China: Ready to strike back

China is gearing up to respond to an expected escalation in US trade agression. Counter-measures against US exports and US business interests look likely, while fiscal and monetary stimulus aims to support the Chinese economy

Trade war with the US likely to escalate

On 3 August China’s Ministry of Commerce announced a $60 billion list of goods on which to impose tariffs ranging from 5% to 25%. This came after US President Trump said he would increase the tariff rate on the next $200 billion of goods to be hit from 10% to 25%. Together with the US’s previous tariffs on $50 billion of Chinese exports, this would mean nearly half of China’s exports to the US are covered by tariffs. This will have a major impact on China’s export, manufacturing and logistics sectors, and therefore the economy as a whole.

China’s retaliatory tariffs will not be enough to match the US like-for-like because China imports much less from the US than it exports. For this reason, China is very likely to impose qualitative retaliation (behind the border obstacles than make it more difficult for US companies to compete in Chinese markets) when the US imposes the next tariffs in order to fully match. The form that qualitative retaliation will take is uncertain, and how harsh these measures will be is also not known. Qualitative retaliation is open-ended in nature, and could create much more uncertainty in the market than simple tariffs.

The Chinese response will depend on how far the US goes with its next round of tariffs. Negative feedback from US companies could pressure the US government to trim the list of goods hit by tariffs, and lower the rate imposed. In that case, China would not retaliate as harshly and the dynamic between the two sides might change for the better. This may lead to risks subsiding gradually.

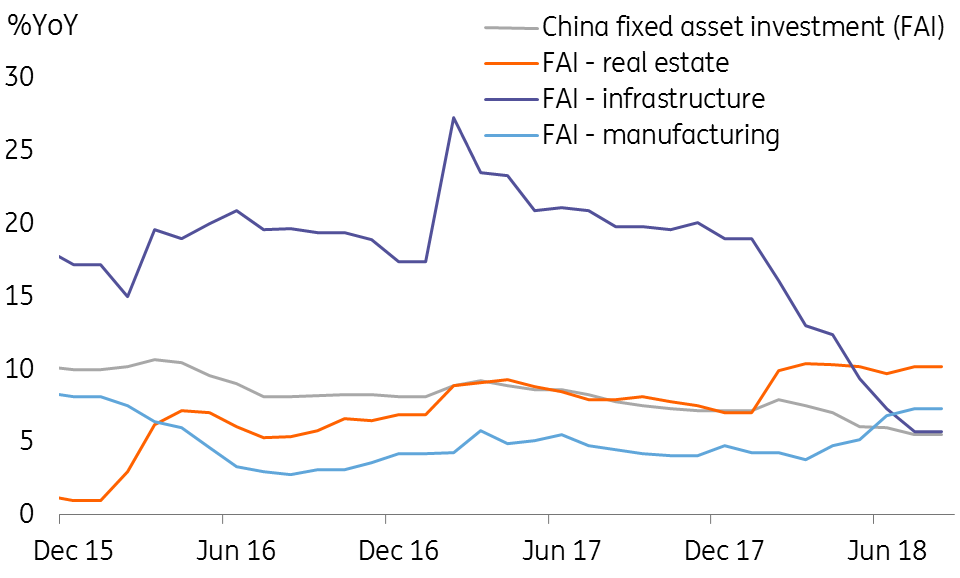

Chinese fixed asset investment

Support measures to help the domestic economy

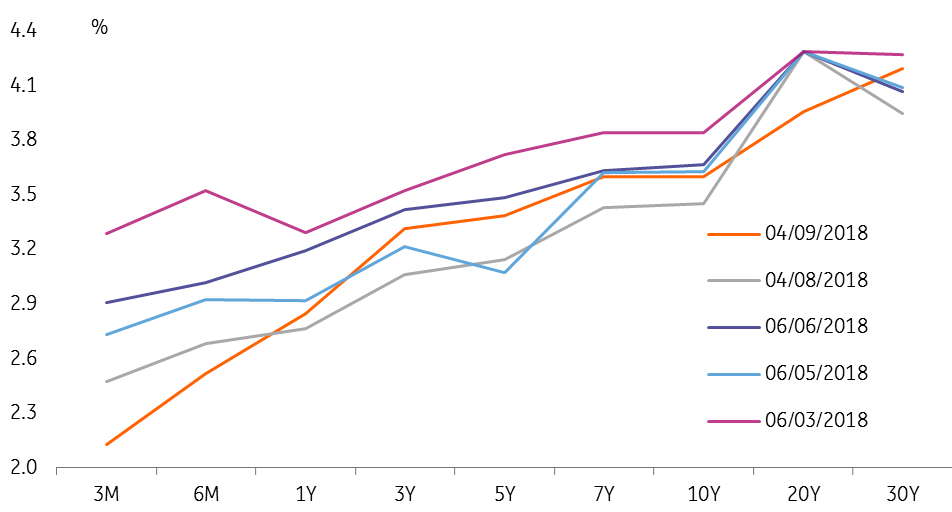

China has put fiscal stimulus and monetary easing in place in order to offset the damage from trade war as much as possible. The front end of the sovereign curve has fallen, suggesting that risks in the Chinese economy are rising.

The State Council announced a CNY2.6 trillion fiscal stimulus package in August, and has also requested that local governments prepare a pool of backup infrastructure investment projects. Fiscal stimulus could increase to CNY5 trillion in 2H18 with another CNY5 trillion in 1H19, particularly if this has to offset the negative impact from the full $200 billion in added tariffs should the US carry out its threats in full. For China’s leaders, keeping manufacturing activities stable so that jobs are secured is a key priority.

In addition, the Chinese central bank (PBOC) has eased liquidity and guided interest rates lower. Liquidity is ample, with a net injection of CNY195.5 billion from the Medium Lending Faciities in August. 3M SHIBOR has fallen from 4.155% at the end of June to 2.878% on 4 September. We expect a targeted required reserve ratio (RRR) cut of 50 bps in October in order to direct liquidity to smaller enterprises and so avoid a liquidity crunch as the export environment deteriorates.

The central bank has also restarted the counter-cyclical factor in the USDCNY daily fixing mechanism which, together with the 20% reserves on short yuan forwards, has slowed the yuan’s depreciation.

Chinese sovereign yield curve

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

7 September 2018

Good MornING Asia - 10 September 2018 This bundle contains 5 Articles