China’s rebound starts with consumption

China's economic recovery following its reopening could be unbalanced initially, but a full recovery later in the year is likely

Recovery starts with consumption

According to data from the National Tax Administration, retail sales revenue this Chinese New Year holiday increased by 12.4% compared to the 2019 holiday. Most of the growth came from travel-related activities, such as sales by travel agencies. In addition, box office results were 14% more than the pre-pandemic levels of 2019. Hotel sales revenue increased by around 20% compared to 2022. This data reflects the fact that Chinese consumers are generally engaging in travel close to home rather than taking long-distance trips within the country.

The current recovery in consumption looks uneven. While luxury shops have seen queues of shoppers, the general consumer base (which still spent more money over the holiday period than in 2022) remains cautious due to uncertainty over wage growth. This uncertainty is even more pronounced in the manufacturing sector, due to weak external demand.

At the richer end of the household spectrum, wages and job security are less relevant. This group can resume their pre-pandemic spending patterns. Not only does this group tend to spend within China, but they are also the first to restart luxury shopping overseas.

For both groups, the strong spending growth in January was due to the lifting of Covid restrictions that coincided with the Chinese New Year holiday. This may not be repeated in February, and we should expect more modest spending growth in that month, before it picks up again in March. That said, we expect consumption to fully recover to pre-pandemic levels in the second half of the year.

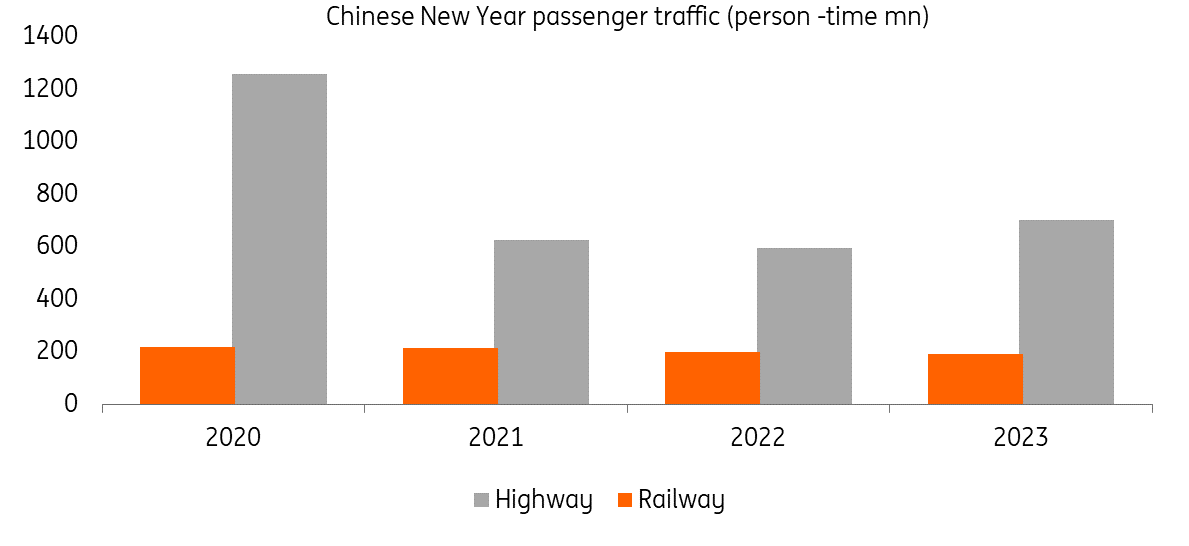

Chinese New Year passenger traffic via railway and highway

Manufacturing may not be as good

Industrial production may not grow as fast as consumption because 1) the peak in export orders in China is usually for shipments between September and November. This means that most existing orders should already have been filled; 2) export markets in the US and Europe are entering a weak phase and there may be fewer orders for Easter than last year; and 3) orders for the summer holidays may not be booked until shortly before the holidays, as sellers in the US and Europe may need more time to gauge market demand.

In short, the risk to industrial production this year lies in external demand. We expect transport and logistics to run smoothly this year, and there should be no supply disruptions on this front.

There is another growing risk. The technology war between China and the US and its allies has been intensified by the possible ban on semiconductor equipment entering China and the ban on solar panel technology from China. This technology war could spread to a wider range of items and could pose a risk to some companies' access to essential components and products. While it is too early to call this a supply chain disruption, the risks are rising.

Real estate is no longer a systemic risk

With the People's Bank of China (PBoC) providing liquidity to property developers, the likelihood of a crisis for indebted property developers has been significantly reduced and this is no longer a systemic risk. We expect the PBoC to widen access to financing for developers and the market should be able to price in the credit risk of different developers appropriately. Real estate construction activity should gradually resume this year.

Infrastructure construction activity should also make a comeback as local governments prioritise growth on their to-do lists. These infrastructure projects include soft infrastructure, which includes technology development, as well as hard infrastructure, which is more likely to be inter-provincial transport projects rather than local projects. These projects could be financed by local government financial instruments or by the People's Bank of China's refinancing programme.

In our view, the PBoC does not need to reduce interest rates or the reserve requirement ratio (RRR) further as the economy is already recovering well. Therefore, for most of the year, the central bank can focus on re-lending schemes to provide additional liquidity to specific sectors, including technology, ESG and agriculture.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

3 February 2023

ING’s February Monthly: This could well be a ‘fool’s spring’ This bundle contains 12 Articles