Iron ore’s rout to continue until China recovers

Iron ore has been one of the worst-performing commodities this year. Concerns over Chinese macroeconomic performance and continued Covid-19-related disruptions have been key to driving prices lower. Hopes of a China recovery in the second half of 2023 should provide support in the medium term. The short-term outlook is more bearish

Gloomy demand outlook

Iron ore prices have roughly halved from their year-to-date high of US$171/t seen back in March to as low as $81/t recently – almost its lowest since early 2020. Futures in Singapore have fallen for seven consecutive months, the worst run since the contract debuted in 2013. China’s attempts to crush outbreaks of Covid-19 have seen tough restrictions, which have not been supportive of the country’s property market, the main driver of iron ore demand. China alone accounts for about two-thirds of seaborne iron ore demand.

The sentiment has deteriorated since China’s 20th Communist Party Congress with the property sector policy tone remaining downbeat and the government continuing to maintain the principle that “housing is for living in, not for speculation”.

China’s property sector accounts for almost 40% of its steel consumption. That sector has been in a steep decline for more than a year amid continued tightening of housing measures across China since March when cities began to introduce a sales ban.

China’s home sales declined again in October, reflecting the difficulties facing the property market, as the slowing economy and ongoing Covid-19 outbreaks dampened homebuying demand.

In the 10 months from January through October, national home sales dropped 25.6% in terms of square meters and 28.2% in terms of value, according to data from the National Bureau of Statistics. Property investment dropped 8.8% over the period, worsening from an 8% decline in the first nine months. New construction starts by property developers in the country fell 37.8% between January and October, compared with the 38% decline between January and September, with developers reluctant to start new construction.

The World Steel Association expects Chinese steel demand to fall 4% for the whole year, driving a projected 2.3% drop in global demand amid surging inflation and rising interest rates. In 2023, new infrastructure projects and a mild recovery in the real estate market could prevent further contraction of steel demand.

Looking forward, the outlook for iron ore is going to largely depend on how China approaches any further Covid outbreaks as well as the scale of stimulus the Chinese government unveils.

Most recently, China’s regulators announced a 16-point plan to rescue the country’s property sector. The measures include encouraging banks to lend to developers and loosening down payment requirements for homebuyers.

China’s GDP is expected to fall to 3.3% this year, according to forecasts by our China economist, well below the government’s 5.5% target. At the same time, global demand for steel is weakening as central banks tighten monetary policy. In 2023, the International Monetary Fund predicts China’s GDP to grow by 4.4%. Meanwhile, Chinese government advisers said they will recommend modest economic growth targets for next year ranging from 4.5% to 5.5%

Demand outside of China also struggling

Steel demand across the rest of the world has been weakening as well, reflecting the impact of high energy prices as well as central bank's increasing interest rates.

In the EU, steel demand is expected to contract by 3.5% in 2022, according to the World Steel Association. With immediate improvement in the gas supply situation not in sight, steel demand in the EU will continue to contract in 2023 with significant downside risk in case of harsh winter weather or further disruptions to energy supplies.

On the supply side, in the January-September period of this year, crude steel production within the European Union fell by 8.2% compared with the same period a year ago, to 105.8 million tonnes, based on WSA data. Japan’s production was down by 6% at 67.8mt, while South Korea’s volume decreased by 4.4% to 50.5mt.

India is the only bright spot in the global steel market with the country’s output reaching 93.3mt in the January to September period, a rise of 6.4% year-on-year.

Total production is forecast to grow 6.1% in 2022 and 6.7% in 2023 in line with the Indian Government’s target to double national production capacity to 300 million tonnes by 2030-2031 on the back of strong urban consumption and infrastructure spending, which will also drive demand for capital goods and automobiles. India’s growth figure is the highest among top global steel consumers.

Most recently, India has unexpectedly removed export duties on a number of steel products and iron ore, which were imposed back in May. This includes iron ore lumps and fines with less than 58% iron content and iron ore pellets. Meanwhile, iron ore lumps and fines with an iron content of more than 58% will still attract a 30% duty. This will mean iron ore producers will return to the export market but the extent of imports will depend on demand from its main importer, China. Iron ore prices traded under pressure following the announcement.

