China Quarterly Update: Technology v bricks and mortar

Lockdowns and social distancing measures are short-term issues for the Chinese economy as a result of the Covid-19 pandemic, but solutions for the recovery affect structural growth. The government has chosen to bet on advanced technology but the quick answer as always is old school infrastructure projects using bricks and mortar. So, debt is on the rise

Covid-19’s impact on the Chinese economy

The Covid-19 health pandemic has had at least two major effects on the Chinese economy:

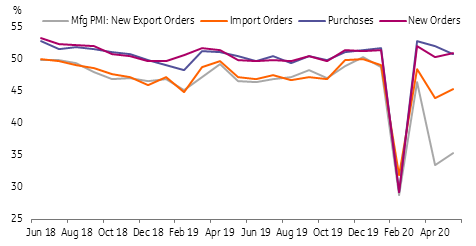

- External demand has been weak, and is likely to continue to be so, as a result of Covid-19 lockdown and social distancing measures, and therefore impacting China's export orders and hurting manufacturing and export businesses.

- Domestic demand in terms of retail sales has been subdued due to social distancing measures.

Covid-19 also makes the US-China 'phase-one' trade agreement less promising. Though China and the US seem to have agreed to uphold the agreement, there are risks that China may import fewer agricultural products from the US.

China will now require food importers to declare that agricultural products have not been contaminated by Covid-19 and this might prompt America to accuse China of not following through on the agreement quickly enough. China has argued that the slow progress is a result of Covid-19.

China's manufacturing PMI breakdown

Another important imminent risk: The technology war

Apart from Covid-19, more Chinese technology firms have been included in the US 'unreliable entity list' in 1H20, which restricts US companies from selling products and services to Chinese tech firms. Some western countries have joined the US banning specific Chinese tech companies, especially if the technology is 5G infrastructure and smartphone-related. It means Chinese technology companies will experience deteriorating sales to foreign companies.

In the longer term, it means fewer technological exchanges between China and more advanced economies. China has decided to dedicate more resources to advanced technology research and development so that it can be self-reliant going forward.

Positive structural factors

- China's new foreign investment law, which in principle means that foreign companies will receive the same treatment as their Chinese counterparts, has come into effect since 1 January 2020.

- To move towards a technologically advanced economy, the government has set a scheme of “new infra”, which contains 5G infrastructure, Artificial Intelligence, Industrial Internet of Things (IIoT), big data centres, ultra-high voltage connectors, and high-speed rails. China has also built its own 'unreliable entity list' that can block out foreign companies from doing business with domestic firms. But at the time of writing this report, the unreliable entity list has not yet been triggered.

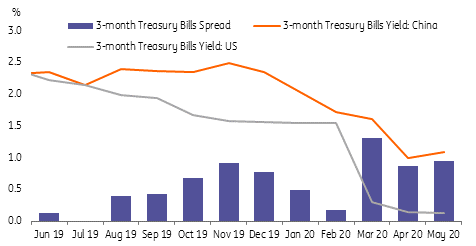

- Massive capital outflows aren't a big concern. China's capital account is not completely open, which is why there are no substantial capital outflows. Even if there was a demand for fund outflows, there are very few channels to do this. On the other hand, the cross border fund regulator (SAFE) has introduced policies that welcome more capital inflows in 2020, e.g. the quota system for foreign asset investments in China has changed to a post-investment registration system, which means there is no limit of inflows into China. Moreover, the sovereign yield spread between China and the US has been positive, which has been an attractive factor for multinational companies operating in China.

- Interest rate liberalisation in progress. The People's Bank of China has created the loan prime rate to replace the benchmark lending rate. But there is still a long way to go to reform the whole process so that the central bank relies on only one short term interest rate as its policy rate. Before the interest rate liberalisation process is complete, the CNY exchange rate cannot be expected to be free-float.

China-US sovereign bond yield spread

Negative structural factors

- China’s fiscal position continues to deteriorate. Government debt per GDP increased to 54% in 2019 from 49%. This amount excludes debt of local government special bonds, which is categorised as corporate bonds by its credit nature of no guarantee from the local governments. Bricks and mortar infrastructure projects are mostly funded by the issuance of local government special bonds. If the debt of local government special bonds is included then government debt per GDP rises to 102% in 2019 from 88% in 2018, and is expected to rise to 110% in 2020.

- Led by the US, the western world is increasingly reluctant to let China become a technology giant. It is likely that China will continue to build its own technical capacity. But in the meantime, there could be a shortage of advanced semiconductor chips, which dampens Chinese technology product competitiveness.

