Wheat tightness to ease

CBOT wheat has traded to the highest levels since 2012 as expectations for 2021/22 global ending stocks have been consistently lowered through the year. However, supply should improve going into the next season which should see prices edge lower from current levels

2021/22 sees a tightening in the wheat balance

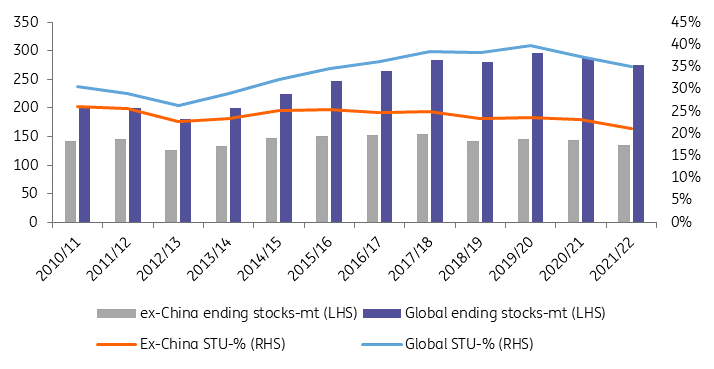

Ending stocks in the current 2021/22 marketing year are set to decline for the second consecutive season. The United States Department of Agriculture currently estimates that stocks will end the current marketing year at 275.8mt, which would be the lowest level since 2016/17 and would be a decline of close to 20mt from the record levels of 2019/20. The numbers look even more constructive when you take into consideration consumption growth over the years. The stocks-to-use (STU) ratio for 2021/22 is estimated at 35%, which is the lowest since 2015/16.

Expectations for supply have fallen over the marketing year, with global output for 2021/22 forecast at a little more than 775mt compared to a forecast earlier in the year of almost 789mt. This has been driven by poorer harvests from Russia, Canada and the US. Global supply in 2021/22 is estimated to be up only 0.1% YoY, whilst global consumption is estimated to grow by 1.4% YoY to a little more than 785mt

Looking at the ex-China balance suggests an even tighter market. The STU ratio excluding China is estimated to stand at just 21% at the end of 2021/22, which would be the lowest level in at least a decade.

It is this tighter than initially expected market which has helped push prices to multi-year highs.

Global wheat ending stocks

2022/23 supply prospects look better

The higher price environment seen this year should provide plenty of incentives for farmers to increase plantings for 2022/23. That and an improvement in yields in some regions mean we expect global wheat output will grow over 2022/23, which should see prices trending lower over the course of next year.

In the United States, USDA estimates that total US wheat plantings will increase by almost 5% YoY, to total 49m acres in 2022/23. If seen, this would be the largest area allocated to wheat since 2016/17, when a little over 50m acres of wheat were planted. In addition, one would expect to see a recovery in yields next season, following the dismal performance of spring wheat this year. Assuming yields are in-line with the 5-year average we could see a wheat harvest almost 380m bushels (10.3mt) larger than 2021/22 and exceeds 2b bushels for the first time since 2016/17. A crop of this magnitude would also see US ending stocks in 2022/23 edging higher once again.

For the European Union, the area for total wheat is expected to remain largely unchanged YoY. Conditions for winter crops have been mostly favourable for planting, emergence and development. The EU is estimated to have produced 137.9mt of wheat in the current marketing year. If we assume little changes and that yields (which have been above average this year) revert to more normal levels, we could see a crop of around 132mt in 2022/23

Russia is also expected to see planted area largely unchanged from last year. There is some risk that it comes in slightly lower due to low soil moisture during the planting period. However, assuming unchanged area along with a recovery in yields, we think Russian wheat output could increase from an estimated 74.5mt this season to somewhere in the region of 78-79mt in 2022/23.

Ukraine is set to see an increase in area for its 2022 winter wheat crop. Farmers are expected to plant 6.68m hectares of winter wheat, which would be up from around 6.1m hectares last year. Despite an increase in area, without a repeat performance of the excellent yields seen this year, output from Ukraine in 2022/23 will likely fall YoY. Assuming yields are in line with the 5-year average, Ukraine could see a wheat harvest of more than 31mt, down from an estimated record crop of 33mt this season. While lower YoY, it would still be the second-largest wheat harvest from Ukraine.

Canada, which has had a poor crop this season due to drought, should see somewhat of a recovery. Persistent dry weather means we are unlikely to see a full recovery. Planted area is expected to increase in the region of 8% YoY, while a partial recovery in yields could see output increase from around 21mt in 2021/22 to somewhere in the region of 25-26mt in 2022/23. However, this is still some distance below the 35mt harvested in 2020/21.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

10 December 2021

ING commodities outlook 2022: Keeping the faith This bundle contains 11 Articles