China: In need of stability

The Chinese economy is weakening, as shown by manufacturing surveys, but fiscal stimulus should soon be in place to counter unemployment risks. The central bank will use its new tool, the Targeted Medium-Term Lending Facility (TMLF), to provide lifelines to both small and private companies

Trade war risks to re-emerge

The Chinese economic outlook depends critically on the development of the trade dispute. If a truce with the US is extended, there will be more upside than downside risk for the Chinese economy and global growth. But for the time being, we are still projecting a trade war scenario re-emerging sometime after 1 March 2019.

The trade war impact has fed through the export sector to domestic sectors via the supply chain. Ports, logistics, and packaging all face lower demand.

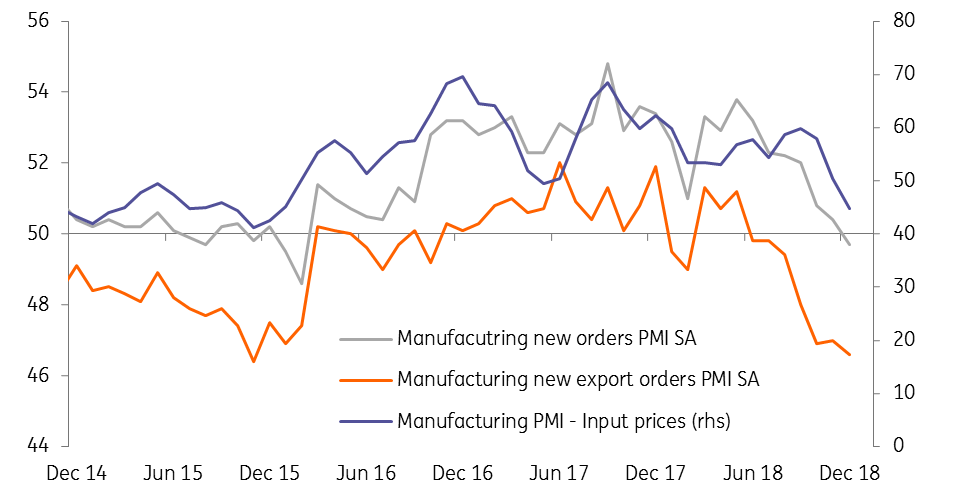

Business surveys show that the Chinese economy is weakening. Headline PMIs have been contracting, and the ‘new orders’ sub-index started to contract in December. Manufacturers, in general, have suffered from fewer orders from the domestic market, as well as fewer orders from foreign markets.

Shrinking manufacturing activity

Pro-growth measures needed

If there are no pro-growth measures we will see jobs at risk, which is a key threat that the central government wants to avoid. Within the “six stability” agenda set by the central government, job security is the top priority, which shows its importance to the government and to society. In terms of growth, job security is also important to avoid the trade war impact spiralling into a downward cycle, which affects spending and therefore corporate earnings.

Regarding fiscal stimulus, we expect a package of CNY 4 trillion in 2019

As a result, fiscal stimulus and monetary easing measures will be needed. Regarding fiscal stimulus, we expect a package of CNY 4 trillion in 2019, and if the trade war continues into 2020, the same amount will be in place next year.

Most of the funding will come from local government special bond issuance, which by definition is “corporate” debt rather than fiscal debt. So we don’t really expect a big jump in the fiscal deficit to GDP ratio of around 4%.

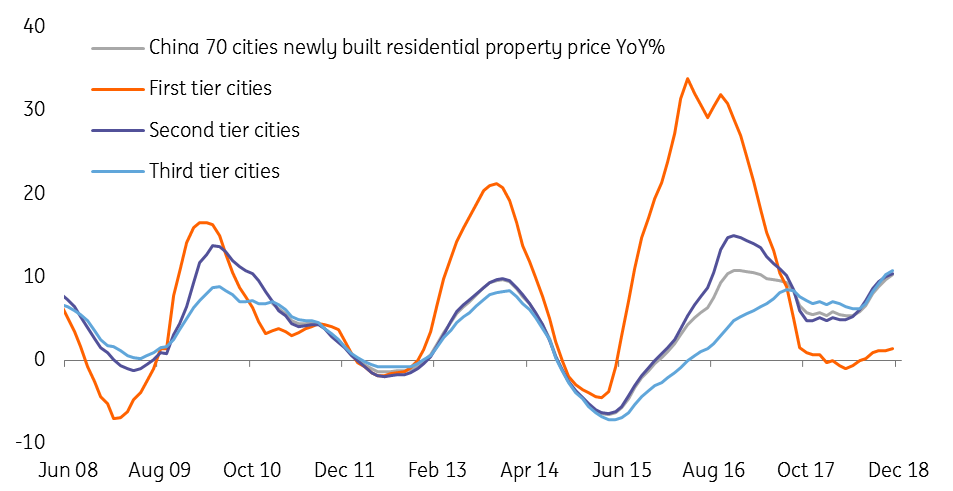

These funds will be used for infrastructure investment. This is a quick solution for local governments to support GDP growth. Some local governments will start to relax housing measures to prop up housing construction activity.

Propping up the housing market

The central government will develop high-quality manufacturing and 5G applications. As 5G faces hurdles on equipment exports, the government will broaden its 5G coverage and speed up 5G applications domestically.

On monetary policy, the central bank has announced a new tool, the Targeted Medium-Term Lending Facility (TMLF), which has an interest rate 0.15 percentage points below the general Medium Term Lending Facility (MLF), with funds channelled to smaller companies and private companies.

We have yet to see how the central bank will implement the new tool, but we expect it to start using it this month. We believe that the TMLF will not fully replace the MLF, but the size of TMLF could be larger than MLF because the government wants to keep private companies alive to avoid job losses.

We also expect the first cut of the required reserve ratio (RRR) to take place this month. Similar to TMLF, this RRR cut will be a targeted cut for smaller companies.

The People's Bank of China changed its exchange rate policy stance to maintaining a stable currency

Near the end of 2018, in its meeting minutes, the People’s Bank of China changed its exchange rate policy stance to “maintain a stable exchange rate at a reasonable level”. We believe the central bank is aiming to minimise the chances of market chaos and massive capital outflows, even if the probability of such an event is very low. Our current USD/CNY forecast is 7.30 by the end of 2019. We may revise the forecast to a milder yuan depreciation, but before that, we need to monitor the trend to confirm the PBoC’s definition of “stability”.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 January 2019

January Economic Update: Overdoing the gloom This bundle contains 8 Articles