China: Why the central bank won’t cut reserve requirements

China's central bank is supporting the onshore bond market by expanding collateral for the medium-term lending facility (MLF). This will reduce contagion risks though standalone default cases could continue. Still, we think it's unlikely the central bank will cut its reserve requirements ratio (RRR) for banks in June. Here's why

Central bank expands collateral of medium-term lending facility

Since 1 June, the central bank (PBoC) has expanded the collateral of its medium-term lending facility (MLF), which is a lending facility for banks.

MLF collateral expands to:

- AA-rated bonds issued by financial institutions for small and micro enterprises, green financing and agricultural financing.

- AA+, AA-rated corporate bonds (priority to accept bonds involving small and micro enterprises, green economy).

- High-quality micro-enterprise loans and green loans.

Before this expansion, the central bank only accepted sovereign bonds, central bank notes, China Development Bank and other policy bank bonds, local government bonds and AAA corporate bonds as collaterals for MLF. The interest rate on MLF is now at 3.3%.

Limiting contagion risks

By doing so, China's central bank is comforting the onshore bond market.

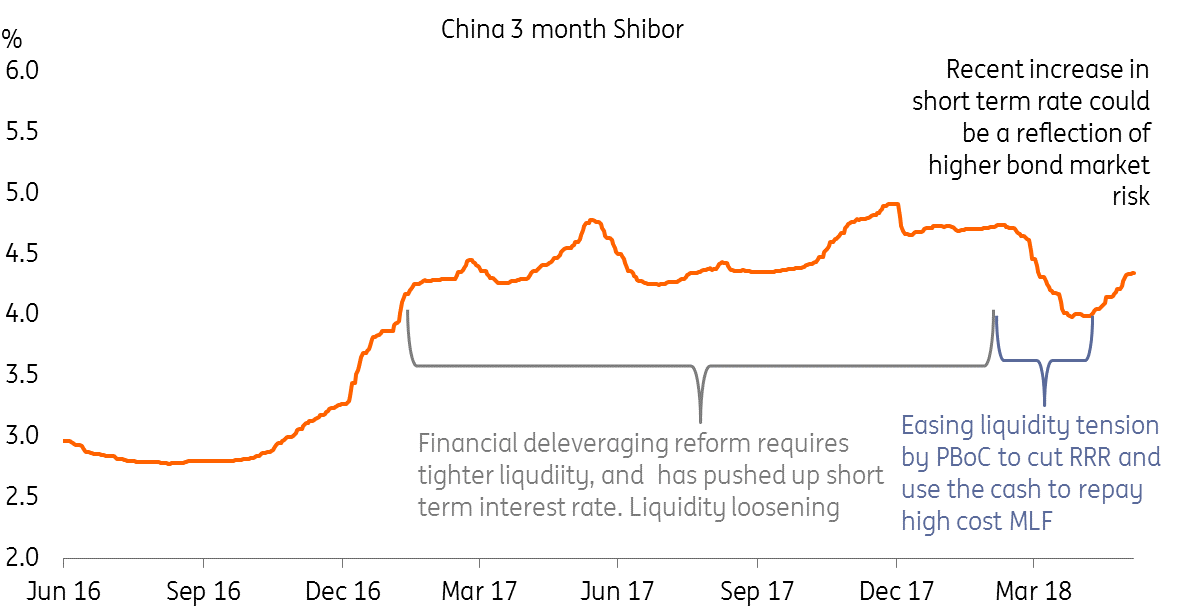

In the past, bonds issued in China were rolled over without any issue. However, as the central bank tightens liquidity to accomplish financial deleveraging reform, maturing bonds have become increasingly difficult to roll over, especially for companies that have weak financial backgrounds.

Collateral expansion for MLF would reduce contagion risks and calm the market, however, we still expect standalone default cases, especially for companies with weak financials as financial deleveraging reform continues.

As of 1 June 2018, some 22 bonds had defaulted involving seven issuers, totalling CNY20.2 billion according to Securities Daily. Though the number of issuers and default amount look small, default risk is rising in the onshore bond market.

According to ChinaBond, on 1 June, the three-year yield spread between AAA-rated and AA-rated credits widened to 76 basis points, much higher than around 30 basis points at the beginning of the year.

Collateral expansion for MLF would reduce contagion risks and calm the market, however, we still expect standalone default cases, especially for companies with weak financials as financial deleveraging reform continues.

Short rate reflects tightness of liquidity

Market expects PBoC to cut RRR and let banks repay MLF in June

For the whole of June, there are CNY920 billion of reverse repos and CNY259.5 billion MLF maturing, in addition, June marks the half-year point. It looks as though liquidity will be extra tight in June.

The market expects the central bank to cut its reserve requirements ratio (RRR) to replace the higher-cost MLF borrowed by banks, a repeat of April's monetary policy after MLF collateral expanded.

Here's why we don't agree with the market

We believe that it is unlikely for the central bank to repeat its April action in June.

- First, expanding MLF collateral implies that the central bank is going to extend more MLF to banks, and banks would get extra liquidity.

- Second, expanding MLF collateral should have an immediate impact on the bond market. It should be easier to roll over maturing bonds as there will be extra liquidity, and this should improve sentiment in the bond market. So there is no imminent need for the central bank to cut the RRR, which may send the wrong signal to the economy that the central bank's monetary policy favours easing over deleveraging.

- Third, expanding MLF collateral and at the same time cutting RRR to repay the MLF complicates the monetary transmission mechanism. Put simply, the actions would induce the market to put up lower-rated corporate bonds as collateral to borrow more from the central banks, and then repay higher-cost borrowing (at 3.3%) with low-return RRR money (at 1.62%). This would distort the efficiency of credit in the whole economy.

Our forecasts on monetary policy in June

We believe that a better way to smooth out seasonal liquidity tightness is to rely on daily open market operations with different tenors, so that liquidity would increase directly and would only be short term to cross the half-year end. At the same time, the market would get a consistent message that liquidity will remain tight as financial deleveraging continues.

As mentioned, expanding MLF collateral would probably induce more MLF lending. This should replace the maturing CNY259.5 billion MLF.

These two actions should be enough to smooth out liquidity tightness created by seasonality and negative bond market sentiment.

We also expect the central bank to follow the Federal Reserve in hiking rates in June to maintain the interest rate spread between China and US. But given that liquidity is already tight, PBoC's rate hike would be a modest five basis points.

A repeat of April's central bank action would be more likely in the second half, as officials need more time to see the impact of its MLF collateral expansion on bond market liquidity.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 June 2018

In case you missed it: Big week ahead This bundle contains 8 Articles