China relaxes rules for foreign investors to take money out

China has relaxed rules for foreign investment schemes to take money out of the country in a bid to open up the capital account. But the new rules need to be tested to gain investor confidence

China lifts capital outflow controls to lure inflows

The central bank has relaxed outward remittance rules for two foreign investment schemes in China (namely QFII, qualified foreign institutional investor programme and RQFII, renminbi qualified foreign institutional investor programme). These schemes allow foreign investors to bring money into China and invest in China's equity and bond markets.

In the past, taking money out of China was difficult and there was a lock-in investment period. This has now been dropped though other rules continue to apply. For example, the remitted amount must be taken after tax.

The central bank has introduced these measures to appease foreign investors who had been concerned about investing in the onshore Chinese market because of rules governing when they could take money out. It hopes this will encourage two-way flows of capital.

But foreign investors might not have trust in the policy immediately

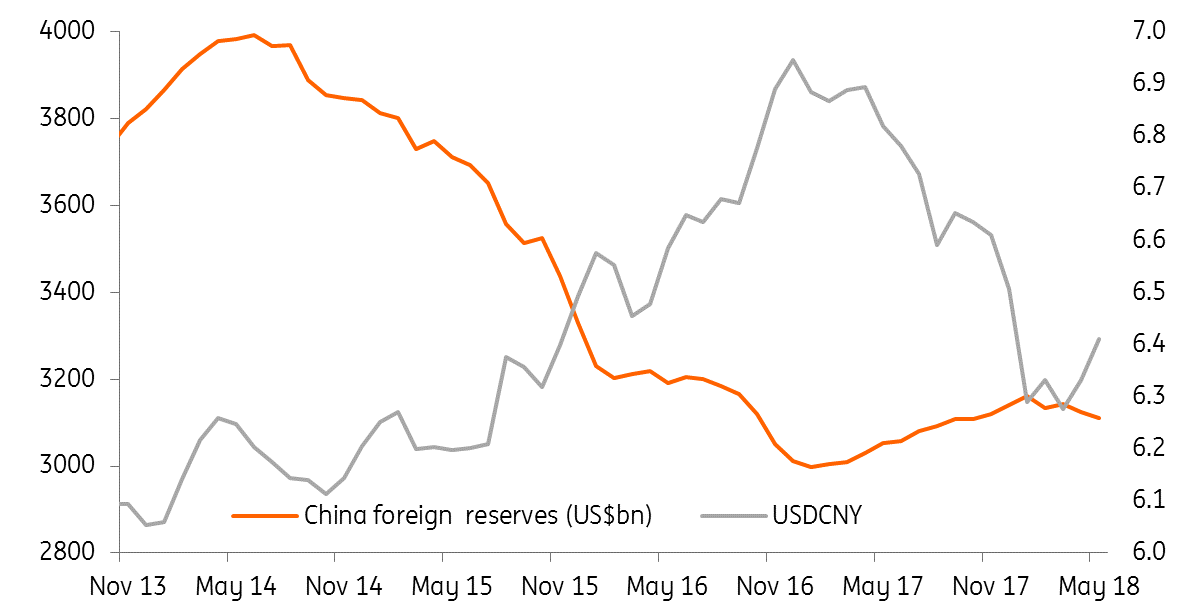

But we believe that this relaxation has to be tested, especially at times of rapid capital outflows from onshore to offshore. Between 2014 and 2016, capital controls were applied to outflows and this situation could be repeated.

Unless foreign investors gain more confidence in the ease of taking money out of China, we don't expect a lot of inflows from the QFII and RQFII schemes.

Outflow pressure increases with a weaker yuan

Central bank must show that outflows are allowed even when the yuan weakens

As we expect the yuan to weaken further in 2018 to 6.60, outflows from funds operated by QFII and RQFII should arise occasionally. If the central bank can show foreign investors that it is willing to stick to its new outward remittance rules even when the yuan weakens, then more foreign investors will be encouraged to invest in the onshore market.

China will then be able to attract more inflows into the onshore market when sentiment is bullish. MSCI is going to include more A-shares into its funds, which may give demand for these shares a push. If these funds are able to return 1.5% in 2018, they will be able to make a profit that offsets the exchange rate depreciation of 1.4% from our USCNY forecast.

New outward remittance rules could encourage foreign investors to invest in the onshore Chinese market but only if the central bank can give more assurance that these investors can take their money out when they want it. This would ensure a genuine two-way flow of capital, which is a preparatory stage for further liberalising the yuan exchange rate. Eventually, the yuan could float like other major currencies. But the prerequisite is the opening up of the capital market.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

13 June 2018

Good MornING Asia - 14 June 2018 This bundle contains 2 Articles