China: shrinking shadow banking

Data for May shows that China has controlled the growth of shadow banking, and we expect financial deleveraging to continue for the rest of the year. Even as credit growth slows and liquidity tightens, we think a cut in banks' reserve requirements will likely be delayed until the second half

| -51% |

China credit growthMonthly change in May |

China central bank staring at financial deleveraging

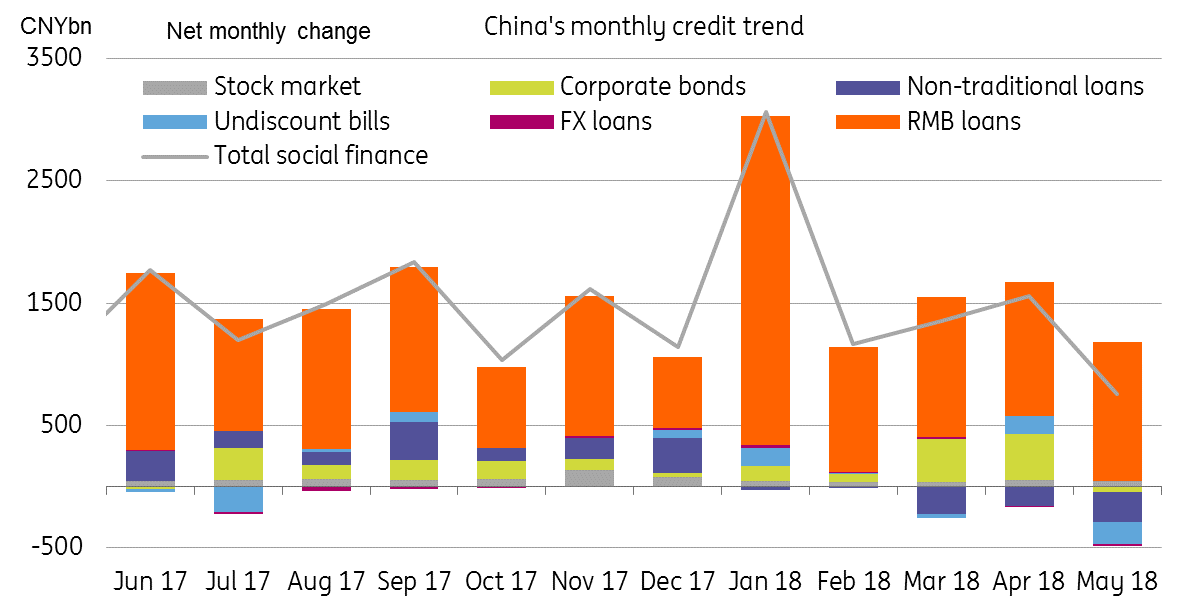

Total credit, which is called aggregate financing, was cut in half in May (from CNY1560 billion in April to CNY761 billion in May) due to a fall in every non-loan item. Yuan loans grew by CNY1150 billion in May, slower than 1180 billion in April.

This was a result of the central bank’s recent policies to reduce issuance and rollover issuance of wealth management products. The shrinkage has induced isolated bond defaults, making for a quiet month in the onshore debt market in terms of new issuance.

The data confirms our view that there will not be a cut in the reserve requirement ratio (RRR) in June after the central bank (PBoC) expanded collateral for its Medium-Term Lending Facility (MLF)- which allows banks to borrow from the central bank. This is because cutting the RRR (even if cash released is used to repay existing and expensive MLF) would send a signal to the market that the central bank has finished its financial deleveraging. In fact, financial deleveraging in China still has a long way to go. The central bank has yet to issue more regulations to prevent leveraging in grey areas.

Tighter credit is the theme in 2H18

We expect the central bank to keep deleveraging until the leverage of the whole economy is under 200% of GDP. Our estimate of China's total leverage is 234% of GDP. Though leverage is coming down in corporate credits, debts are piling up in local and central governments.

We also expect more policies to be imposed on non-financial institutions which hold assets of financial institutions. That would create a new tide of liquidity tightness, and is likely to push up financial costs in the onshore market.

Deleveraging measures will surely reduce credit growth. The PBoC will manage liquidity risks through daily open market operations and MLF operations. We think the central bank will only cut the RRR when it sees interest rates rising to such a level that they could induce a credit crunch. Otherwise, a cut in the RRR is not imminent.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article