China’s overcapacity debate and how to avoid a collision course

Chinese companies are rapidly gaining market share in strategic industries amid increasing accusations of subsidy-induced overcapacity. But what does ‘overcapacity’ actually mean, how concerned should we be, and what might happen next?

The debate on overcapacity is heating up

Discussions about China’s overcapacity issue have been ongoing for many years. Most recently, various industries, such as those dealing with solar panels, wind turbines, steel, and cement, have started to debate the issue.

The discourse was reignited following US Treasury Secretary Janet Yellen’s visit to China in April, where she brought up concerns about industrial overcapacity, noting that China’s economy was too large to “export its way to rapid growth,” and called for shifting away from state-driven investment and returning to market-oriented reforms.

In our view, the overcapacity debate is not really about overcapacity in its most precise term, but rather what we call “problematic overcapacity”, when a country’s excess capacity begins to crowd out international competitors and affect industry development in other countries.

While overcapacity has affected various sectors at different periods of history, we will focus on the recent concerns which are primarily focused on the question of overcapacity in the green economy, in particular the new energy vehicles (NEV) sector where Chinese firms have quickly become among the world’s most competitive.

The crux of the issue on the overcapacity debate boils down to friction over two of China's economic transitions, with the first moving up the value-added ladder, and the second the green transition. There is a fear that China's state-led investment and support will increasingly be directed into strategic industries and cause market distortions and competitive imbalances. China’s attempt to move into the upper end of the value chain naturally rings alarm bells for those currently occupying this domain.

We expect it will be difficult to avoid friction given the rise of protectionism, heightened geopolitical friction, and the sheer scale of China’s economic transition. However, drawing upon Japan’s experience in the 1970s-80s, there is still room for some win-win solutions, such as increasing Chinese investment abroad.

In this report, we aim to explore key talking points of the most recent debate, the current state of China’s industrial capacity, and the potential ways forward.

'Problematic overcapacity' explained

It’s always useful to clarify what is being debated; when people are talking about overcapacity, what exactly are they talking about?

The textbook definition of overcapacity is usually along the lines of when production capacity is higher than expected sales. Discussions of overcapacity on a macro level are less clear-cut, which likely explains why some deny there is an overcapacity issue at all while others think it is a crisis.

The most straightforward definition is a sum of the parts calculation of the current utilisation rate, where when the rate drops significantly below average it could be deemed to be in overcapacity. However, we’ve also seen some use a definition of overcapacity as when domestic supply outweighs domestic demand, while others include future projections in the overcapacity definition.

In our view, it may be helpful to distil the debate down to a question of “problematic overcapacity”, which can be described as when exports of excess production start crowding out or significantly damage industry competitors globally. There is certainly a grey area on where this begins, but typically when a country’s production capacity is enough to cover a dominant share of (or in egregious cases, the entirety of) aggregate global demand, or when the producers engage in dumping, it could be deemed to be problematic overcapacity.

Anxiety over Chinese overcapacity likely stems from recent experiences within the solar industry, where industrial policy contributed to Chinese solar panel producers’ global leadership and solar panels becoming one of the “new three” exports, but also resulted in a price war which saw many firm failures and industry turmoil.

- China has achieved and retained dominance in the industry, accounting for 80% of global solar module production capacity in 2023, and now holds the most important role in global supply chains.

- From a global and industry level, solar panel prices have fallen drastically, helping many locations reach grid parity. As a result, solar power generation globally surged a massive 30-fold between 2010 and 2021 to more than one million gigawatt hours. Various downstream jobs have been created.

- The solar industry underwent rounds of consolidation amid heavy competition, and many companies (including Chinese and global competitors) faced bankruptcy or acquisition.

With the dust settling, was the solar industry case seen as a success or a failure? From China’s perspective, the answer would appear to be the former. Despite volatility along the way, after cutthroat competition leading to survival of the fittest, many of the global solar champions are Chinese. Competition has also helped bring the industry from a niche sector needing subsidies to a viable form of energy generation in many locations.

In the most recent debate, the overcapacity discussion is largely centred on another of the “new three” exports, namely the NEV sector. The rise of Chinese NEVs has rapidly turned China from a net importer of autos as recently as 2019 to the world’s largest auto exporter in 2023.

The rise of Chinese NEV manufacturers has been facilitated by a more advantageous backdrop compared to many global competitors. There is a significant amount of contention around the topic of subsidies and their impact, but overall the industry has benefited from a supportive policy environment and public infrastructure investment which facilitated NEV adoption, including building charging stations and scaling the market and supply chains. Many entrepreneurs have piled into the sector after signals of government support and after the success of some NEV sector early movers.

