Vancouver are particularly hot with home prices typically exceeding C$1m.

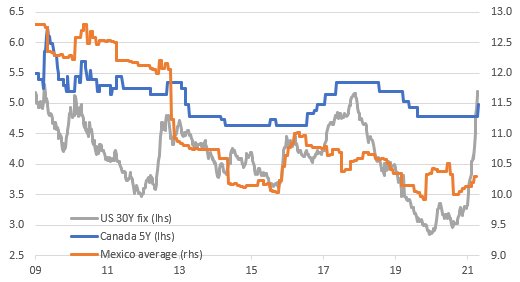

As in the US, low borrowing costs helped spur demand, but while the Bank of Canada is likely to keep pace with the Federal Reserve on interest rate increases having already raised the policy rate by 75bp, there is likely to be a less marked swing in new mortgage rates.

The standard mortgage in Canada isn’t the 30-year fixed, as it is in the US, but a five-year mortgage amortised over 25 years, which is more determined by what happens to short-term borrowing costs rather than driven by big swings at the end of the yield curve. The chart below compares mortgage rates in the US, Canada and Mexico and shows far less volatility in Canada’s mortgage market.

Typical mortgage rates – more volatility in the US market

Moreover, the Canadian jobs market has outperformed that of the US with employment already at record levels while the economy’s high weighting of commodity production should see investment and job creation continuing to outpace most other major economies. Demand should be further supported by rapid population growth, which is currently the fastest in the G7 at 5.2% between 2016 and 2021 versus 2.6% in the US. Mexico’s population grew 5.6% over the same period.

Recent Canadian budget proposals have included C$2.5bn of support to stimulate the construction of 10,000 affordable housing units while there are proposals to help affordability, such as a tax-free savings account for first-time buyers. This is unlikely to dent the excess demand in the market. With prices remaining elevated we suspect the construction market for private homes will remain strong this year and next. We expect housing starts, which peaked at an annualised 304k in the first quarter of 2021, to slow to an annualised 240k by the end of 2022, with starts holding at this level through 2023.

In Mexico, higher borrowing costs are less of a hindrance

In Mexico, house price rises have been far less extreme than in the US and Canada, likely given the overall economic underperformance and far less fiscal stimulus for households. Consequently, given where Mexico is positioned in the economic cycle, there is arguably potential upside versus Canada and the USA.

In this context, it is important to remember that the Mexican residential property market is different to that of the US and Canada. Rather than mortgage financed purchases, the majority of Mexican homes are either bought with cash or self-built or inherited given the high proportion of multigenerational homes. The number of home purchases financed by a conventional mortgage is only around 10% in Mexico versus 70% in the US. Consequently, higher mortgage costs are less of an issue, but strong inflation in building material costs will still be a major headwind to construction activity.

House price growth (YoY%)

Employment is at record levels domestically, while the number of Mexicans employed in the US reportedly exceeded seven million in December, which combined with rising wages plus US stimulus payments, has boosted worker remittances back into Mexico. Remittances amounted to $51.6bn in 2021, a 27% jump from 2020.

The government's subsidising of fuel prices has meant inflation has not risen as rapidly as elsewhere and is in fact lower than in the US. This also means that real wage growth is in better shape than in both Canada and the US, which should also be supportive of economic activity on a relative basis.

This stronger employment growth outlook and income story vis-a-vis the US and Canada, plus the lower price level start point and the low reliance on mortgages (plus less sharp moves in mortgage borrowing costs), suggest rising residential construction at faster rates than in the US and Canada. Nonetheless, the rapidly rising cost of building supplies will act as a cap on that growth.

Non-residential: focus on private spending as government infrastructure disappoints

Regarding the US, we wrote in January that “we are particularly optimistic on the non-residential sector which is likely to see delayed projects reinstated, refurbishment plans increase, while a generally strong economy can give a further lift together with massive government infrastructure investment support over coming years”.

Today, the strong investment outlook for corporate America is underscored by robust core durable goods orders and various capex intentions surveys posting strong outcomes. Unfortunately, the outlook for government infrastructure isn’t looking quite as good as we had hoped.

The Infrastructure Investment and Jobs Act totals around $1.2tr of spending for the next five years. We wrote about this in detail here. It contains substantial funding for projects that range from public transport to the power system, and from climate resiliency to emerging technologies that can accelerate the country’s energy transition.

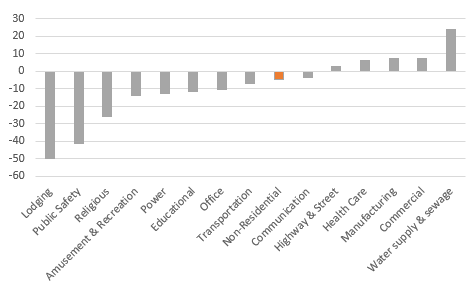

Change in US non-residential construction between pre-pandemic peak (Jan 2020) and latest (Feb 2022)

However, the second part of US President Joe Biden’s investment plan – Build Back Better – has stalled and given the proximity to November’s mid-term elections, is unlikely to be revived. Republicans are opposed and key Democrats are not inclined to back it.

