China: Stability guaranteed

Constitutional changes in China will allow President Xi Jinping to serve as president indefinitely. What does this mean for the economy?

Xi extends his tenure as the leader of the country

Although Xi’s (pictured) tenure will no longer be limited by the constitution, it will end at some point. Let’s assume that the arrangement would be similar to a Kingdom. Whether the Monarch eventually abdicates or passes away, the monarchy passes to someone else. The same arrangement is likely to apply to Xi, who is now 64. That means he could be the country’s leader for a long time yet.

Overall, this could be positive for the economy because economic policies are likely to be consistent.

This is positive for the economy because economic policies are likely to be consistent.

In contrast, democratic countries’ policies often get overturned at elections, and sometimes fail to achieve their goals. China does not have such hindrances. So Xi can set his policies with a long-term vision.

Xi has already initiated several important projects for the economy. These need time for the results to be seen.

- Firstly, the anti-corruption campaign.

- Secondly, the Belt and Road Initiative.

- And finally, to modernise society, that is, to have a society that is wealthy and high-tech.

With Xi likely to be in place for some time, there is a higher probability that these projects will conclude and achieve their results, and in turn, provide economic stability. To maximise the benefit of Xi’s longer tenure, he will also need his advisory team to be as stable as possible. That means he will engage people who share his thoughts (Xi’s new era thoughts), which will be added to the State Constitution after they have been added to the Party’s Charter.

Other countries could feel the heat of a stronger economy and leader

As the economy becomes stronger and more stable, other countries may begin to feel that the rise of China could provide opportunities as well as risks.

Japan and Australia have gestured that they would like to create another project similar to the Belt and Road initiative (BRI). This is perhaps because these two economies are left out of BRI. In the meantime, western countries see China’s strength as more of a threat than an opportunity, with the US and some European countries hinting at trade sanctions against China’s products.

Could this turn into a trade war? We do not think so because we don't believe that China will react by imposing retaliatory trade sanctions on other countries. This includes the US despite its intention to slap import tariffs on steel and aluminium.

Could this turn into a trade war? We do not think so.

We doubt China will react with tariffs on US food imports. There is a more effective way for China to prevent countries ratcheting up their trade sanctions against them. For one, China could simply stop the companies of hostile countries from operating in Mainland China. Companies of hostile countries would lobby their governments in turn.

Besides running a stronger economy, Xi may build up China’s military power faster as mentioned in the 19th Congress. Neighbouring countries and the US will feel the heat. But it is too early to say whether China’s military power will worsen geopolitical tension.

New central bank governor will not change the course of interest rate and exchange rate reform

The Two Sessions, Chinese People’s Political Consultative Conference (CPPCC) and the National People’s Congress (NPC), will be held on 3 and 5 March. We expect by then, Xi’s advisory team will be clearer and we should know who will lead the central bank (PBoC) as Zhou retires for another role.

We believe that the new central bank governor will be someone who shares Xi’s gradual reform approach on interest rate and exchange rate liberalisation.

We believe the central bank (PBoC) will follow the Fed’s four expected rate hikes in 2018.

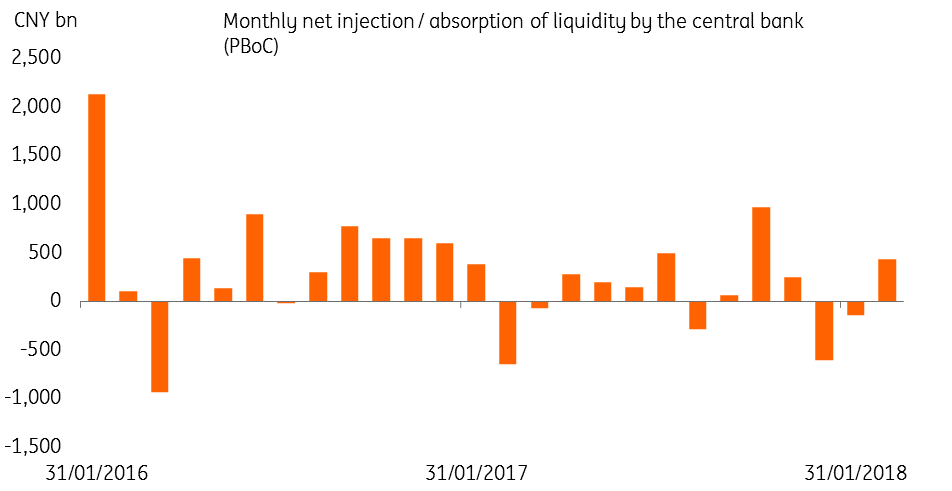

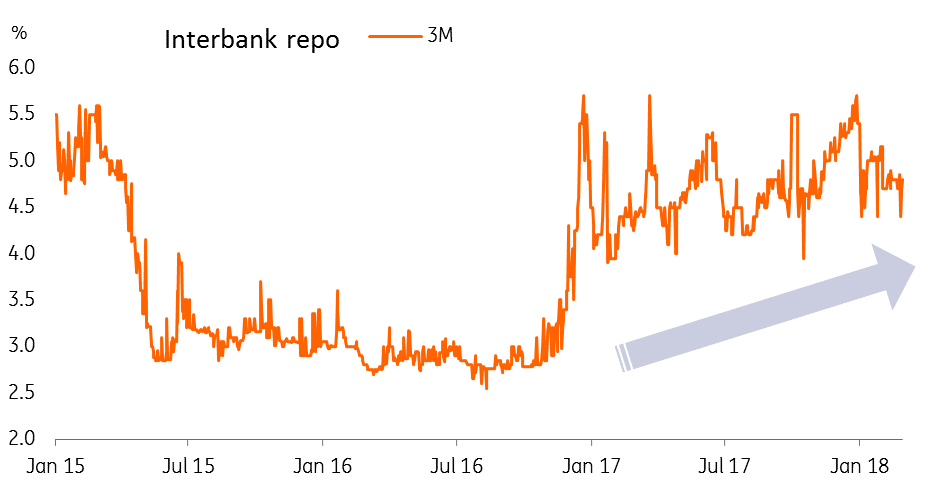

That means the status-quo for monetary policy and exchange rate policy. We believe the central bank (PBoC) will follow the Fed’s four expected rate hikes in 2018 to keep interest rate spreads stable, but could only add five basis points each time, as financial deleveraging would push up short-term interest rates further.

Short-term rates should rise with more frequent net liquidity absorption

PBoC may follow the Fed but at 5bp a time

The exchange rate mechansim will also remain largely the same. We do not expect any widening of the daily trading band unless the spot rate becomes more volatile during intraday sessions. We maintain our forecast of USD/CNY and USD/CNH of 6.1 by the end of 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

2 March 2018

Good MornING Asia - 5 March 2018 This bundle contains 5 Articles