China: What do the targets set by the National People‘s Congress mean?

China Premier Li Keqiang’s government work report at the National People’s Congress tells us more about how China is going to move on after Covid-19, and how the economy is going to tackle the damage from international tensions. Here are our views

What does the report mean for China and international economies?

Below are what we consider to be the highlights of the government work report, listed in the sequence of importance for the Chinese economy.

A lot of emphasis on job stability

Stabilising jobs is the top priority of the government, setting a GDP target is not.

The report highlighted many times that jobs are important to the economy this year. By repeating this objective, it's clear how critical the job market situation is.

The target for the jobless rate is around 6%, which is optimistic as global demand is sinking. This is especially true for factory workers.

So how can the government achieve this target when the current jobless rate is already at 6%?

The work report provides some hints. Higher education institutions are going to increase capacity by two million students this year. This could absorb new graduates from high schools to continue their education and allow others to do post-graduate degrees, which will reduce the number of people looking for jobs. But this may not help young factory workers who have been recently laid off. These workers are usually in the low-income group, they need a job not only for themselves but also for their families living in rural areas.

Stabilising jobs is the top priority of the government, setting a GDP target is not.

Size of the fiscal stimulus

The amount of fiscal stimulus is uncertain but seems low compared to my estimate of between 6% and 8% of nominal GDP.

The work report stated a fiscal deficit of more than 3.6%, but it did not provide an upper limit. So it seems the government wants to be flexible on the stimulus amount.

Looking at the special government bond size of CNY3.75 trillion (+1.6 trillion from 2019) together with the special government bond of CNY 1 trillion, the stimulus is smaller than I had expected. However, the government can beef up the issuance of local government special bonds around August when the situation around the coronavirus becomes clearer. The government did increase this quota in June last year after the trade war escalated.

The report set a very strong tone on how the money should be spent.

- Fee and tax cuts, rental reduction, inducing consumption and investments.

- It cannot be used on the operation of local governments

- General government expenses have to be reduced

Lower interest rates and innovative lending programme to keep companies afloat

The report, by emphasising job stability, stated that banks should lend to companies to keep them afloat. We expect the PBoC to lower interest rates and provide innovative policies to lend to SMEs.

Advancing technology is the focus for long-term growth

The focus of growing technology is obvious and the report highlighted this as an important objective.

As we have mentioned, the New Infra scheme is now at the core of its long-term growth plan. Though this plan has been laid out by the government, it will be up to the private sector, i.e. the market to decide which areas will grow within the wide scope of technology.

To us, this signals that the technology war between China and the US has escalated. China is going to develop its own technological capacity so it won't be too dependent on the rest of the world.

The section on trade is vague

As usual, there is a section on trade. But apart from “implementing the Phase 1 deal with the US” and building regional trade mechanisms, the description of trade is quite vague.

This may signal that China realises the difficulties faced by exporters this year, as global demand is weak.

No growth target

No growth target has been set for 2020 and indeed, there was not a single word on GDP growth. This is what we expected.

Our view is that it is impossible to set a growth target at this uncertain time when the whole world has suffered from Covid-19 and global demand is very weak, which will have a serious impact on China's economic growth. The risks, however, are not all one way. If Covid-19 subsides quickly, and there is no second wave then global demand could recover faster than we expect and GDP growth in China could be better than our forecast of -1.5% for 2020.

There is another threat to China's growth, however, which is the technology war with other economies, especially the US. We believe this will hurt China's businesses even if Covid-19 subsides. Moreover, there is a chance of a second round in the trade war.

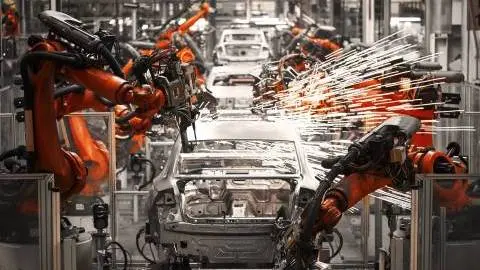

- So how can we gauge the performance of the government if there is no GDP growth target? We can gauge its performance by looking at industrial profits. The damage from Covid-19, the technology war and potential trade war are hurting the manufacturing sector more than the service sector in China. An improvement in industrial profits should be a barometer of how well the economy has managed these three risks.

The work report changes our forecasts on China

We keep our GDP growth forecast at -1.5% for 2020, with a stimulus size of 6% to 8% of GDP unchanged because we believe the government will increase the size of the local government special bond around August.

But we revise our forecast on USD/CNY to reflect a slower pace of strengthening in the rest of 2020. Previously, we forecast USD/CNY at 6.90 by the end of 2020. This seems to be too optimistic from our reading of the report. We now see USD/CNY at 7.050 by the end of 2020.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

22 May 2020

Good MornING Asia - 26 May 2020 This bundle contains 5 Articles