Cocoa prices tumble on supply forecasts

Cocoa prices have fallen significantly from their highs, with the market set to return to surplus. While we believe prices have further room to move lower, the market is facing supply risks. In addition, low stocks mean prices will likely remain volatile

Continued volatility amid lower market participation

The first quarter of this year has continued to see significant volatility in cocoa prices. London cocoa has traded in an almost GBP3,400/t range so far this year, while implied volatility remains above pre-2024 levels, although admittedly it is down from the peak seen in 2024. The market is trading at its lowest level since November, which has seen cocoa go from the best performing commodity of 2024 to the second worst performer so far this year.

Prospects for a small surplus in the 2024/25 season have helped ease some supply concerns, however, with global inventories still tight, following three years of deficit, the market will likely remain volatile. In addition, there are still supply risks facing the market. But assuming these risks do not materialise, we expect prices to trend lower.

Spreads also suggest less concern over market tightness. The front end of the London market curve has flattened and in fact moved into a small contango, although to be fair, any speculative money that has been present in the market will likely have been in the nearer term contracts and so liquidation of these longs would naturally put pressure on the nearby time spreads.

In terms of positioning, the managed money net long in London cocoa has more than halved since the start of the year. In January, funds held a net long of almost 32k lots. This now stands below 13k lots.

However, what has also made the market even more volatile is the fact that open interest and traded volumes have been trending lower. Average daily traded volumes have held up relatively better than open interest, which is reflected in the average daily volume/ average daily open interest ratio, which has been trending higher since 2024. This dynamic only adds to the volatility in the market.

London cocoa market liquidity continues to fall

A factor behind reduced market participation would be that physical longs are reluctant to hedge (sell futures) given the broader strength we have seen in the market in recent years. Obviously, selling futures into a market that has been trending higher can create liquidity issues for market participants, who will face larger margin calls.

Furthermore, uncertainty over supply also means that physical longs would have likely been reluctant to hedge too much supply given the risk of having to buy back hedges.

If we look at the producer short in the London market, they hold their smallest position on record - falling from over 350k lots in early 2024 to less than 100k lots currently. The lack of physical longs selling removes some of the resistance you would usually expect the market to face.

Producer shorts hold a smaller share of London cocoa futures (%)

Supply looks better but still concerns

Given the tightness in stocks, the market has been more sensitive than usual to weather and crop developments in West Africa.

Dry harmattan winds have raised concerns over the mid-crop, which does leave some uncertainty in the market. This followed heavy rainfall in September and October, which helped increase the spread of brown rot fungal disease.

While cocoa arrivals at ports in the Ivory Coast are up 14% year-on-year at 1.4mt, the gap has narrowed as we have moved through the season. The YoY gap peaked at 34% in late November/ early December.

The mid-crop in the Ivory Coast is set to start in April and there are suggestions that it could come in at around 300kt, down from an historical average of 500kt. However, for now total output (main and mid-crop) in the Ivory Coast for the 2024/25 season is forecast to grow by a little under 11% YoY to 1.85mt, which is still below the more than 2.2mt produced in 2022/23.

Other large increases in supply are expected from Ghana and Ecuador, which are forecast to see supply grow by around 13% and 12%, respectively.

The International Cocoa Organization (ICCO) estimates that global output will grow by 8% YoY to 4.84mt.

Ivory Coast arrivals up from last year but pace slows (000 tonnes)

Higher prices help rebalance the cocoa market

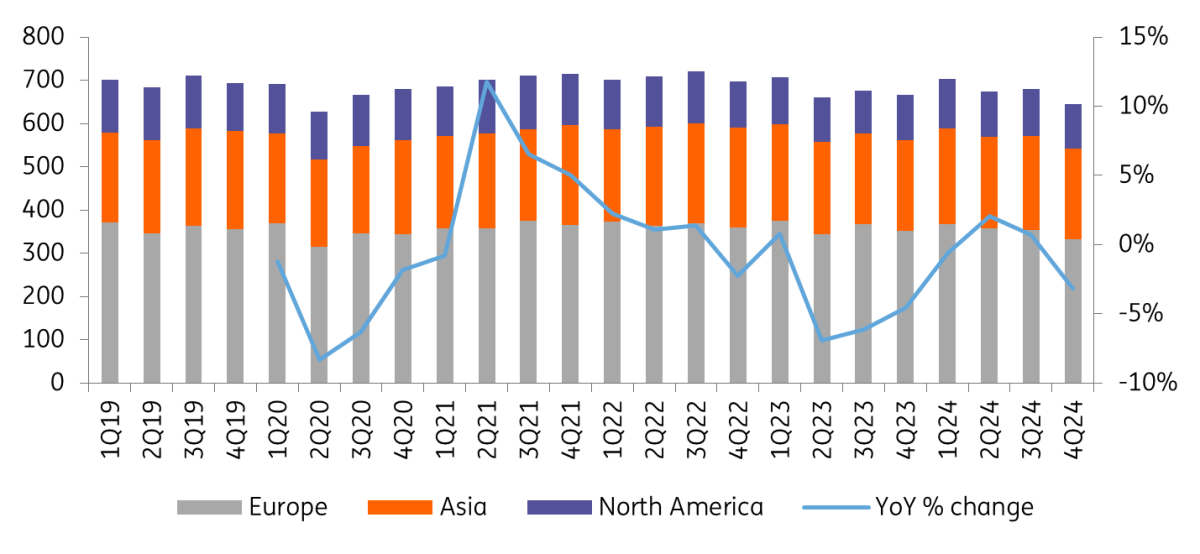

While higher prices are painful for consumers, they do serve a purpose in trying to rebalance the market through demand destruction. Grinding data from the largest consuming regions is released on a quarterly basis, and so the latest numbers are for the final quarter of 2024.

The numbers show that grindings in Europe, North America and Asia were down 3.2% YoY in 4Q24. In fact, grindings in the final quarter of last year hit their lowest level since 2Q20. The decline was driven largely by Europe, where grindings were down 5.4% YoY. Despite weaker grindings in the second half of 2024, full year numbers were only down 0.7% YoY. This reflects the fact that it takes time for higher prices to be passed onto consumers.

While we need to wait until mid-April to see how grindings performed in the first quarter of this year, it is likely that they remained under pressure. The ICCO forecasts that grindings in the 2024/25 marketing year will fall by around 5% YoY to 4.65mt.

Higher prices start to weigh increasingly on cocoa grindings (000 tonnes)

Global balance shifts to surplus

The global cocoa market is forecast to return to a surplus of 142kt in the 2024/25 season, however, there is uncertainty over this number as it is yet to be seen how the mid-crop develops. Furthermore, while the ICCO forecasts demand will shrink by 5% this season, there is always the risk that demand proves stickier than expected.

In addition, cocoa stocks started this season at their lowest level since the 1980s. If you look at the stocks-to-grinding ratio, it started the 2024/25 season at the lowest level since the 1970s. This is after three years of deficit, which would have led to stocks falling more than 700kt over this period. Therefore, while a surplus this season is helpful, at just 142kt, it still leaves stocks tight and the market sensitive to developments on the supply side. Stocks at the end of 2024/25 are forecast to total 1.48mt, which would leave the stocks-to-grinding ratio at 31.8% - the second lowest level since the 1980s.

Global cocoa market balance (000 tonnes)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article