Precious metals’ golden year to continue

Demand for gold as a safe-haven is likely to remain strong in 2020, but lacklustre physical demand could cap gains. Palladium continues to outperform, and while there are rising substitution risks, there's little evidence of widespread demand destruction. The market remains focused on a deficit environment

Gold's safe-haven allure

2019 has been a golden year for precious metals as escalated trade disputes created a risk-averse environment among investors and demand for safe-haven assets increased. We expect the trend to continue in 2020 as most issues are still unresolved, even though both the US and China have been making efforts to prevent the situation from getting worse.

Increased prices may continue to weigh on physical gold demand, especially in emerging economies including China and India. A stronger US dollar and higher import duties continue to add pressure on consumers here. For platinum group metals, stronger demand from the automobile sector pushed palladium to a record high; however, the Pt/Pd ratio of around 0.4 increase risks of substitution.

Increased prices may continue to weigh on physical gold demand

Total known ETF holdings of gold increased by c.9.8mOz in 2019 as investors poured more money into the safe-haven asset. The escalated trade war and those associated multiple tariff hikes during the year created a risk-averse environment among investors. Falling Fed rates in the US and negative interest rates in Europe further supported the higher inflow of investment money into precious metals rather than chasing Treasuries only.

Physical demand for gold took a knock in 2H19 as price-sensitive Chinese and Indian gold demand dropped. And the trend is likely to be similar in 2020 where the economic slowdown should keep disposable income under pressure. In India, higher duties on gold imports put further pressure on demand. India’s gold imports dropped 5% YoY to 642 tonnes over the first three quarters of 2019 (annualised c.830 tonnes) after falling 11% YoY to 872 tonnes for the full-year 2018 and could stay around 800-825 tonnes in 2020.

In China, the PBoC was a major purchaser of gold in 2019, buying around 3.1mOz of gold; however, the bank appears to have put a brake on its gold buying for now, which may keep Chinese demand under pressure too.

ETF gold holdings (mOz)

Palladium's 'near sorrow' and 'distant concern'

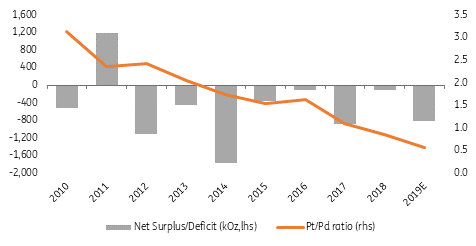

Palladium has been the best performer in the commodity market with a gain of c.40% in 2019. A key pillar behind palladium's stellar performance over recent years has been the persistent supply deficit and this has widened further. We don't imagine that's going to change much in 2020 and we'll continue to see a sizeable supply deficit.

The nature of palladium supply is that it mostly comes as a by-product from platinum and nickel mines, leaving that supply more inelastic compared to the volatile demand picture. In recent years, despite the price strength, both primary production and recycling growth has remained fairly stable. However, the demand picture has been more volatile, and more than 80% of palladium goes towards catalytic converters which have been the key driver behind stronger demand growth. China and Europe have seen the strongest demand here.

The market is likely to remain focused on the deficit environment and the constructive demand picture in the short term

The bullish fundamental picture for palladium has increased speculative interest in the metal. And looking at the CFTC data, we think speculators still have room to add to their positions, with the current net long of 12,776 lots still some distance from the high of 27,471 lots seen in early 2018. You may be surprised at ETF palladium holdings, which stand at just 610koz, down from around 3moz back in 2015. This reduction reflects more tightness in the physical market, with holders lending out the metal due to very healthy lease rates.

However, the momentum may come under risk in 2020 as the Pt/Pd ratio increased to a record low of around 0.4 and some of palladium's demand could be switched to platinum for gasoline vehicles. The key issue is that up until now, there has been little evidence of substitution taking place. We believe the market is likely to remain focused on the deficit environment and the constructive demand picture in the short term. However, longer term we may see growing concerns over demand destruction should higher prices lead to substitution becoming a reality. If this turns out to be the case, that would suggest downward pressure on prices in the longer term.

Palladium market balance vs Pt/Pd ratio

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 December 2019

ING’s 2020 Commodities Outlook This bundle contains 11 Articles