With China’s domestic auto sales and exports starting to slow, production continuing to grow rapidly, and prices starting to drop, some observers have watched with concern that the NEV sector could go down the same path as the solar panel industry.

Slowing NEV sales but rising production may fuel overcapacity fears

The key arguments

Since Yellen’s comments in April, we’ve seen a plethora of voices chime in with their opinions. Here are some of the key talking points from both sides:

“Chinese overcapacity is a problem”

- “Rising Chinese dominance of select industries will harm industry development and workers in other countries.”

- Given the scale of China’s manufacturing industry, excess capacity is not just a domestic but a global issue.

- Countries will want to protect their investments in strategic sectors and secure a share of the market.

- The industries currently in the spotlight (particularly the auto sector) are crucial to many economies, particularly in Europe.

- Overreliance on any country for strategic sectors carries an element of risk, with concerns about supply chain security and geopolitical factors.

- Oligopolistic risks rise if no intervention is taken, as survival of the fittest will crowd out smaller players.

- “China’s overcapacity is exporting deflation to the rest of the world.” This argument is that China’s excess capacity ends up being exported at lower prices than similar goods in other markets, which in theory causes a deflationary impact.

- “Industrial policy usage goes beyond historical norms.”

- There is an implicit tolerance of “normal” industrial policy use. For example, infant industry protection is often seen as a viable form of industrial policy; without intervention, many industries would have no chance of surviving.

- At an indeterminate point, behaviour turns from acceptable to anti-competitive. While it is a grey area, many accusations are that China has passed this threshold.

- Zombie firms contribute to overcapacity globally. Firms that should have failed under normal market competition are artificially kept alive via supportive policies and prevent correction of excess production.

- “Overcapacity is a symptom of poor resource allocation.” This argument is more domestic rather than trade-focused. Overcapacity pulls resources away from other areas where they may be more productive to a sector that does not need the extra investment. This is why China has discussed the overcapacity problem for the past two decades.

“Chinese overcapacity is not a problem”

- “The overcapacity critiques are inherently flawed.” Given the overarching nature of this response, we split some common arguments into several categories.

- Free market ideology indicates that countries with competitive advantages in specific areas should invest in them, and there is nothing wrong with producing and exporting more than domestic demand. As long as supply does not eclipse global NEV demand, overcapacity beyond domestic demand is not a problem.

- Industrial policy may lead to excess capacity, but subsidies are a net positive as they translate into lower prices for the end consumer. This mentality is more emblematic of the peak globalisation era where trade was a win-win prospect rather than a mercantilist competition.

- “Unfair competition criticisms are unmerited.” A common argument from China’s side is that its advantages in the NEV market are not due to subsidies, but due to economies of scale, innovation, as well as complete supply chain integration. Currently, other than a purchase tax waiver for NEVs (which has been adopted by other countries as well), there does not appear to be official NEV sector subsidies in place. Proponents of this argument often view tariffs as discriminatory measures with no merit.

- “Overcapacity exists, but global sustainability goals should outweigh the fight for market share and profits.”

- Less effort should be expended on fighting over who will profit from the green transition, and more effort made toward moving the world toward a more sustainable path.

- Adding tariffs on price-competitive green products undermines global sustainability efforts.

- Achieving climate goals provides a positive externality well beyond the benefits of securing a larger green economy market share.

- “Overcapacity is temporary and will self-correct.”

- Industrial policy may create overcapacity, but the problem will self-correct as market forces cause survival of the fittest.

- Excess capacity will eventually grow, especially amid ambitious carbon goals in China and globally.

China’s industrial capacity utilisation rate has been rangebound but trending lower

What the data tells us about overcapacity

An 80% capacity utilisation rate is sometimes described as an ideal level, with higher levels unsustainable and lower levels a waste of capacity. However, by this definition, the majority of economies are facing an overcapacity issue. In practice, this is more of an arbitrary and aspirational level rather than a firm level to target, but it is helpful in providing a point of reference.

China’s overall industrial capacity utilisation rate fell to 73.6% in the first quarter of 2024. Aside from the major shock from Covid lockdowns, capacity utilisation has mostly fluctuated between 73-78% over the past decade.

How does China’s capacity utilisation stack up internationally? Looking at the data, China’s capacity utilisation on a national level is somewhat toward the lower side, but still well above the lowest levels. The United States, for example, had a utilisation rate of 77.4% in the first quarter of 2024, Germany's was a healthy 81.3%, while South Korea's and Thailand's came in lower at 71.3% and 60.5% respectively. On a country level, China does not appear to be facing a significant overcapacity problem.

