China: Very weak data is a wake-up call

China's fixed asset investments and industrial production were very weak in August while retail sales growth was moderate. Even Premier Li Keqiang has said that 6% GDP growth will be hard to achieve. As such, we are cutting our growth forecasts for this year and expect more stimulus to come

Very weak data diverges from our estimates

Frankly speaking, August's industrial production and fixed asset investment data was a wake-up call. Even with a large fiscal stimulus in infrastructure investment, it will be hard to overcome the damage from the loss of export orders due to the trade war and the structural weakness in global demand for smartphones and related products, both of which are highly weighted in the industrial production data.

The number of smartphones produced fell 10.7% year-on-year, which led to an overall drop of 6.2% YoY in electronic telecom devices. The production of cars fell 7.3% YoY. These products not only face headwinds from structural changes in their own markets but also from soft global demand.

Infrastructure investments are still the main pillar of growth

From fixed asset investments, we see that railway investment and mining supported most of the growth. Railway investment grew 11.0% YoY YTD while mining grew 26.2% YoY YTD.

However, again, these investments cannot help sectors that are directly hit by the trade war. Textile investment fell 5.0% YoY YTD.

China industrial production trends lower

China investments were only supported by infrastructure projects

Car sales continued to shrink

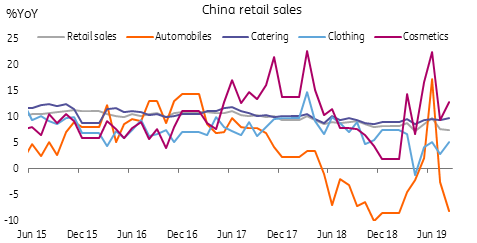

Retail sales growth was almost flat

Retail sales grew 7.2% YoY. We believe that this was supported by the stable job market. The surveyed jobless rate edged down from 5.3% to 5.2%.

Apart from automobiles, all items reported positive year-on-year growth. One reason for this is that food prices have been high due to swine flu.

We believe that some consumers will spend money at home, rather than take overseas trips, which will be supportive to domestic retail sales.

Our expectation on further fiscal stimulus and monetary policy

We expect more stimulus policies because:

- We believe that Premier Li was managing the market's expectations in saying 6% growth will be hard to achieve.

- The August data is very weak even with massive infrastructure investment support.

- We don't see an end to the trade war anytime soon, which will continue to hurt exporters.

- Even if there is continuous fiscal stimulus, the damage from the trade war will continue to be significant, and will hurt exporters further. So it is very hard to believe that there will be no further stimulus action from the government.

Fiscal stimulus policies will include infrastructure projects as well as projects on R&D to enhance China's self-reliance on its technological advancement. These two policies do not only provide investment growth to support GDP but will also stabilise the job market, which in turn stabilises retail sales.

Monetary policy action will include more cuts to the reserve requirement ratio in 4Q19 (0.5 percentage points to 1.5 percentage points), and interest rate cuts to the 7D reverse repo, which will then lower interest rates on the MLF (medium lending facility). This will pass through to a lower LPR (loan prime rate).

We still need to revise GDP growth downward

Due to the expected further damages from the trade and technology wars, we are revising our 2019 GDP growth forecast to 6.0%, and to 5.7% YoY and 5.8% YoY for 3Q19 and 4Q19, respectively. Our previous forecasts were 6.3% for 2019 and 6.1% YoY and 6.3% YoY in 3Q19 and 4Q19.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article