Coal weakness to persist

Cheap LNG and a strengthening carbon market in Europe have been weighing on coal prices. Those themes will continue throughout 2020, keeping the coal market under pressure

Pressure to persist

2019 has been a year of weakness for thermal coal markets, with API2 prices down more than 37% since the start of the year, and trading down to levels last seen in 2016. The ramping up of LNG export capacity has increased the availability of cheaper alternative fuels for power generation, while in Europe stronger carbon prices mean that gas has been favoured as a feedstock over coal for power generation.

For 2020, it is difficult to see this trend reversing. LNG supply is expected to increase further which should keep gas hub prices relatively week and, as a result, coal prices too. Furthermore, we would expect carbon prices in the EU to remain well supported, with the Market Stability Reserve managing carbon allowances in the market. We expect to see a general shift away from coal power generation to cleaner fuels elsewhere as part of the broader energy transition trend

Demand broadly negative

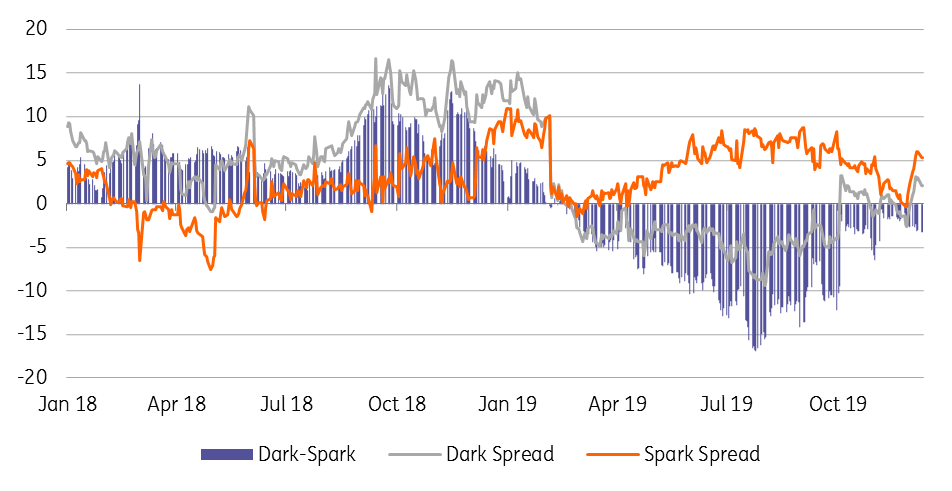

The demand outlook for coal in Europe remains negative. 2019 has been a year where we have seen record LNG volumes flowing into Europe, given the ramping up of LNG export capacity. Meanwhile, the EU’s Emission Trading System has become increasingly more effective due to the strength we have seen in carbon prices. As a result, spark spreads in Europe will likely remain more attractive than dark spreads, which should continue to support the coal-to-gas switch for power generation over 2020.

In Asia, several markets in the region have seen weaker demand so far over 2019. In Japan, cumulative thermal coal imports over the first ten months of the year are down around 3% YoY. The restarting of nuclear capacity in the country is a key factor behind this weakness and with further applications for reactor restarts, we would expect this will continue to weigh on Japanese coal imports in the longer term.

The demand outlook appears to be relatively more bearish in Europe than Asia

South Korea has also seen weaker imports. Over the year the country has temporarily shut down several coal power plants in order to try to lower pollution levels, and similar action will be taken over this winter with the government idling a number of plants. This suggests the outlook for coal demand from the country will remain fairly week as we move through 2020.

China, however, has performed fairly well with imports, with volumes over the first ten months of the year increasing almost 8% year on year. China is key for the seaborne market, and what makes it more challenging is the uncertainty around government policy. In recent years the government has intervened to try to stabilise the domestic market. This could have a dramatic impact on the seaborne market should the government feel the need to take action again in 2020. Domestic coal prices are trading down at levels last seen in 2016 and, if there is further weakness, the government could look at the possibility of restricting imports to try to support the domestic coal industry.

Given that the demand outlook appears to be relatively more bearish in Europe than Asia, we would expect to continue seeing Newcastle coal trading at a healthy premium to API2. However, the key risk to this view is if China does clamp down on imports over the course of 2020.

Dutch spark & dark spreads (EUR/MWh)

Supply to edge lower

Turning to supply, and the low price environment has had an impact. Colombia has seen a downturn in flows, with Europe largely responsible. This, in theory, should mean we see increased flows of Colombian coal into Asia; however, the lack of its competitiveness means that exports have only slowed.

For Indonesia, the country has repeatedly produced above production caps. However, the current low price environment should weigh on output in the future. Additionally, domestic demand growth should also eat into the country’s exportable surplus in the long run.

To Australia, where export flows have performed strongly, reaching record levels. They're only set to increase given expansion and the ramping up of new capacity. The longer-term outlook for Australian supply is less uncertain. Despite the high price environment seen in the coal market over 2018, exploration expenditure is still struggling to reach the levels seen back in 2011. This does highlight the general attitude towards coal that with an uncertain demand outlook, miners appear reluctant to invest significantly in new projects while obtaining financing from banks is likely to be another key issue.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 December 2019

ING’s 2020 Commodities Outlook This bundle contains 11 Articles