- An ageing population is a real problem for China. The government is addressing this by moving more residents from rural to urban areas, but the progress is slow.

Policies to fight against the downward cycle

- Fiscal deficit as a percent of GDP is set by the 'Two Sessions' at over 3.6%. This is a flexible target compared to market estimates of 8% to 11%. The momentum of infrastructure stimulus seems to be slower than expected, particularly transportation infrastructure, which is one of the “new infra” projects. This could be a result of social distancing measures.

- Monetary policies can only supplement fiscal stimulus to help the economy recovery from Covid-19. As such, the central bank has adopted a targeted approach for SMEs and broad-based easing should be limited only.

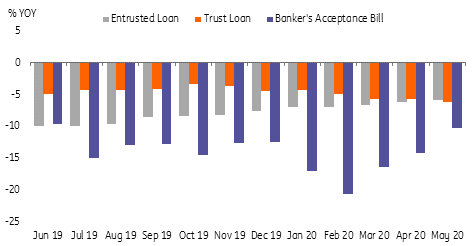

- The silver lining is that we have not seen shadow banking activities make a comeback when there is a big need for credit growth to support infrastructure.

- There have been no signs that the PBoC has used the depreciation of the yuan to boost exports as the reason behind dismal exports is very weak global demand. A slight depreciation of the yuan can't help exporters to get orders from foreign buyers. USD/CNY continues to move in tandem with the dollar index, and from time to time reacts to market news related to global Covid-19 cases, the technology war and the trade war.

Shadow banking continues to shrink despite the need of credit to support infrastructure

Loan growth has been fast but may be not as effective

Chinese loan growth has continued rising in the first five months of 2020 at 11.06%YoY compared to 9.49% in 2019 to support economic growth.

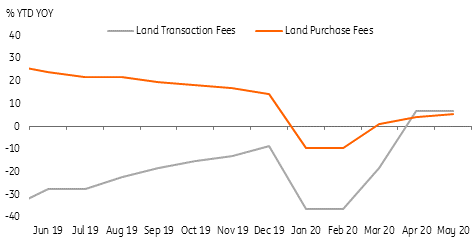

However, loan growth does not always translate into economic growth. It seems that some loans have entered into asset markets, including some real estate projects (as land sales fees have increased), stock and bond markets, and structured deposits. The rest has gone to infrastructure projects even when progress has been slow. Ample liquidity will keep interest rates low. 3-month SHIBOR has fallen continuously to 1.453% per annum at the end of May 2020 from 3.02% at the end of 2019.

The central bank has invented an innovative re-lending program for SMEs. At the end of May, Chinese banks have offered relief on CNY3.9 trillion of loans since the outbreak of Covid-19 to SMEs. More, banks have postponed taking principal repayments on CNY 1.44 trillion in loans to almost 800,000 SMEs and pushed back CNY 65.4 billion in interest payments. Banks also rolled over CNY2.4 trillion in financing to SMEs according to Bloomberg citing CBIRC officials. As such bank margins are expected to be squeezed in 2020.

Land fees increase during Covid-19

Forecasts

GDP forecast

- Policies in 2020 are likely to focus on rebuilding the economy, which include structural policies, e.g. the “new infra” scheme and cyclical policy of fiscal stimulus. But the high uncertainty brought by Covid-19, e.g. whether there could be a second wave of infection, locally and globally, has made the government decided not to set any GDP growth target for 2020. This decision was reached after GDP growth in 1Q20 was -6.8% after +6.0% in 4Q19.

- The PBoC applies a targeted approach for liquidity injection, but monetary policies can only help the economy to a limited extent. When small businesses have difficulty surviving due to loss of foreign orders, which could be longer than previously expected if social distancing measures continue globally.

- We maintain our forecasts for the Chinese economy at -1.5% in 2020.

Interest rate forecast

- The PBoC is expected to continue its targeted easing approach. There should be more SME loans. This means broad-based easing is increasingly less likely.

- We expect there could be one more targeted RRR cut of 0.5 percentage points but unlikely to have an interest rate cut unless Covid-19 cases increase quickly and become difficult to be under control in China.

USD/CNY forecast

- The PBoC has shown no preference for a weaker yuan even during bad times like this. The yuan has strengthened against the dollar in Mayas Covid-19 cases subside globally.

- We expect USD/CNY will continue to move with global Covid-19 trends, the technology and the trade war, which means volatility can be high.

- Our forecasts for USD/CNY remains unchanged at 7.05 by the end of 2020.

Forecast table

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 June 2020

Reopening vs resurgence This bundle contains 8 Articles