China: What to expect in the upcoming Central Economic Work Conference

At the 13 December Politburo meeting, the Chinese government once again emphasised its six-stability policy. Together with the weakness in the economy reflected in November activity data, we believe that the upcoming Central Economic Work Conference will highlight the importance of stimulus to the economy at a time of trade tensions.

The economy is weak

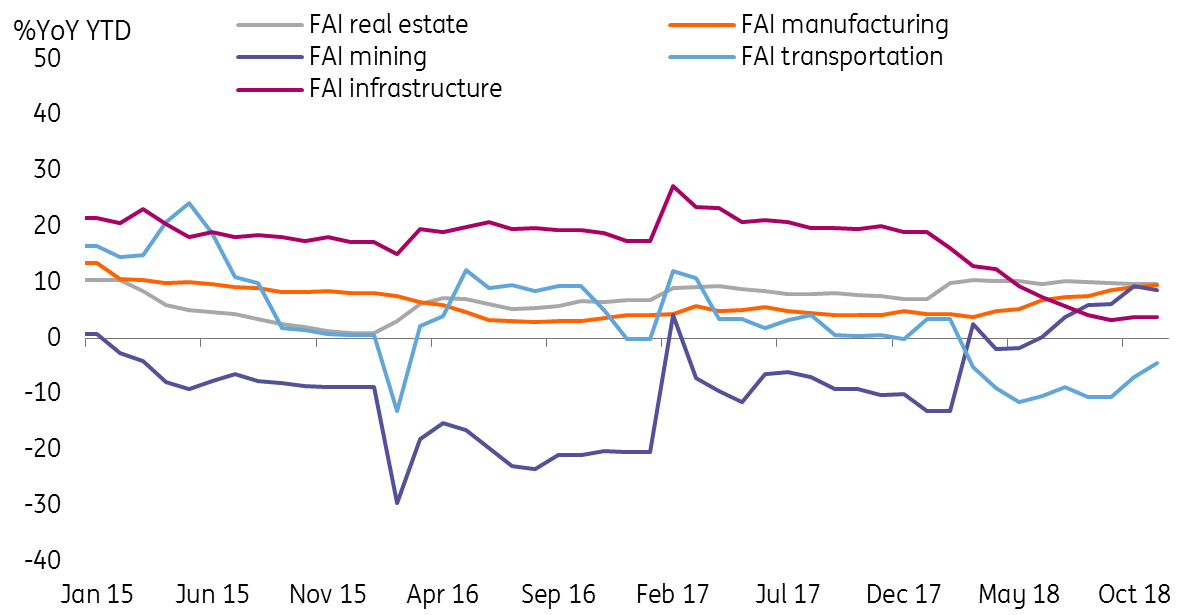

November activity data shows that the economy is weakening. Industrial production growth fell to 5.4% YoY from 5.9% in October. Retail sales only rose by 8.1% YoY, from 8.6% last month. The only positive note is on fixed asset investments, growing at 5.9% YoY from 5.7%, with growth up for a fourth month in a row.

The automobile sector was performed worst. Automobile manufacturing was the only sector that saw negative growth and this was even more negative in November (at -3.2% YoY, from -0.7% in October). Retail sales of automobile fell 10% YoY in November, worse than the 6.4% fall in October. The sector has suffered from competition from ride-sharing activities, which lowers demand for a second car.

The positives came from sectors related to construction. Retail sales of construction materials rose 9.8% YoY, from 8.5% the prior month. Fixed asset investments in property construction rose 16.8% YoY YTD in November, up from 16.3%. This will continue as the government quietly relaxes tightening measures on housing.

But surprisingly, infrastructure investment grew only by 3.7% YoY, flat vs the previous month. As local government infrastructure projects start construction activities infrastructure investment should grow faster. If the growth rate continues at a low-single-digit level then we may need to revise our GDP forecasts downward.

China investment is growing but slowly

The Politburo emphasisied stability to support economic growth

On 13 December, the Politburo met on the preparation of 2019 economic policy. The meeting emphasised its six-stability policy.

The six stabilities are:

- job stability

- financial stability

- external trade stability

- foreign investment stability

- investment stability

- expectation stability

This six-stability policy has been repeated frequently by the government recently. The background of this policy is to provide policy support during the current trade tensions. The re-emphasis of this policy indicates that the government expects these could continue into 2019, reinforcing the need for a pro-growth policy.

There are more signs from the Politburo meeting that the government prefers growth to reforms. For example, deleveraging reform has not been mentioned since October's Politburo meeting, and environmental protection was missing in November's meeting.

What to expect from the upcoming Central Economic Work Conference

Aside from the six-stability highlight, the government has to focus on defusing trade tension with the US. We expect that the government will need to put out a pro-growth plan as well as open up more markets for foreign investments during the Central Economic Work Conference which should be held in December.

We expect the following outcomes from the Central Economic Work Conference:

- Consolidation of Xi's thoughts, key to how the market works with the government.

- An emphasis on high-quality growth, promoting advanced technology. We expect only low profile pronouncements on technology so to avoid triggering any re-escalation of China-US tensions.

- A further opening up of markets to foreign access: measures could include reducing tariff rates on more goods and easing market access for foreigners.

- A proactive monetary policy that can support economic growth.

- A sizeable fiscal stimulus - we expect CNY 4 trillion per year in 2019 and 2020, with part of the money going to debt repayments. The amount is comparable in size to 2009 -2011. GDP has increased 2.3x between 2009 and 2018.

- Consolidate pro-growth measures for rural regions, so boosting domestic demand.

- Limiting risks in the asset market.

- An absence of further tightening policies in the housing market. This will allow some local governments to relax housing tightening measures and lowering mortgage interest rates.

- A softer tone on pollution prevention so that coal plants can keep running to support economic growth.

Market will gauge policy effectiveness from future data

Apart from the Central Economic Work Conference, the market will also be monitoring future data, especially PMIs, industrial profits, fixed asset investments, industrial production, retail sales, and home price data, to gauge the progress of the support provided by monetary policies and fiscal stimulus.

Even the government has an "investment stability" mandate the yuan market will react to data release, which could more volatile in 2019. We are still forecasting a 7.30 USD/CNY by end of 2019 based on our view on the progress of the 90 days trade truce, which will be unlikely to be able to unwind all existing tariffs aimed by the Chinese government, and delaying such actions could re-ignite tension between China and US.

In an unlikely scenario that China's agenda of unwinding all existing tariffs will be matched by US then we expect the trade war should end, and the yuan per dollar should regain momentum to 6.50 by end of 2019.

Download

Download article"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).