China: Incipient recovery?

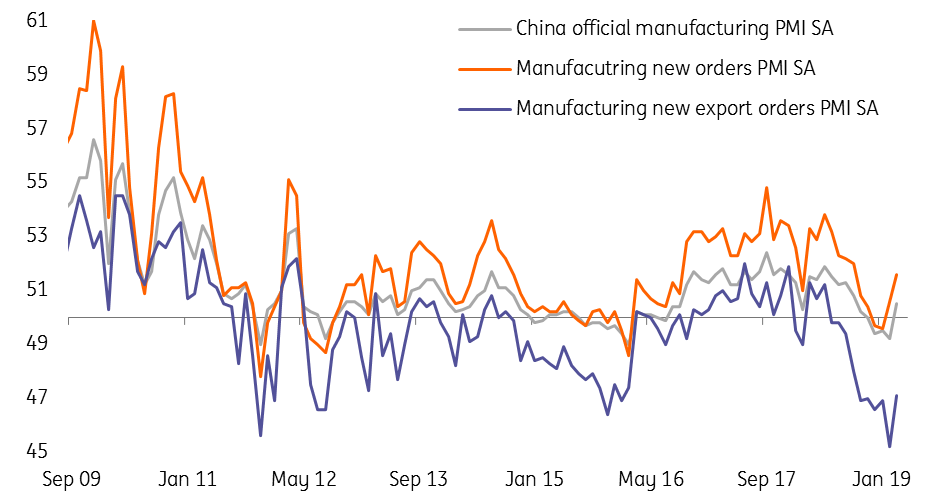

China’s fiscal stimulus has begun to work. Manufacturing PMI showed activity expanded in March. We believe this is in large part because of the fiscal measures taken over recent months. Continued support from fiscal policy will likely be required to maintain activity even if a trade agreement with the US is reached

China’s fiscal stimulus has begun to work. The official manufacturing PMI showed activity expanded in March, with the survey measure rising to 50.5 in January from 49.2 in February.

Without the fiscal loosening, we think even this slight recovery in the manufacturing sector would have been unlikely. The authorities are likely to maintain fiscal stimulus even if a trade deal is signed with the US to continue to support the economy.

With the fiscal stimulus, manufacturing PMI is rising

We believe that manufacturers’ profit should improve with the current fiscal support. Upstream manufacturers, such as miners, will benefit first, and then it will gradually move downstream to manufacturers of final goods.

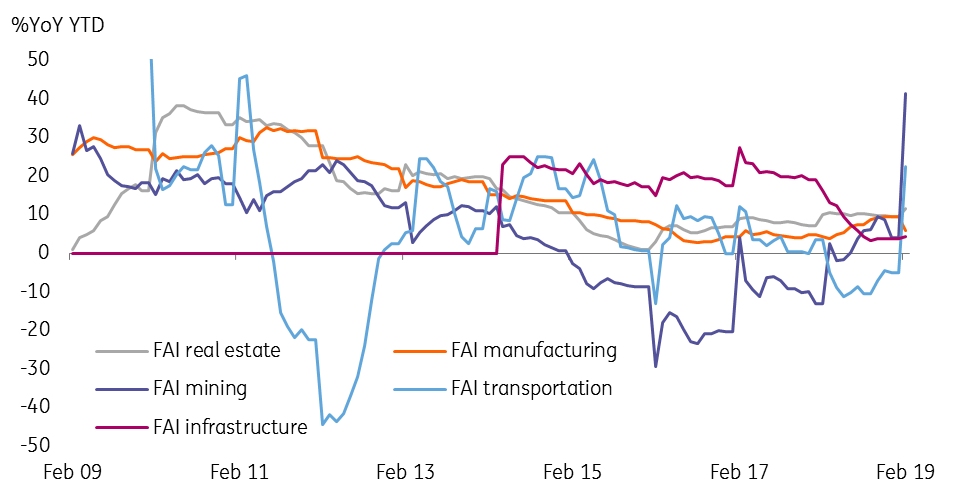

However, we expect that fiscal stimulus will mainly boost infrastructure investments and related production, e.g. investments in mining and transportation. It cannot change the external environment, especially the uncertainties surrounding the US-China trade war. Export-related manufacturers will continue to suffer from US tariffs, and they will consequently be more reluctant to expand their factories.

The recovery was only in the sectors of transportation and mining from infrastructure projects

Trade negotiations between China and the US continue, but still, appear some way from a final resolution. Both sides face difficult choices, with China’s currency policy and approach to cybersecurity two key outstanding issues where it appears the two sides have yet to reach an agreement.

On monetary policy, the central bank (PBoC) governor has said that room for further required reserve ratio (RRR) cuts is limited. As such, we still expect four cuts this year but have revised each RRR cut to 0.5 from one percentage point. Small private firms in China still need targeted monetary easing as they do not benefit from the fiscal stimulus.

The risk from trade tension remains material, and a deal is by no means guaranteed

On the yuan, we keep our forecast for USD/CNY and USD/CNH at 6.75. A major appreciation seems unlikely, as the US has pressed China to commit to refrain from using currency depreciation as a policy tool in the future. That means the Chinese authorities will not want to see an appreciation now, given they may not be able to reverse it later if needed.

In short, the Chinese economy is currently supported by fiscal stimulus. The risk from the trade tension remains material, and a deal is by no means guaranteed. And even there is an agreement; questions will remain about how long it will last.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

5 April 2019

What’s going on in Australia? This bundle contains 6 Articles