CNY: Hints of a PBoC change in FX policy priorities?

A central bank official has today proposed that China should let the yuan appreciate to offset the rising costs of commodity imports. Does that herald a shift in policy from the People's Bank of China? If so, we read that as broadly bearish for the dollar

A policy recommendation

Writing in China Finance, the PBoC’s Lu Jinzhong today suggested some policy responses to higher commodity prices, which have ‘aroused widespread concern from all walks of life’. One such policy suggestion is to ‘enhance exchange rate flexibility, appropriately appreciate the RMB and resist import effects’.

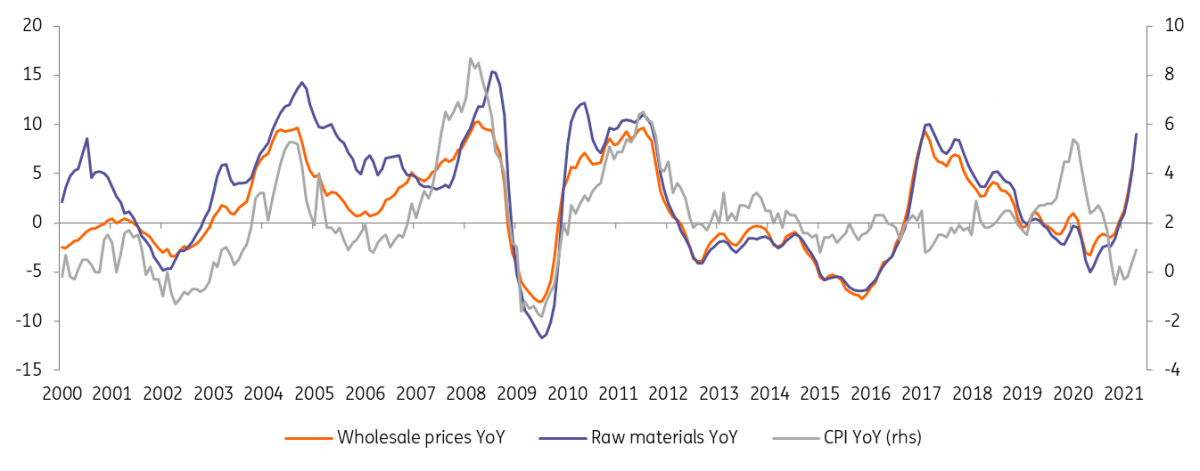

China has been struggling with the recent surge in commodities prices. As prices soar for everything from steel and raw materials to copper, alarm bells are ringing on imported inflation pressure. High prices have started to bite into downstream margins and have led to some small businesses cutting down operations, as they cannot pass on the costs of inflation.

Beijing has come up with several measures to cool commodity prices, including ratcheting up trading restrictions and increasing margins for iron ore trading from the Dalian Commodity Exchange (DCE). It has also introduced several measures to induce more supply, such as removing the import VAT tax on raw materials and the export tax on some steel products. Earlier, the State Reserve Bureau was said to release some aluminium stocks; all aimed at increasing market supply.

Chinese wholesale prices take off (% YoY)

Would the PBoC change FX policy?

It is early days, but here is Iris Pang’s opinion on the matter:

“Regarding the PBoC comment to let the yuan rise to offset higher commodity import prices, my opinion is that it is possible for the PBoC to let the yuan move by itself in reaction to those PBoC comments. The market could push the yuan higher against the dollar, in effect, the market will be fulfilling the PBoC’s desire for a stronger yuan.

But I wonder how much yuan strength, in terms of percentage gains against the dollar, can offset the high percentage increase in commodity import prices. The impact should be minimal. The Chinese government needs multiple tools to limit the increase in production costs brought about by higher commodity prices, which is partly due to expected US infrastructure projects.

My view is that it will be very hard for USD/CNY to reach 6.10. Our existing forecast is 6.30 by year-end. The main risk of such a strong yuan is that it hurts exports, and as such, it hurts exporters and therefore producers in the same way as high commodity prices. Exports are still very important to China as the western world recovers from Covid.”

How will the FX market react?

If this is a trial balloon floated by the PBoC, then we should all be watching USD/CNY and the offshore USD/CNH a little more closely. While the PBoC does have a formal policy of enhancing exchange rate flexibility, the market still believes the CNY is one of the more ‘controlled’ currency pairs – with the PBoC quick to re-institute administrative controls, especially when the CNY is under pressure.

Let’s see whether USD/CNY can break under the 6.40/41 area over coming weeks (we do in general like a soft dollar environment this summer) and in general, broad trends in USD/Asia – particularly in USD/CNY – do tend to support the overall USD trend. Such a move could encourage portfolio flows back into Asian equities – albeit warily watching developments in the semiconductor sector – and even encourage flows into the Japanese yen as investors consider rotating into Japanese equities.

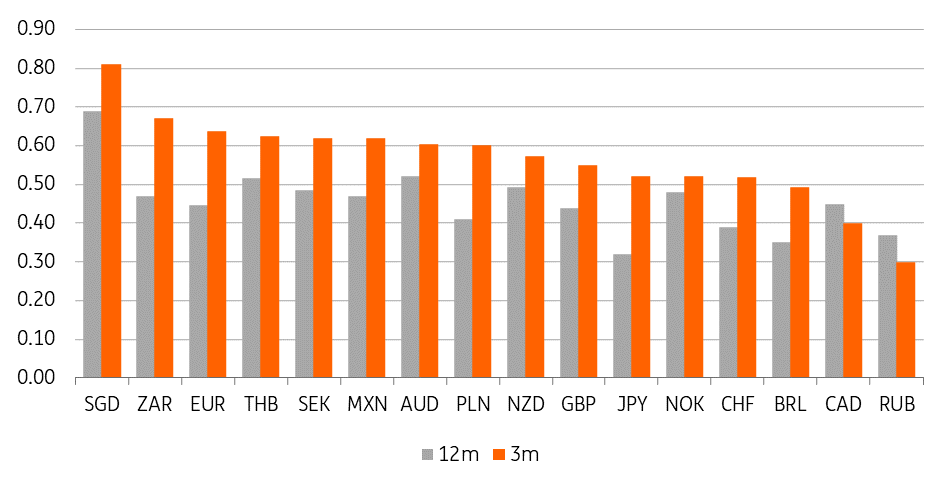

In terms of correlations with the CNY/CNH move, our chart below shows the highest correlations with the Singapore dollar – which is because the Monetary of Singapore formally manages the SGD against a basket of currencies in which the CNY will have a large weight. The South African rand also pays quite a lot of attention to the path of USD/CNH.

It is also interesting to see the high correlation between the EUR and CNH. Yes, you may say that the PBoC is also managing the CNY against a basket of trading partners where the EUR has a large weight. But if we do see an independent move lower in USD/CNH as the market does the PBoC’s bidding of delivering a stronger currency to fight import prices – stable correlations suggest EUR/USD would be rallying at the same time. Such a move would support our end year EUR/USD forecast of 1.28.

The European Central Bank might also be a little more tolerant of EUR/USD strength in such a situation since the trade-weighted (TWI) EUR would not be moving as much. This is because the high weight of China (17%) in the ECB’s TWI EUR would limit the EUR TWI’s advance.

Daily correlations between G10 and EM FX currencies with the CNH

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 May 2021

Good MornING Asia - 25 May 2021 This bundle contains 3 Articles