China: What’s happening and what to expect next

Reforms front-running the Politburo are making significant changes to the economy and the market

Reform mode

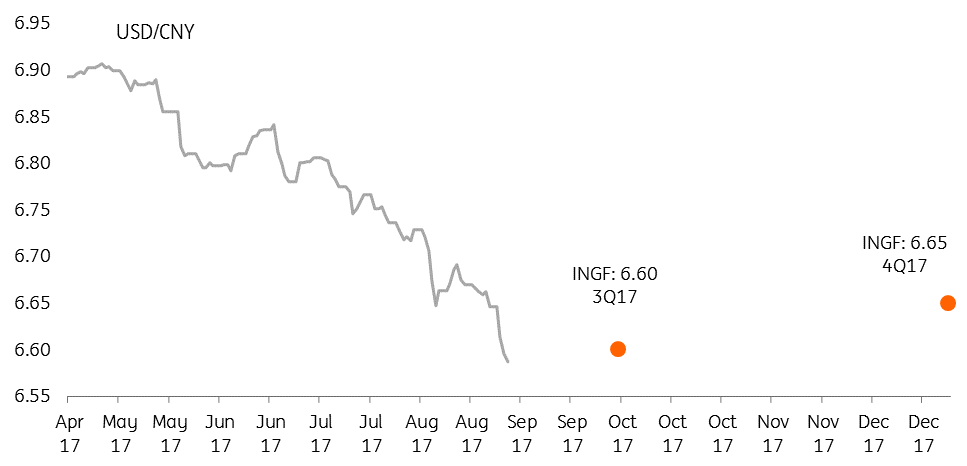

Economic activity in China continues to run well, so the authorities can keep their focus on deleveraging and other reforms. The market seems to be waiting for announcements from the Politburo, which is a meeting to re-arrange the top leaders in the Communist Party; that's expected later in the year. Of course, statements from these meetings are important. But reforms, which are equally important, are front-running the Politburo meetings. We believe that the government is setting the scene for the Politburo, given that the economy is already in “reform mode”. And this is already having a positive impact on the economy and markets. Apart from that, the stronger yuan continues to stem capital outflows. We expect the yuan will stabilize around 6.60 in September.

Retail sales, industrial production and asset investments movements

Retail sales, industrial production and fixed asset investments showed slightly lower growth in July compared to prior months, but growth rates were still encouraging. If housing policies continue to tighten, which we think they will, growth in fixed asset investment will slow further. But at the same time, potential home buyers, unable to buy flats, may instead use their cash to consume, which would keep retail sales rising. As the economy has kept growing at the targeted speed, the government is currently putting most of their focus on reforms.

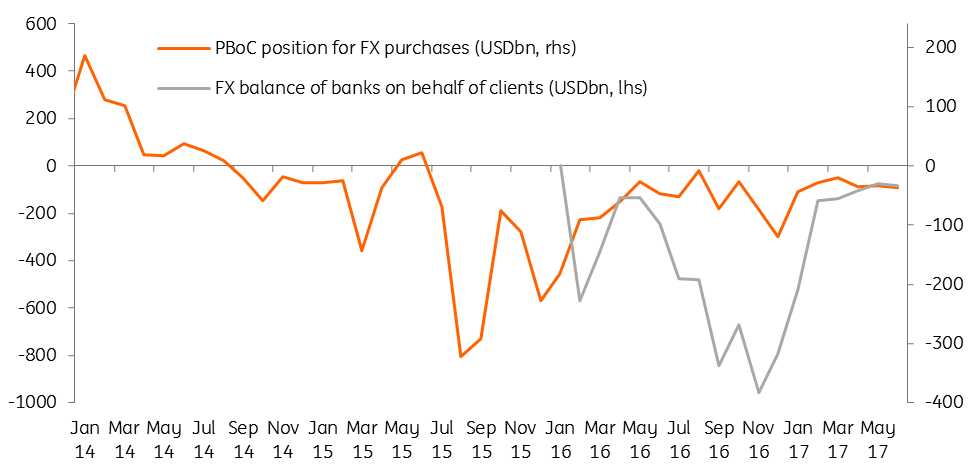

Outflows Subsiding

State Owned Enterprise reforms at centre stage

We saw two important reforms related to state owned enterprises (SOEs) in August. Namely, the first SOE bond haircut and secondly, merging two big SOEs into a giant.

The first SOE bond haircut is a very significant event for the onshore corporate bond market. The market will no longer perceive SOE bonds as similar to quasi-government bonds with an implicit government guarantee. Hedging needs will rise, and this, in turn, will help the CDS market to develop, which is good long term. But the short-term impact is higher volatility in the onshore bond market from a reshuffling of bond portfolios.

In short, the government keeps the very large SOEs, and lets the market decide if the smaller ones can survive.

Another SOE reform is the approval of the merging of two big SOEs into a giant in the electricity generation sector. We expect more similar SOE mergers in the future. Looking at this particular case, the new giant SOE will have greater bargaining power, especially when it invests offshore (eg, under the Belt & Road initiative). The cost of the merger is a less competitive environment, which usually pushes prices up. But electricity prices will probably not go up as these are price-controlled. That said, such benign price implications may not follow from upcoming mergers in other sectors. Another cost is that the bigger SOEs may enjoy even softer budget constraints, that is, even less efficient use of capital.

These two SOE reforms send a valuable message to the market. The government would like to reduce the number of SOEs and is more likely to keep the very large ones as they have strategic value for the country. For the small to medium size SOEs, their future depends on whether they emerge from a survival of the fittest contest in the market.

Yuan may weaken if political risks escalate

Policy tightening and a strong Yuan

As we expect the deleveraging process to continue, the central bank (PBoC) will keep liquidity tighter and therefore push up interbank rates gradually.

On the yuan, there has continued to be rapid appreciation. The yuan strengthened more than 2% in August. We believe there have been three forces behind this:

- First, the US dollar has been weak.

- Second, the PBoC has fixed the yuan stronger even when the DXY has increased.

- Third, exporters have started to convert yuan from their dollar receipts accumulated in 2016 when the dollar was strong.

We expect the second and third forces to remain in coming months. But the yuan could weaken if geopolitical risks escalate. All in all, we keep the current forecasts on USDCNY (6.60 in 3Q and 6.65 in 4Q), but will monitor closely. The strong yuan is not enough to guarantee regulations relaxing window guidance on outward remittances.

Even if capital outflows stop, we do not expect regulators to relax administrative measures on capital outflows for the rest of 2017. The central bank will be careful to prevent capital outflows returning. We expect that until capital inflows surpass outflows persistently, regulators will not consider relaxing window guidance on outward remittances.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).