Chinese purchases of US soybeans pick up

Given the deteriorating relationship between the US and China, one would think this would result in reduced Chinese interest in US soybeans. However China has been fairly active in buying US soybeans in recent months, although flows so far this year are still well below pre-trade war levels

Strong Chinese demand

While Chinese demand took a hit earlier in the year, during the peak of the country’s Covid-19 outbreak, we have seen a substantial recovery in demand in more recent months. In fact, June saw China import a record 11.16mt of soybeans, whilst for July, import volumes totalled 10.09mt. This leaves cumulative imports over the first seven months of the year at a record 55.14mt, up almost 18% year-on-year, and even surpassing imported volumes prior to the US/China trade war.

While crush margins in China have come off from their recent highs seen in July, they are still well in positive territory, and so demand should remain fairly robust for now.

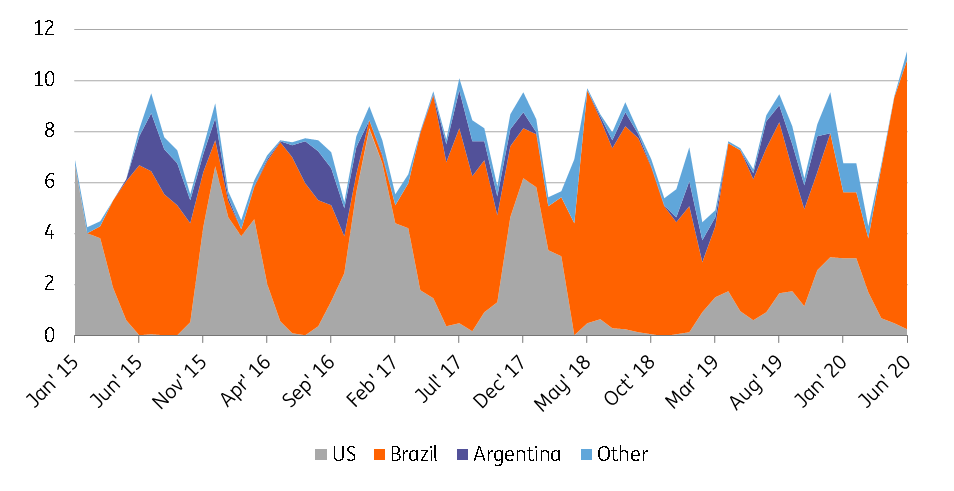

Obviously, with US volumes to China still well below pre-trade war levels, this has left Brazil benefiting from stronger demand. However, as we transition from the seasonal peak in Brazilian supply to US supply, we should see more Chinese interest in US soybeans, something that recent US export sales data shows. Clearly though, there is plenty of risk around this if we were to see a further strain in the US/China relationship, which leads to the removal of tariff exemptions on US soybeans.

The trend in Chinese soybean imports is very clear, and not surprising, given developments between China and the US over recent years. Brazil has made up 72% of total China imports so far this year, while the US accounts for just 21% of imports. This is much improved from the 15% seen over the same period last year, but it is still well off from the 43% share seen prior to the trade war.

China monthly soybean imports by origin (m tonnes)

Brazil’s record crop… yet again

Brazil is set to deliver a record soybean harvest in 2019/20, with the country estimated to have produced 120.9mt of soybeans, up 5.1% YoY according to CONAB, and surpassing the previous record of a little over 119mt in 2017/18. The stronger crop has been driven by a combination of area, which has grown 3% YoY, whilst yields are estimated to have increased by 2.1% YoY. Expectations for 2020/21 are that the country will see yet another record crop, with the USDA estimating that production will reach 130mt, with attractive prices in Brazilian real terms leading to increased acreage.

Exports from the country have grown substantially, increasing 43% YoY over the first seven months of the year to total 73.3mt. Obviously stronger demand from China has been supportive, whilst the weakness seen in the BRL over much of the year has made Brazilian soybeans attractive.

More recently though, cash values for Brazilian soybeans have strengthened significantly, making them less competitive. Strong exports earlier in the season, along with entering the low period of Brazilian supply, has been supportive for Brazilian cash values. Clearly, if we were to see a further deterioration in relations between the US and China that would likely provide more upside to Brazilian values.

What about US supply?

The US is set to see quite the recovery in soybean output in the 2020/21 marketing year, following the impact from heavy rains and flooding during the planting season last year. The USDA estimates that output over the season will total 120.4mt, up almost 25% YoY. Despite this stronger crop, ending stocks in the US are estimated to be largely unchanged YoY, due to a pick-up in domestic crushing, but more importantly stronger exports, on the expectation of larger flows to China in 2020/21, with the phase one trade deal.

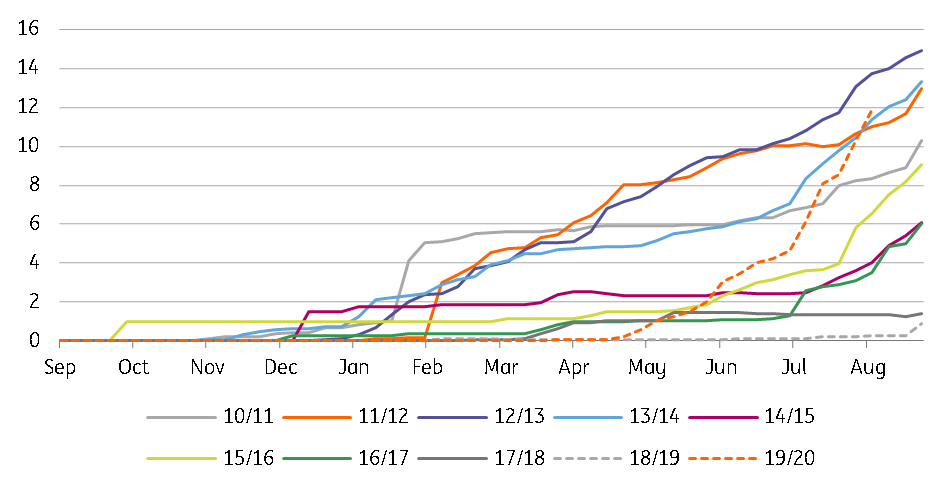

So far in the 2019/20 US marketing year, US export sales to China stand at 14.56mt, up 24% YoY. This, however, is still well below the 27.6mt of export sales in the 2017/18 season, and even further away from the more than 35mt sold in the 2016/17 season.

But given the recent rally in Brazilian cash values, this has made US soybeans more competitive into China, and so assuming that tariff exemptions remain in place for US soybeans, Chinese buyers should favour US soybeans.

US export sales data is aligned with this view. The latest data from the USDA shows that export sales for the next marketing year (starting on 1 September) stand at a little over 11.9mt already. This compares to just 260kt at the same stage last year, and the highest level of sales for new crop beans at this stage of the year since 2013, when 13.75mt of US soybeans had been sold to China for the following season.

US soybean export sales to China for next marketing year (m tonnes)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

21 August 2020

Good MornING Asia - 24 August 2020 This bundle contains 2 Articles