Canada and Mexico have more of the cycle to run

Meanwhile, we expect Canada to be the strongest-performing developed market economy in 2022 and 2023 overall with high commodity prices, firm domestic demand, and record employment supporting GDP, as well as potential corporate investment projects across the economy.

Infrastructure spending is also a key plank of the Canadian government’s growth strategy, having promised more than C$180bn of funding over the next 12 years. Projects include public transport links, and improving broadband and energy infrastructure.

In Mexico, the deep recession and the subsequent growth relapse have heaped pressure on the government to do something to jump-start the economy, and there are proposals for a “multi-billion dollar” infrastructure package. Plans in progress include $10bn on rail infrastructure to link five southern states with more than 900 miles of new track, while the Dos Bocas refinery project is expected to exceed $12.5bn. Finance minister Rogelio Ramirez de la O has said an announcement on joint public-private financed projects will be forthcoming and it could involve more than 40 projects including highways, energy, ports and telecommunications.

That said, details are lacking and there is the risk that weak tax revenue growth and the government’s reluctance to increase debt make grand aspirational infrastructure plans vulnerable to cuts. We are wary about getting too optimistic about these announcements.

We are hopeful that the corporate sector will contribute to an improving outlook for the construction sector as economic confidence recovers while the impact of Covid on global supply chains may incentivise investment and construction activity in Mexico. The zero-Covid policies implemented in China have extended the challenges for US manufacturers in the region, particularly the auto sector, and we suspect this could result in more sourcing and production of components in the Americas region at the expense of Asia over time.

Nonetheless, concerns regarding government interference and the weakening of independent regulatory bodies and the associated worries surrounding transparency and accountability may make some companies wary.

Conclusion: Mexico and Canada play catch-up as US headwinds mount

While the post-pandemic recovery, boosted by pent-up demand, should be a boon for construction, there are obvious headwinds. Supply chain disruptions and the challenge of sourcing, particularly with ongoing port congestion and freight challenges, provide a huge headache. The lack of labour with the right skill sets is another. This is pushing up costs right across the industry and is making long-term planning much harder.

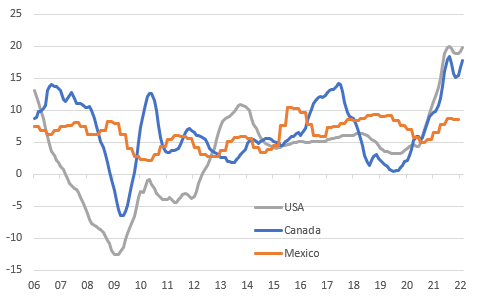

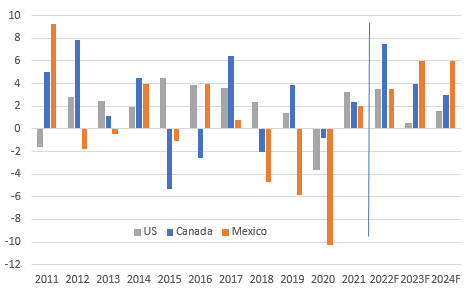

Out of the three North American economies, we see the weakest outlook being for the US. While the non-residential construction sector should perform strongly over the coming years, our concerns for the residential market in 2023 and 2024 are heightened. Rising mortgage rates and a general lack of affordability are weakening the demand outlook at a time when supply is coming on strong in 2022. The risk of a modest correction in prices, transactions and eventually construction activity is skewing the outlook more and more to the downside, while the lack of progress on Build Back Better is an obvious disappointment. After growing 3.5% in real terms in 2022, we see a slowdown to just 0.5% growth in 2023 and 1.5% in 2024.

Construction value added YoY% with ING forecasts

The fundamentals underpinning the Canadian residential market appear stronger given the employment and population growth outlook and the impact of rising mortgage rates is less pronounced than in the US. At the same time, the strong macro outlook and heavy commodity focus make Canada our top pick for overall economic growth, and on top of this, the government infrastructure plan provides further support for the sector. We expect construction growth of 7.5% in real terms in 2022 followed by 4% in 2023 and 3% in 2024.

Mexico has more scope for recovery than elsewhere given output remains well down on pre-pandemic levels, but fiscal constraints mean it may not necessarily be especially rapid. Nonetheless, steady progress can be made over the coming years with decent income growth – both domestic and via remittances – and less reliance on mortgage financing allowing for growth in the residential sector. This can then be complemented by private construction as economic optimism gradually returns. We look for Mexican construction to expand by 3.5% in real terms in 2022 with 6% growth in 2023 and 2024. This would still leave the level of Mexican construction output four and a half percentage points below 2017 levels, but should fiscal policy become more expansionary, we will look to revise these projections higher.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article