China: Ready to strike back

China is gearing up to respond to an expected escalation in US trade agression. Counter-measures against US exports and US business interests look likely, while fiscal and monetary stimulus aims to support the Chinese economy

Trade war with the US likely to escalate

On 3 August China’s Ministry of Commerce announced a $60 billion list of goods on which to impose tariffs ranging from 5% to 25%. This came after US President Trump said he would increase the tariff rate on the next $200 billion of goods to be hit from 10% to 25%. Together with the US’s previous tariffs on $50 billion of Chinese exports, this would mean nearly half of China’s exports to the US are covered by tariffs. This will have a major impact on China’s export, manufacturing and logistics sectors, and therefore the economy as a whole.

China’s retaliatory tariffs will not be enough to match the US like-for-like because China imports much less from the US than it exports. For this reason, China is very likely to impose qualitative retaliation (behind the border obstacles than make it more difficult for US companies to compete in Chinese markets) when the US imposes the next tariffs in order to fully match. The form that qualitative retaliation will take is uncertain, and how harsh these measures will be is also not known. Qualitative retaliation is open-ended in nature, and could create much more uncertainty in the market than simple tariffs.

The Chinese response will depend on how far the US goes with its next round of tariffs. Negative feedback from US companies could pressure the US government to trim the list of goods hit by tariffs, and lower the rate imposed. In that case, China would not retaliate as harshly and the dynamic between the two sides might change for the better. This may lead to risks subsiding gradually.

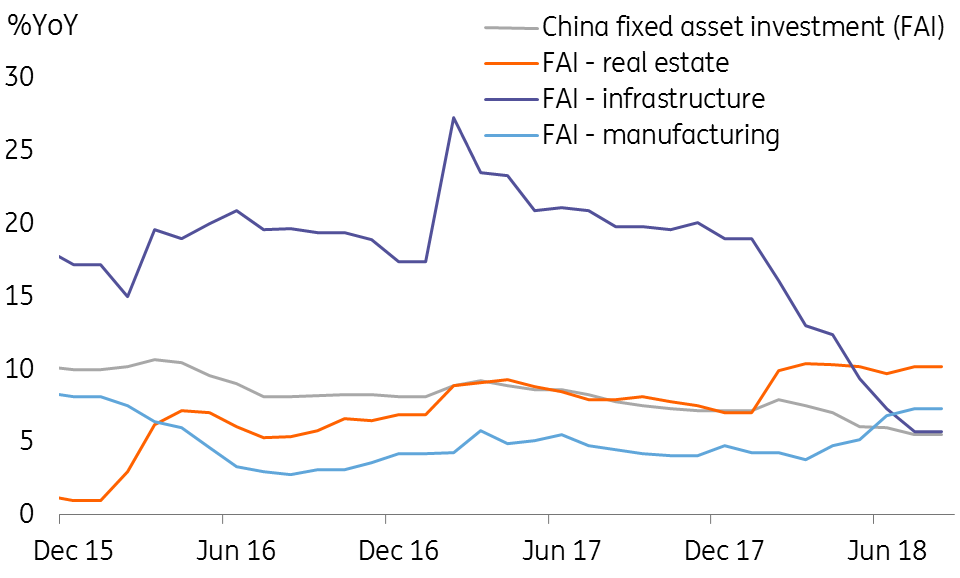

Chinese fixed asset investment

Support measures to help the domestic economy

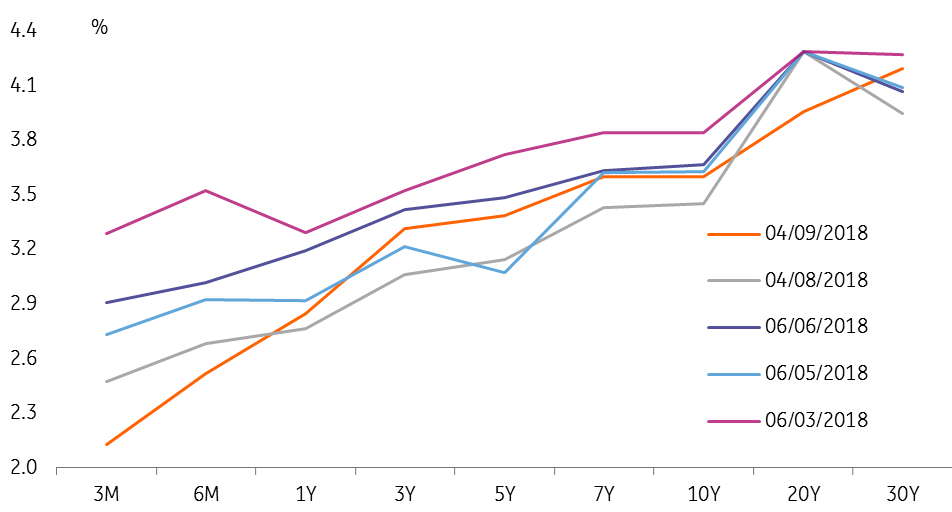

China has put fiscal stimulus and monetary easing in place in order to offset the damage from trade war as much as possible. The front end of the sovereign curve has fallen, suggesting that risks in the Chinese economy are rising.

The State Council announced a CNY2.6 trillion fiscal stimulus package in August, and has also requested that local governments prepare a pool of backup infrastructure investment projects. Fiscal stimulus could increase to CNY5 trillion in 2H18 with another CNY5 trillion in 1H19, particularly if this has to offset the negative impact from the full $200 billion in added tariffs should the US carry out its threats in full. For China’s leaders, keeping manufacturing activities stable so that jobs are secured is a key priority.

In addition, the Chinese central bank (PBOC) has eased liquidity and guided interest rates lower. Liquidity is ample, with a net injection of CNY195.5 billion from the Medium Lending Faciities in August. 3M SHIBOR has fallen from 4.155% at the end of June to 2.878% on 4 September. We expect a targeted required reserve ratio (RRR) cut of 50 bps in October in order to direct liquidity to smaller enterprises and so avoid a liquidity crunch as the export environment deteriorates.

The central bank has also restarted the counter-cyclical factor in the USDCNY daily fixing mechanism which, together with the 20% reserves on short yuan forwards, has slowed the yuan’s depreciation.

Chinese sovereign yield curve

Download

Download article

10 September 2018

Good MornING Asia - 10 September 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).