While this data should be taken with a grain of salt, as country-level capacity utilisation data is already somewhat shaky, and it is uncertain if methodology across countries is consistent, it provides a rough international comparison.

International comparison of industrial capacity utilisation rates in 1Q24

Industry level capacity utilisation paints a different picture

A deeper dive into the data shows significant variation by industry. Most categories were better off than the headline number, however there was quite a significant drag from non-metal minerals (62%), food (69%), and most importantly for global markets, the auto industry (65%).

After peaking at 80.5% in the fourth quarter of 2020, auto industry capacity utilisation has been volatile but trended lower in the last several years. Aside from the pandemic-impacted 1Q20, the 1Q24 level is the lowest level on record since the start of data publication. It stands to reason that given domestic demand growth is slowing, if further trade barriers are placed on China’s auto exports, this utilisation rate could tumble further.

The auto sector capacity utilisation rate is well below the average

Is China’s auto industry in “problematic overcapacity”?

Recall our earlier definition of problematic overcapacity; when exports of excess production start crowding out industry competitors globally. Does the data show Chinese automakers crowding out global competition?

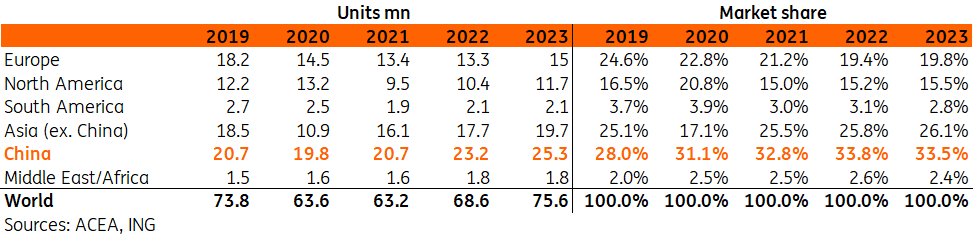

According to data from the European Automobile Manufacturers’ Association (ACEA), global auto production finally returned to above pre-pandemic levels in 2023, but there has been a shift in market share amid China’s rise in the NEV sector.

China’s auto production has grown around 22% in the last five years, and the market share has increased from 28% to 33.5%. At the same time, we’ve seen a modest decline in production in Europe and North America, though both appear to be in recovery the past two years. However, Asia ex-China, the Middle East and Africa saw production ramp up as well over this period, indicating that the rise of Chinese automakers is not causing a drop in auto production across the world.

Overall, while China has made fairly significant gains in market share, the data thus far does not seem to support the idea that China is crowding out global production.

China has gained market share but has not yet crowded out global production

The data available would appear to indicate that China has not yet had a major crowding-out effect on global competitors, but there is concern that it could only be a matter of time.

There have been some recent signs of China’s increase in production starting to create pressure on the overall market. As mentioned previously, auto production and exports continue to see rapid growth, while domestic auto sales growth has cooled somewhat. Auto sector capacity utilisation has fallen. At the end of the first quarter of 2024, around 34% of automobile enterprises were loss-making, above the long-term average of around 20%.

Price competition in the auto industry has started to drive domestic transaction prices downward, and the automobile subcategory of inflation has been in deflation since 2023. It is not unreasonable to expect that price competition will translate into cheaper exports as well, and that less competitive auto companies will likely come under greater pressure. At some point, industry consolidation is likely to occur.

Average transaction prices have been falling amid heightened competition

Friction could be difficult to avoid

The data available indicate that while China’s overall capacity utilisation rates look within a relatively normal range compared to global peers, there is a more significant issue in specific industries, including the closely watched automobile sector. We expect that we will eventually see a point of saturation at which time the industry will need to undergo some consolidation.

At risk of oversimplification, the debate in essence boils down to a case of friction amid conflicting interests as China utilises industrial policy in its efforts to move into strategically important high-value-added sectors. There would likely be few complaints about overcapacity if this excess production capacity only centred on low value-added areas of production such as agriculture or textiles.

The rise of trade protectionism, heightened geopolitical tensions, and the sheer scale of China’s manufacturing transition may make avoiding friction a difficult task.

China will likely continue to position itself to compete in strategically important sectors, and industrial policy will still be key to directing resources in the right direction.