China steel output lags

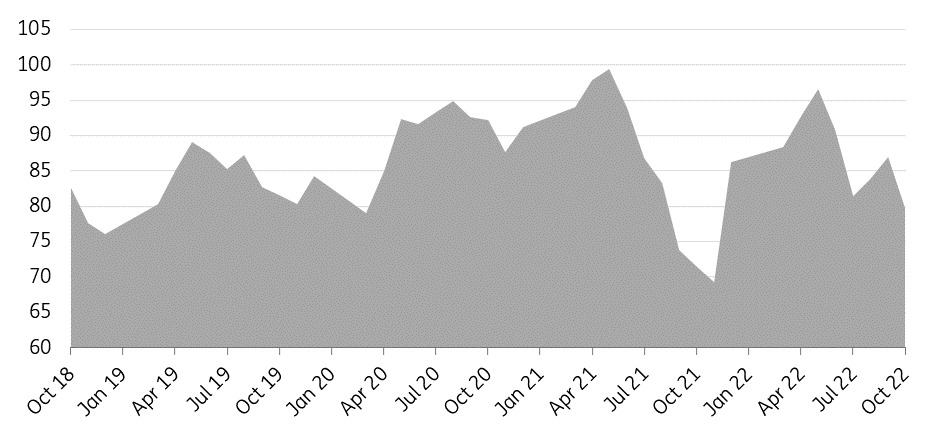

Chinese steel output has also been under pressure for much of the year. The start of 2022 saw output cuts in some regions during the winter Olympics weigh on national output, whilst in more recent months Covid lockdowns have weighed further on both steel demand and supply.

Negative steel margins have prompted mills to intensify output cuts ahead of the winter steel curbs, with around 20 shutting down blast furnaces and speeding up annual year-end maintenance, shutting off at least 100,000 tonnes of daily output. Steelmakers in China are usually ordered to decrease production during the winter months to cut back on pollution.

China’s steel production is falling – in large part because of China’s property crisis. China’s total steel production from January to October came to 860.57 million tonnes, down 2.2% on the same period last year, and compared with a 3.4% year-on-year contraction in January-September, according to data from the National Bureau of Statistics. Meanwhile, China’s cap on annual steel output to limit carbon emissions paints a bleak picture for iron ore demand going forward.

China monthly crude steel output (million tonnes)

China iron ore imports slow down

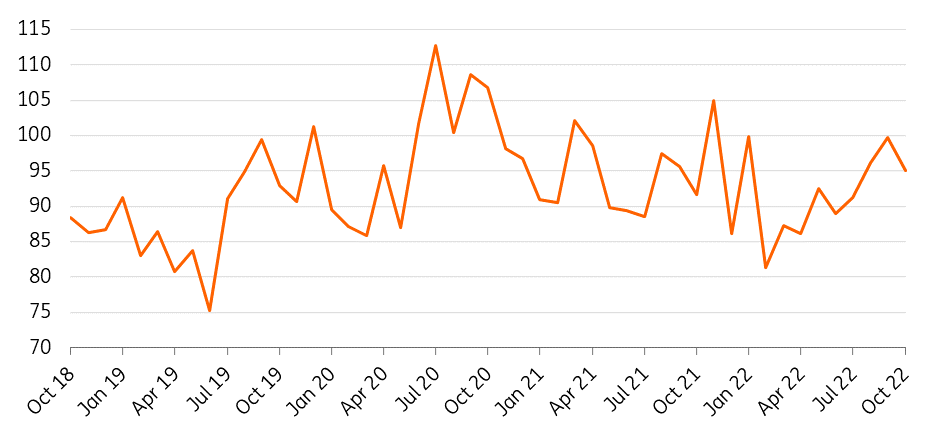

Amid lower steel output from China, iron ore imports have also been under pressure this year.

The world’s top consumer brought in 94.98mt of iron ore in October, down from September’s 99.71mt, the General Administration of Customs said, while they fell 1.7% year-on-year to 917mt in the first 10 months of the year.

