China hits back where it hurts - soybeans

China said it would retaliate against US tariffs, and that is exactly what they did today. But to the surprise of many, they included US soybeans in the reciprocal tariffs, which sent the soybean market plunging downwards. If these tariffs stick, expect further pressure

A blow for US soybean farmers

China is the world’s largest soybean consumer, with the country estimated to consume around 111 million tonnes (mt) of soybeans over 2017/18, which is equivalent to 32% of total global soybean consumption. The bulk of this demand is met by imports, with the country estimated to import 97mt over 2017/18. This is a significant number when you consider that global import demand totals around 151mt.

Developments between the US and China will certainly play into the hands of Brazilian farmers

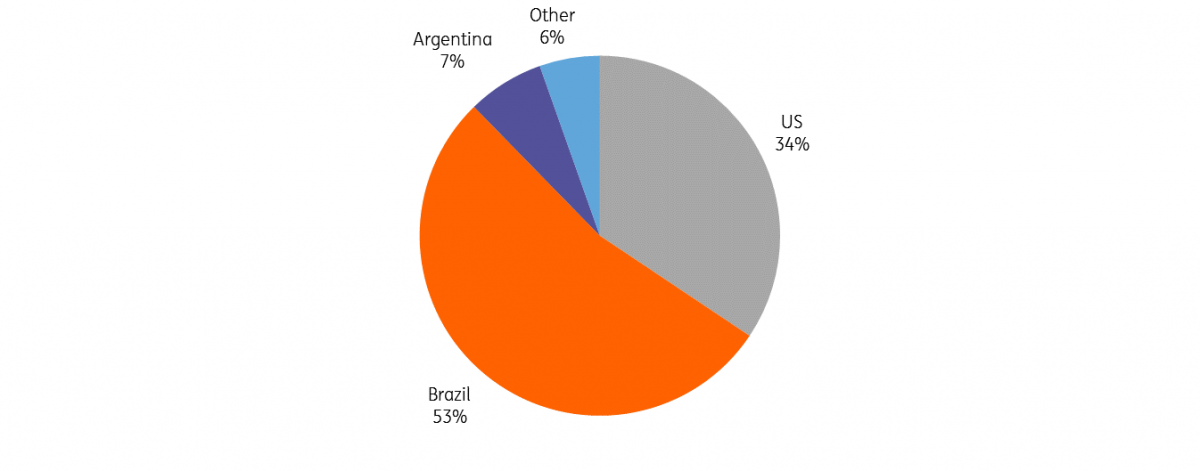

The US is the largest soybean producer in the world and a key supplier of soybeans to China. Historically the US was the largest supplier to China, although over recent years this has changed, with China increasingly turning to South America, due to the strong growth in Brazilian soybean output. In 2010, the US met 43% of Chinese import demand, however, this fell to 34% in 2017.

Now with US soybeans set to attract a further 25% import tariff, the trend that we have seen over the last few years, is likely to pick-up in pace, with Chinese buyers turning as much as they can to alternative supplies.

China soybean imports by origin (%)

For the US this trend is clearly not good news, with farmers finding it more difficult to find homes for their beans. The US exported 49.1mt between January and November 2017, of which 27.9mt went to China. The next biggest buyer is the EU, in a distant second, importing just 4.05mt over the same period.

