China: More retaliation on the way

With trade tensions with the US only set to increase, we expect the People's Bank of China to allow the yuan to depreciate to 7.00 by the end of this year

Trade war looks set to be long and increasingly complicated

On 18th September, China announced fresh tariffs on a list of $60 billion worth of US goods. The tariff rates are set between 5 to 10%, which is lower than the 5 to 25% that was proposed previously, following a US decision to initially limit tariffs to 10% on its list of $200 billion worth of goods. However, these lower tariffs are only set to last until the end of 2018, and if the US increases the rate to 25% in 2019, as it has suggested, we expect China to follow suit – as it initially suggested back at the start of August.

Given that China imports less from the US than it exports, there is only so much China can do quantitatively. So the focus is now increasing on China’s qualitative retaliations

This so far includes the reinstatement of a 2013 WTO dispute and lowering import taxes on various goods - a move designed to weaken the competitiveness of US companies in China. This decision will benefit other countries’ exports to China, while US imports suffer from the additional tariffs and this is a situation is similar to that of US automobiles, which face higher tariffs in China than imported cars from other economies.

But the trade war doesn’t end with tariffs. Geopolitical tensions in the South China Sea escalate at a time where China will not return to the negotiation table until after the US mid-term elections. The new trilateral trade bloc of US, Mexico and Canada (USMCA), will include a clause that allows any member to veto trade agreements between China and other members. With negotiations between China and the US delayed, the trade war is set to be a long and increasingly complicated process, which undoubtedly will continue into 2019.

PMIs show China still holding up domestically despite fall in export orders

Fiscal stimulus should help economic activity in the months ahead

Fiscal stimulus in China has started quietly as various local governments are starting infrastructure projects, and support from these economic activities should be seen in the months ahead. For now, industrial profits and PMIs, as shown in the chart above, point to a slowdown in export activity, while domestic demand still appears to be holding up.

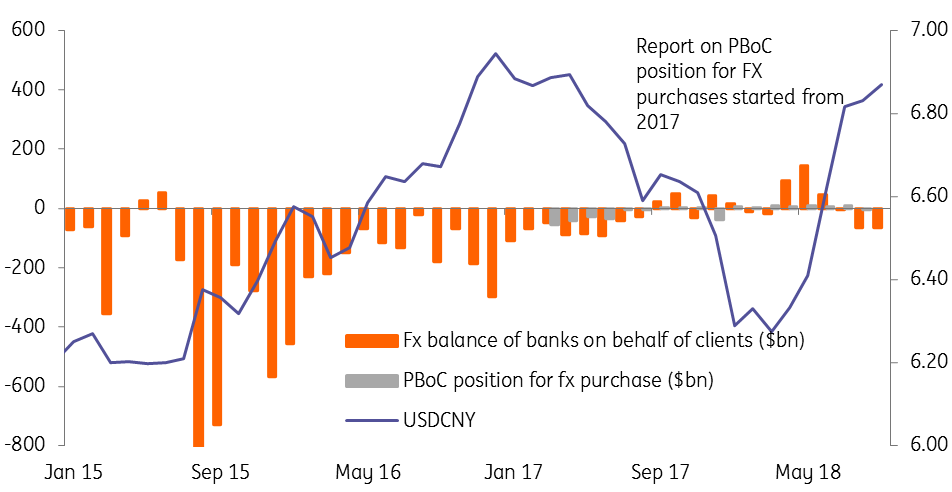

We don’t believe that further yuan depreciation will trigger massive capital outflows as there were inflows into the onshore asset markets to offset regular outflows, and the cross-border regulator (SAFE) has closed illegal loops of outflows. The figure shows that conversion from yuan to foreign currencies has been low compared to the 2015 level.

We expect the People’s Bank of China to allow the yuan to depreciate to 7.0 by the end of this year (Spot rate was 6.88 at the time of writing this note).

We believe that USDCNY is heading towards 7.0 by end 2018

Download

Download article

5 October 2018

Global Economic Update: Looking for a silver lining This bundle contains 8 Articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).