China’s 2Q GDP slowed by more than expected in new challenge to achieving growth target

China’s 2Q GDP growth slowed by more than expected to 4.7% year-on-year as weak consumption and property continued to be a drag on growth. More policy support will be needed in order to achieve this year’s 5% growth target

| 4.7% |

China's 2Q GDP |

| Lower than expected | |

China's GDP slowed by more than expected in the second quarter

China’s 2Q24 GDP growth fell to 4.7% YoY, coming in noticeably softer than forecasts for 5.1% YoY. This brought the year-to-date GDP growth down to 5.0% YoY for the first half of the year, which keeps China still on pace to achieve its 5% GDP growth target for now.

Through 1H24, the secondary industry has been the primary driver of growth, up 5.8% YoY, as manufacturing has largely outperformed expectations in the year to date amid the strength of the EV sector and a pivot toward hi-tech manufacturing and technological self-sufficiency. The tertiary industry growth slowed to 4.6% YoY from 5.8% YoY in 2023, as weak consumption momentum impacted services demand.

The two big drags on GDP growth continued to be the property sector and consumption.

The drag from the property market should come as no surprise. Property investment slumped -10.1% YoY through 1H24, and today’s price data showed the price decline continuing in June. A silver lining was that more cities saw price increases, and we saw some stabilisation in some key tier 1 and 2 cities. Stabilising home prices should be the top priority in order to support confidence, and if policy support continues to roll out we could see some positive signs in the coming months. Nonetheless, the actual drag on GDP growth will likely persist for an extended period of time, as even if prices bottom out, there is still a high level of inventories that need to be digested before new investment takes place.

We've discussed the slowdown of consumption many times in the focus on shifting growth drivers for China in 2024. After accounting for an 82% share of growth in 2023, the 2% YoY growth in retail sales was the weakest level since exiting pandemic restrictions, and showed weak consumer confidence remaining a major headwind to the economic recovery. A negative wealth effect from falling property and stock prices, as well as low wage growth amid various industries’ cost cutting is dragging consumption and causing a pivot from big-ticket purchases toward a basic “eat drink and play” theme consumption.

Another point to note was that amid the very gradual incline of inflation in the second quarter, we consequently saw a significantly less supportive GDP deflator in 2Q24 of -0.7% compared to -1.1% in 1Q24. This added 0.4 percentage points less to real GDP growth and may have contributed as well to the softer-than-expected read.

Despite GDP growth remaining on pace to achieve the 5% growth target for now, there will be less supportive base effects in 2H24, making the road to 5% challenging. We will likely need to see further policy support in the coming months if this goal is to be reached.

Property prices continued to slide but there are signs that support measures are taking effect

China's 70-city property prices continued to see sequential declines in June, with new home prices down -0.67% month-on-month, and used home prices down -0.85%. The continued price decline is discouraging at first glance but there are a few silver linings in the data.

First, the declines were smaller than May's -0.71% MoM and -1.00% MoM, respectively. While these declines are still on the steeper side relative to what the market may have hoped for, it is at least a relief that the rate of decline did not accelerate further.

Second, and more importantly, more cities saw price increases, and we saw some stabilisation in some key tier 1 and 2 cities. Beijing (0.2% MoM), Shanghai (0.5%), Nanjing (0.1%), and Hangzhou (0.3%) saw small used home price gains in June. This is a very important signal; price stabilisation will likely occur first from the large cities, which benefit from more real demand.

Of the 70-city sample, four cities saw price increases in new home prices in June and two saw no change in prices, versus just two cities seeing price gains in May. The secondary market also strengthened, with four cities seeing price increases in used home prices in June, compared to all 70 cities seeing declines in May.

The stabilisation at the core shows that the property support measures are starting to take effect. We expect more supportive policies to continue to roll out in the coming months, as stabilising the property market is a key step to restoring confidence.

More cities saw property price increases in June

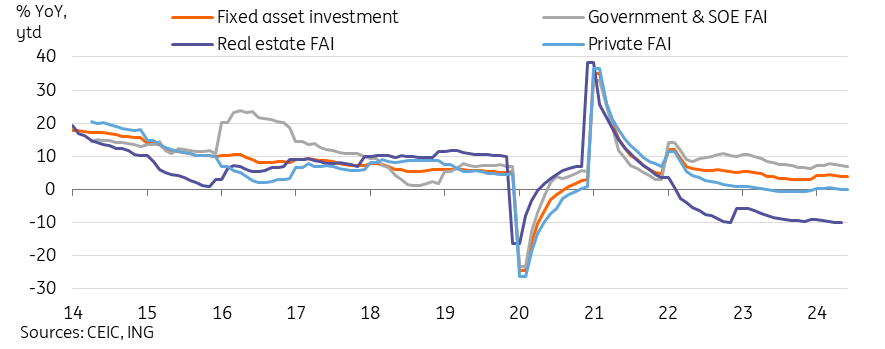

Investment remained lacklustre as property and private investment offset government investment

Fixed asset investment (FAI) slowed to 3.9% YoY ytd through the end of 1H24, which was in line with expectations.