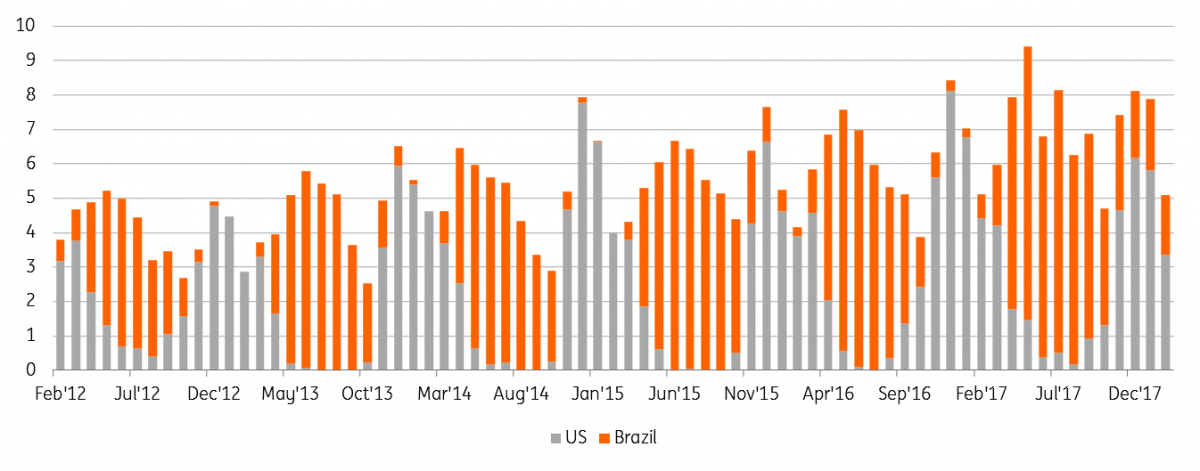

However, seasonality in northern and southern hemisphere supply should offer some respite to US farmers. The bulk of Brazilian supply is exported over the northern hemisphere summer, while US export supply is at its peak over the northern hemisphere winter. So Chinese buyers will still need to turn to the US during the low point in Brazilian supply. Although we think Chinese buyers will try stock up on South American soybeans as much as possible during the peak of supply from the region.

Seasonality in Chinese soybean imports

US vs. Brazil in million tonnes

Potential for US farmers to reduce soybean area

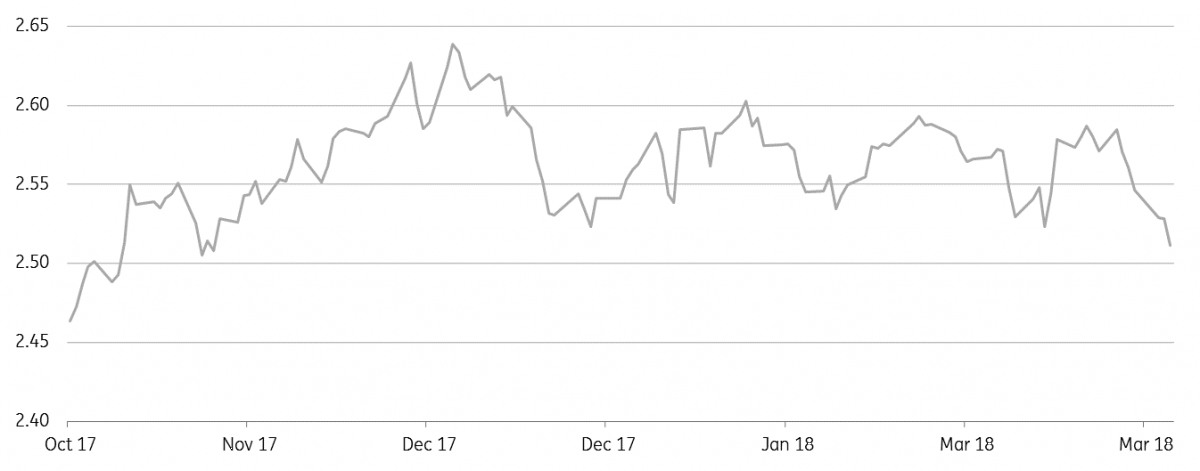

In the United States Department of Agriculture (USDA) Prospective Plantings report last week, the agency estimated that planted soybean area in the US would exceed corn area. The soybean/corn ratio gave a clear sign to farmers to plant more soybeans. However this latest development should mean further pressure on Chicago Board of Trade (CBOT) soybeans, leading to a weakening in the soybean/corn ratio moving forward, this should see some farmers revise their planting intentions, and instead look to plant more corn at the expense of soybeans.

It will be tight for some farmers, as many would have made the decision and the commitment already to plant soybeans, but those with flexibility will likely reassess their planting ideas for the upcoming crop.

CBOT soybean/corn ratio

A windfall for Brazilian farmers

Brazil is looking at another strong soybean harvest this season. Last season they produced a record 114mt, and in Companhia Nacional de Abastecimento's (CONAB) latest estimates for the 2017/18, they expect output to total 113mt. It does seem as though there is upside to this number, with the agency having revised higher the crop several times, while some other analysts are forecasting that Brazil will actually set a new record this season.

So developments between the US and China will certainly play into the hands of Brazilian farmers, with China increasingly turning towards them. Given the strong crop last year, stocks within Brazil are at elevated levels, and with another strong crop expected, export availability is set to increase.

Where to next?

It is important to remember that these planned tariffs from China have not been implemented yet, and we may see China and the US trying to negotiate broader trade issues between them. US farmers will certainly lobby the government quite hard to ease some of the tariffs on China, in the hope that the Chinese will also soften their stance.

Failing to agree, and the implementation of this tariff should mean further pressure on CBOT soybeans. We would need to see CBOT trade to levels where US farmers start to switch area from soybeans to corn.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

4 April 2018

In Case You Missed it: Trump’s trade fight This bundle contains 6 Articles