- Déjà vu? History shows that countries directing industrial policy toward high-end production will face criticism and friction. The current discourse on China is reminiscent of Japan’s rise in 1970s-80s. During Japan’s ascent to the world’s second-largest economy, there was significant pushback against Japan’s electronics and auto exports. Examples of criticisms included exports taking jobs from other countries and targeting “domination of the world market”, a lack of access to domestic markets, and that competitiveness was due to “unfair trade practices” and “currency manipulation”. Responses included 100% tariffs on Japanese electronics and trade quotas on Japanese autos.

- There is ultimately little choice in the matter from China’s side: industrial policy to support strategic industry development is the only clear path forward. Even if there was somehow a willingness to stick to the status quo of the past few decades of being the world’s low-cost factory, rising education and wage levels will gradually reduce competitive advantages in these areas. Relying on market forces alone to drive industry development in the early stages is unlikely to achieve satisfactory results, and as industrial policy encourages investment in specific sectors, a natural result is a race to compete and eventual survival of the fittest followed by consolidation.

Other countries with ambitions to compete in the same industries will likely attempt to provide better conditions for their industries to compete, and geopolitical factors and supply chain security considerations may drive decision-making beyond purely economic factors.

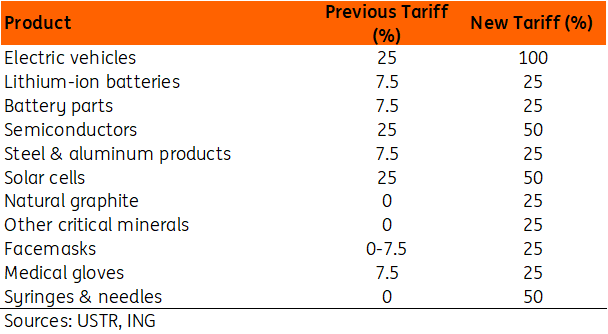

- Tariffs could help cut off Chinese products from their markets and give room for domestic players to grow. The most recent round of new US tariffs announced in May 2024 focused on pushing China’s NEV industry out of US markets.

- Non-tariff barriers such as trade restrictions, quotas, or sanctions could also come into play, though to varying extents these measures risk escalating tensions.

- Support for tariffs is not unanimous. Hiking tariffs could also have various negative effects which could outweigh the benefits. Automakers with significant exports to China could be harmed by a reciprocal tariff hike. Additionally, Chinese components remain a significant part of the EV supply chain, and tariffs on these components could set back industry development and the green transition as well.

US tariffs on various Chinese goods showed ramping up of protectionism

Are there any other ways forward?

There are a few potential proposed solutions to address the overcapacity issue.

In our view, the best win-win solution would be for Chinese firms to expand investments abroad and seek foreign partners for manufacturing activities, supply chain integration, and downstream services.

There is a good historical precedent for this: in the 1980s, the Japanese auto industry managed to alleviate trade friction with the US by investing heavily in the US industry. According to a Japan Automobile Manufacturers Association report, Japanese automakers invested more than US $61.6bn in US auto manufacturing between the 1980s and 2023.

This solution would allow Chinese firms to shift some production capacity abroad, and foreign partners would see various benefits from Chinese investment including job creation, knowledge and technology transfer, and infrastructure development. This could also help strengthen ties after years of elevated tensions. However, there is a question of how much countries would welcome such investments, and unfortunately, the issue may end up driven more by political rather than economic factors.

We have already seen some action taken in this direction, with Chinese firms ramping up investment in select Central and Eastern European countries such as Hungary and Serbia. These countries may be more receptive to and benefit more from Chinese investment compared to Western European countries with more mature existing auto industries already established.

Simply ramping up investment may not be a simple task. Japan’s 1980s investments may have been more welcome in an era of globalisation and due to political alliances, but an environment with higher levels of protectionism, concerns about national security, and geopolitical friction may add to resistance toward Chinese investment in the US and Europe.

Other proposed solutions are less realistic, less effective, too long-term, or too vague in our view. For example, there are calls for China to unilaterally reduce its capacity through facilitating industry consolidation via mergers and acquisitions or implementing a supply cap on certain production. Other calls are for China to increase domestic demand to absorb the excess supply; measures for boosting demand are already in place. Finally, there are often calls to further implement market and state-owned enterprise reforms, which are all important long-term goals but likely will move too slow to affect the current debate.

Expanding Chinese outward direct investment could be a win-win outcome but may face political resistance

If the key global green economy players fail to avoid a collision course, both sides will bear costs and other sectors could also get caught in the crossfire, while progress toward global climate goals could also be affected. The best realistic path forward may be to find areas for cooperation where possible, while protecting domestic industries where necessary.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Trade Wars Tariffs Overcapacity Emerging markets China Capacity utilisation Automotive Asia Pacific AsiaDownload

Download article