China: PMI disappoints but stimulus is coming

Though both official manufacturing and non-manufacturing PMIs are worse than expected, we believe that stimulus is on the way as local governments have raised funds to finance infrastructure projects

Manufacturing PMI at the brink of 50

Manufacturing activities did not grow in November despite local governments having raised funds for infrastructure projects. New orders grew slower to 50.4 in the month, down from 50.8 a month ago. New export orders were still gloomy at 47 but edged up from 46.9. It shows that stimulus on infrastructure projects has come in later than expected.

Slower new orders show stimulus was slow to get into the economy

But stimulus from local governments should arrive soon

The come back of local government financial vehicles should mean that stimulus via infrastructure projects is on the way. But it seems that some of the funds could have been used for debt repayments, and have yet to get new infrastructure projects up and running. But with the massive issuance of debt from local governments, via local government financial vehicles and local government special bonds, we expect stimulus will be more obvious in adding manufacturing activities from December.

We also expect that the government is going to cut import tariffs on more goods. This will reduce production costs in the manufacturing sector.

But we expect new export orders to keep contracting as long as the trade war continues, not to mention that the trade war tension could escalate after this weekend's meeting between President Xi and President Trump.

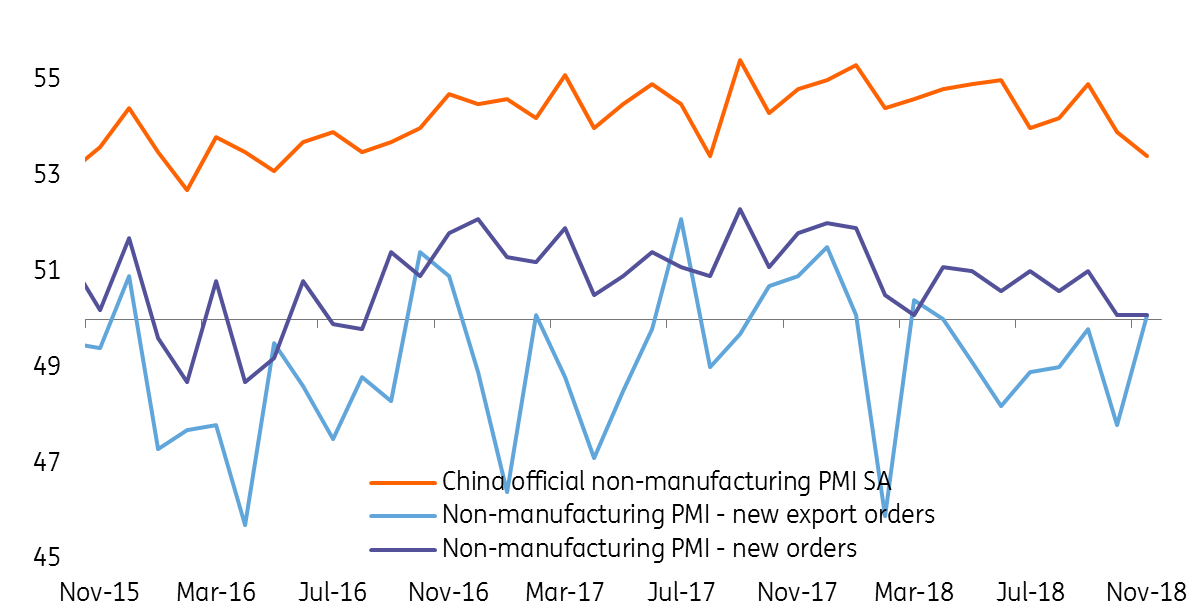

Non-manufacturing PMI shows that consumption is slowing but it should be temporary

A slowdown in non-manufacturing activities is a concern. Catering and real estate services were in contraction according to the Statistic Bureau. Shrinking real estate services, a result of a fall in housing market transaction volume will continue in the coming months until more local governments relax tightening measures.

The contraction of the catering service is a surprise to us. It reflects that consumption is falling. But this could also be temporary as an expansion of activities in financial services, including insurance activities that back up loan growth, could provide a lifeline to private companies, which will secure jobs, and therefore consumption.

Non-manufacturing PMI falling steeper than expected

Overall, we are not pessimistic

As fiscal stimulus is on the way, we believe that both manufacturing and non-manufacturing activities should be steady from here. Our estimate of the size of fiscal stimulus is around CNY9-10 trillion for late 2018-2020, ie, averaging CNY4 trillion each year in 2019 and 2020.

Though some fiscal money will be used for debt repayment and loan rollovers, the rest will go into infrastructure projects, which will support manufacturing activities, even if the trade war continues to escalate.

Financial and insurance activities for lending and insurance to back up loans will support non-manufacturing activities.

As such we keep our GDP forecast at 6.3% in 2019 from 6.6% in 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

30 November 2018

Good MornING Asia - 3 December 2018 This bundle contains 4 Articles