We continued to see state-led investment account for the lion's share of growth, up 6.8% YoY ytd. However, continued weakness in private sector investment, up just 0.1% YoY ytd in 1H24, weighed on overall investment levels. Private sector confidence has remained very downbeat, and elevated real interest rate levels are also dragging appetite for new investment. Foreign enterprise investment also saw a sharp contraction of -15.8% YoY ytd.

Given the price action, real estate investment unsurprisingly also continued to drag overall investment levels, with a steep contraction of -10.1% YoY ytd in 1H24. New home starts fell by -22.6% YoY ytd, and activity is likely to remain depressed for some time as prices have yet to establish a trough.

On the brighter side, manufacturing (9.5% YoY ytd) FAI continued to see solid growth, with fast growth in the railway, shipbuilding, and aerospace (28.2%) as well as food (27.0%) manufacturing industries. Infrastructure investment growth continued to outpace the headline at 5.4% YoY, but has been softer than we expected in the first half of the year.

In order to achieve the growth target, we expect that investment may need to be ramped up in the second half of the year. We expect part of the proceeds of this year's RMB1tn of ultra long-term bonds to be directed toward strategic investments.

Private sector and real estate investment have dragged FAI despite government efforts

Consumption continued to disappoint as households tightened their purse strings

Retail sales growth hit a new post-pandemic low of 2.0% YoY in June, bringing the full year growth down to 3.7%.

Consumer confidence has remained downbeat, translating to weak consumption activity in many discretionary consumption categories. In June, the biggest drags on retail sales included the auto (-6.2% YoY), household appliances (-7.6%), and cosmetics (-14.6%) subcategories. Thus far, it does not look like the trade-in policies have had much of an effect in stabilising auto and household appliance sales yet.

We continued to see most of the "eat, drink, and play" theme outperform this year, as these categories are the last to decline during periods of difficulty. In June, catering (5.4%), tobacco & alcohol (5.2%) grew at more than double the headline rate. However, the sports & recreation category (-1.5%) unexpectedly dropped into contraction in June after leading growth in the year to date. While it appears likely to be a blip for now, especially given the resilience of spending in leisure and tourism, it is worth monitoring to see if the "eat, drink, and play" theme sees consumers may be cutting back on the "play" component amid weak sentiment.

"Eat drink and play" has been the lone source of strength for the Chinese consumer this year

Industrial production moderated in June but continued to be the main driver for growth

Industrial production growth slowed to 5.3% YoY from 5.6% YoY in June, which was largely in line with our forecasts and stronger than market expectations. Through the first half of the year, industrial production has grown at 6.0% YoY ytd, outpacing the other key economic activity data.

We continued to see strong growth in hi-tech manufacturing (8.8% YoY) and computer & electronic equipment manufacturing (11.3% YoY), which should remain a major area for growth as China prioritises its transition toward higher end manufacturing and establishing technological self-sufficiency.

However, auto production has begun to slow, falling to 6.8% YoY in June, bringing the 1H24 ytd growth to 9.8% YoY. As tariffs take effect and as some smaller producers may be reducing production amid intense price competition, auto production growth could remain weak in the second half of the year.

Export demand has supported industrial production in the first half of the year, but this factor could begin to weaken in the second half of the year if global growth moderates, and if tariffs come into effect.

Industrial production remained the lone bright spot in the key activity data

PBOC held rates unchanged in July as expected but we expect easing in coming months

Despite another month of largely softer-than-expected data, the People's Bank of China (PBOC) held its 1-year medium-term lending facility rate unchanged at 2.5%, which was in line with market expectations.

The PBOC has thus far held back from rate cuts due to the priority placed on currency stability this year. Similar to many other central banks, the PBOC may be waiting on the Fed to start its rate cut cycle before easing in order to avoid widening its yield spread and adding to depreciation pressure on the RMB. Our view is that soft data in the past few months is adding pressure for the PBOC to ease. The coming months' data will be important to see if the PBOC can indeed afford to wait until the Fed's move.

Assuming the Fed's rate cut schedule proceeds along our ING baseline scenario for three cuts in 2024, and that the current trend for the Chinese economy contiinues, we see the PBOC cutting rates 1-2 times before year-end as well.

Today's data releases showed that the road to 5% growth remains difficult, and more fiscal and monetary policy support will be needed in the second half of the year if this year's key growth target is to be achieved.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article