At the same time, iron ore inventories at Chinese ports have been growing since mid-October, reaching 136mt in mid-November. China’s iron ore port inventory is a key indicator that reflects the supply and demand balance, as well as the safety net and imbalance between the iron ore supply and the steel mill demand.

With the peak construction season coming to an end and with the expected demand recovery not meeting expectations, there is little upside for steel output and iron ore demand in the short to medium term.

China monthly iron ore imports (million tonnes)

Australian supply to edge higher, Brazilian shipments suffer

The supply side has been mixed with Australian exports increasing this year due to a strong performance by majors, while supply from Brazil, the world’s second-largest exporter behind Australia, is slightly below last year’s levels with the country struggling to see iron ore shipments return to levels seen prior to the Brumadinho dam disaster in January 2019.

In 2021, total Brazilian iron exports totalled 358mt, still down from the 371mt exported in 2018. Exports in 2022 have struggled as well with total shipments of iron ore from Brazil at around 154mt in the first half of 2022.

Vale’s year-to-date production fell to 227mt, which marks a 1.9% decline year on year. This is primarily due to the 6% drop in production reported in the first quarter of 2022 due to the heavy rainfall in Minas Gerais in January that halted the Southern and Southeastern Systems operations.

Vale has recently cut its production guidance for 2022 to 310-320mt from 320-335mt, compared to the production of almost 316mt last year. Looking further ahead, Vale still aims to reach 400mtpa of annual capacity.

Total Brazilian exports are forecast to reach 347mt in 2022, a fall of around 2.8% compared with 2021.

Meanwhile, Australia is in the process of ramping up supply from a number of new projects, of which the largest is BHP’s 80mtpa South Flank mine which started operations in 2021. This follows the startup of Fortescue’s 30mtpa Eliwana mine which commenced operations in late 2020 and has ramped up output since. For this year, Rio’s 43mtpa Gudai Darri mine started operations in June, while Fortescue was meant to start operations at its 22mtpa Iron Bridge mine this year, but the start date of this has been pushed into 1Q23.

These new projects, along with some expansion projects, could add to the downside pressure on prices.

The majors have recently released third-quarter reports, with FMG reporting a 2mt YoY increase to 47.5mt, Rio Tinto adding 1mt YoY to 84mt, and BHP also contributing an additional 1.5mt YoY to 72mt.

Australian iron ore export volumes were 0.9% higher year-on-year in the first half of 2022, with new greenfield supply starting to come online from major producers. Exports are forecast to increase by 3.1% in 2022-23 to reach 903mt and rise by 3.8% to 937mt in 2023-24, according to Australian trade data (Department of Industry, Science and Resources).

Looking ahead, we should continue to see the ramping up of supply from new projects in Australia, along with Vale continuing to target an annual production capacity of 400mtpa.

Iron ore prices to ease in the short term

There is more downside ahead for iron ore as there are fears that China’s strict zero-Covid policy is here to stay in the near term, despite the recent easing of Covid restrictions and the government’s pledge to bolster vaccinations among senior citizens. We believe the Chinese government is likely to stick to its zero-Covid policy through winter. China continues to see record daily cases of Covid, which has resulted in some cities tightening mobility restrictions. Reports of Covid protests in China will also likely prove harmful to sentiment.

We believe the short-term outlook remains bearish with sluggish demand from China suggesting that prices should trend lower. We expect prices to slide to $85/t in the first quarter of 2023 and hover around $90/t throughout the second and third quarters.

Prices should be supported in 2H23 due to expectations of a recovery in China and easing Covid-19 restrictions, with prices moving above $95/t in 4Q.

However, it appears that China will continue to cap crude steel output whilst also looking to replace older steel capacity with electric arc furnace capacity in order to help the country meet its decarbonisation goals. Growth in electric arc furnace (EAF) capacity at the expense of basic oxygen furnace (BOF) capacity will be a concern for the medium to long-term outlook for Chinese iron ore demand. It also suggests that we have already seen China’s iron ore imports peak in 2020.

ING forecast

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 November 2022

2023 Commodities Outlook: Stormy seas ahead This bundle contains 13 Articles