A matter of class in the nickel market

The primary nickel market could swing back to surplus in 2022, but a structural deficit in the Class 1 market may remain sticky. This, compounded with low exchange inventories, suggests that elevated prices may be here to stay

Prices recover on supply and demand dislocation

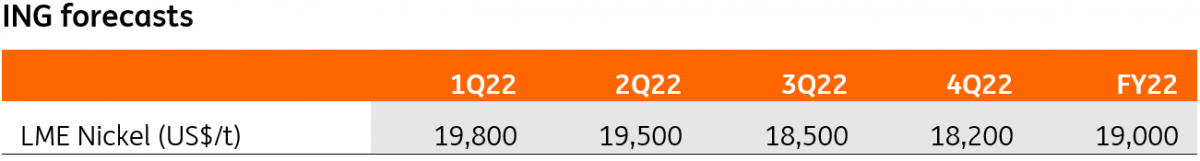

The nickel market has rebounded strongly from its March/April lows as supply growth has been weaker-than-expected while demand has picked up. Prices (LME 3M) tentatively broke out above US$20,000/t in 4Q21 with the continuous drawdown in reportable inventories after the market unexpectedly slipped into deficit. This is particularly the case for the Class 1 market, which is witnessing a structural deficit.

Massive supply disruptions lead to slower supply growth

Expectations of strong supply growth were misplaced chiefly due to significant disruptions. Over the second half of the year, there has been a significant number of unexpected disturbances in ex-NPI (nickel pig iron) operations that have resulted in more than 100kt of supply losses. Major producers, including Vale and Norilsk, both reported lower production. Meanwhile, Vale also lowered its production guidance for the coming years following the disruptions and license issues at Onca Puma. From 3Q21, high energy costs have put some operations at risk, and a 7ktpa ferronickel producer based in Kosovo halted production due to high power prices.

Expectations of strong supply growth were misplaced

In addition, the expected strong growth in Indonesian NPI and HPAL (high-pressure acid leach) supply has fallen short of expectations due to Covid-related travel restrictions and power issues. In China, a contraction in NPI production was largely expected as Indonesia has banned its high-grade ore exports. Supply has been further hit by power rationing in major NPI production regions. This is reflected in NPI prices, which have surged to record highs in the onshore market.

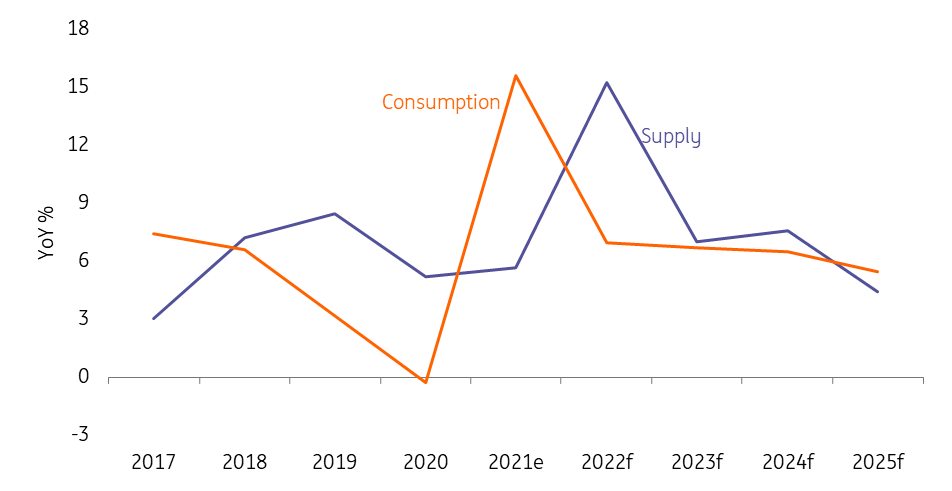

As a result, the primary nickel supply is set to grow by 5.6% year-on-year in 2021, much lower than expected at the start of the year. For 2022, our base case calls for supply growth to come back on track. This is estimated to surge by more than 15% YoY chiefly driven by the Indonesian NPI sector. However, if the latest Omicron variant leads to increased disruptions, this strong growth in supply may be delayed. Further downside risks to supply may come from ex-NPI supply and delays to HPAL projects.

A burning issue in the Class 1 market

The bottlenecks in supplying suitable feedstocks to meet rapid demand growth continue to be a key issue. Earlier this year, Chinese Tsingshan announced plans to convert NPI into nickel matte which can be further processed into sulphate. The market plunged in response to this news as this was supposed to ease the tightness in this part of the market.

However, though technically viable on a commercial scale, this route requires NPI, matte and sulphate to be constantly profitable. As for the more traditional route (i.e. hydrometallurgical), the supply of mixed hydroxide precipitate (MHP) has grown fast after the commissioning of China Lygend Mining's hydrometallurgical project in Indonesia and First Quantum's reinvigorated Ravensthorpe project in Australia.

The timing and scale of delivery are important in the supply of raw materials to produce battery-grade nickel. This is often a swing factor that jolts the market. Based on current timelines, we expect the battery-grade nickel market to remain in deficit, albeit narrower, over 2022. This is partly because of displacement pressure from lithium-iron-phosphate (LFP) chemistry particular in the China market at the lower end of the vehicle segment.

Stronger consumption underpinned by twin-engines of growth

The twin-engines that have underpinned nickel consumption growth have beaten expectations, with battery and stainless steel usage surprising to the upside. Global stainless steel production is on track to rise 14% YoY this year, with Indonesian production almost doubling, and all major regions seeing double-digit growth. The nickel-rich type, i.e. the 300-series, representing almost 60%, is estimated to rise 20% YoY driven by 8% YoY growth from the world's largest producer, China.

Despite still being smaller than stainless steel, nickel consumption in the batteries sector is estimated to grow by 75% YoY in 2021. The sector’s share relative to overall primary nickel consumption has doubled from around 4% pre-pandemic to 8% this year and is set to expand to 10% in 2022. This is driven by the rapid penetration of electric vehicles. In the first 10 months of 2021, total new energy vehicle (NEVs) sales grew by 177% YoY, according to the China Association of Automobile Manufacturers(CAAM).

World primary nickel supply and demand growth

Cautiously optimistic before structural tightness eases

The dislocation in supply and demand led to the overall primary nickel market flipping into a deficit in 2021, but the situation is forecast to improve over the course of 2022, weighing on the market. Nevertheless, before any major signs of improvement have been felt, the structural tightness in the battery nickel market remains a burning issue and is becoming a major force supporting the market. In particular, a key battery material, nickel sulphate, fell into a big deficit as chemical prices skyrocketed to record highs during 4Q21, and remained elevated thereafter, which may continue to support the inventory drawdown in nickel briquettes (a majority type of LME nickel inventory). Hence, we are cautiously optimistic for 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 December 2021

ING commodities outlook 2022: Keeping the faith This bundle contains 11 Articles